Janux stock plunges after hours following mCRPC trial data

Since the summer, Fed Chair Powell has described the labor market as being in a “curious kind of balance.” See his remarks in August in his Jackson Hole speech:

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

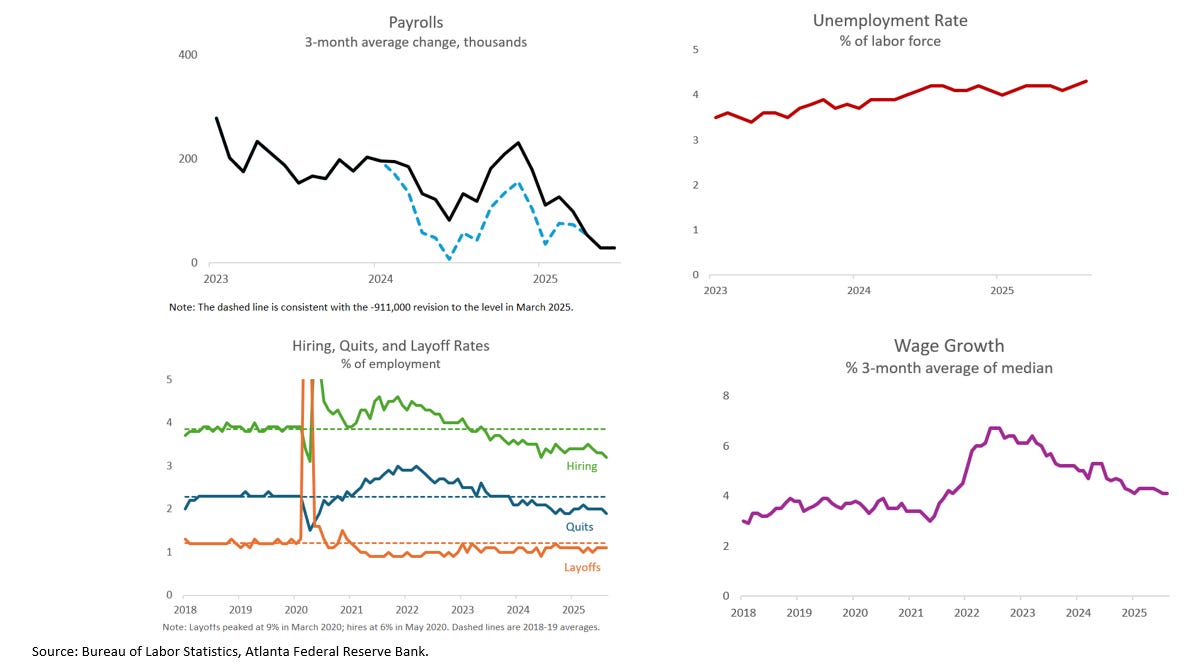

We can put that description into labor market indicators. Job creation (top left) has slowed to a crawl, but the unemployment rate (top right) has only edged up over the past year, suggesting that a softening demand for labor has been largely offset by a softening supply of labor.

The low-hire (green line in the bottom left) and low-fire (orange line) have been features of the labor market for over a year. The gradual slowing of wage growth is also consistent with weaker demand only slightly outrunning weaker supply. The big question is, how sustainable is this “curious balance,” and what are the risks of it unraveling into a recession?

Powell’s label of “curious” got me thinking about the other “curiosities” of the labor market during this cycle. The pandemic recession and recovery have offered several unusual situations. Here are some in the labor market:

-

First job-full recovery since the 1980s in 2020-2021.

-

Relative wage gains of low-wage workers and a high degree of churn in 2021-2022.

-

Rebalancing the labor market (and lower inflation) without a recession in 2023-24.

-

Low-hire, low-fire labor market in 2024-2025.

Examining these various curiosities reveals three main takeaways. First, current labor market conditions should be evaluated within the context of the unusual cycle. Normalization is still a factor. Next, large unexpected shifts in labor supply (first due to the pandemic and later due to changes in immigration) have reduced the usefulness of common business cycle indicators (including the Sahm rule). Finally, assessing the risks of a recession would benefit from more timely and consistent measures of labor supply.

There are various ways to see the importance of context. The very low pace of job creation comes after a rapid recovery early in the cycle. Relative to the level of employment at the cycle peak, the increase in employment over the subsequent five and a half years is now larger than after either the Great Recession or the 2001 recession.

The rapid rebound occurred despite the historic employment declines during the pandemic recession. What looks almost like a jobless expansion now follows the first job-full recovery since the 1980s.

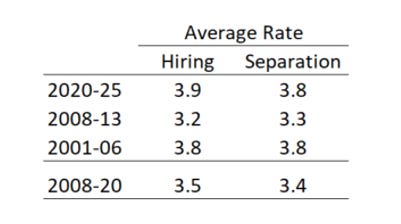

Likewise, the current low-hire, low-fire labor market follows a period of very high labor market churn. In the chart below, the three shaded areas represent the first five and a half years following the start of the 2001, 2008, and 2020 recessions. In the current cycle, the hiring rate (blue line) and separation rate (red line) were elevated early in the recovery and have fallen since.

In contrast, after the Great Recession, these measures of churn declined initially and then rose slowly as the recovery progressed. The hiring and separation rates were relatively stable after the 2001 recession.

Averaging across the first five and a half years, the current cycle stands out as having high hiring, not low hiring. The strength of hiring in this cycle is particularly large relative to the Great Recession.

It is not just a matter of the aggregates. Industries with higher quit rates during 2021-22 tend to have lower quit rates during 2023-25—a pattern that is also consistent with the normalization of the labor market. Given the unusually large swings in the labor market since the pandemic began, it is important to maintain that comparison when evaluating current labor market conditions. That is part of the reason why I do not see recessionary dynamics in the labor market now.

The entire talk, including a discussion of labor supply, is available below the paywall.

Here are some recent discussions of mine on the labor market and the economy.

-

From a Business Insider piece, on the recent layoff announcements:

Claudia Sahm, the chief economist for New Century Advisors, said layoff announcements can at least give the direction, but not the magnitude, of what’s happening in the job market.

“Layoff announcements, first and foremost, are about the companies,” Sahm said. “They’re business decisions. And so Amazon’s a very large company, but it is not the US labor market.”

-

I was a guest on Moody’s podcast Inside Economics with Mark Zandi. We covered a wide range of topics, and generally, the takeaway is one of cautious optimism.