Investor caution ahead of Nvidia earnings "understandable," Barclays says

It was a relatively subdued trading session, with the indexes finishing near flat. At this point, this has become the typical pattern we’ve seen over the past couple of weeks: big rallies on Monday mornings, as implied volatility falls sharply, followed by consolidation, and then a retracement.

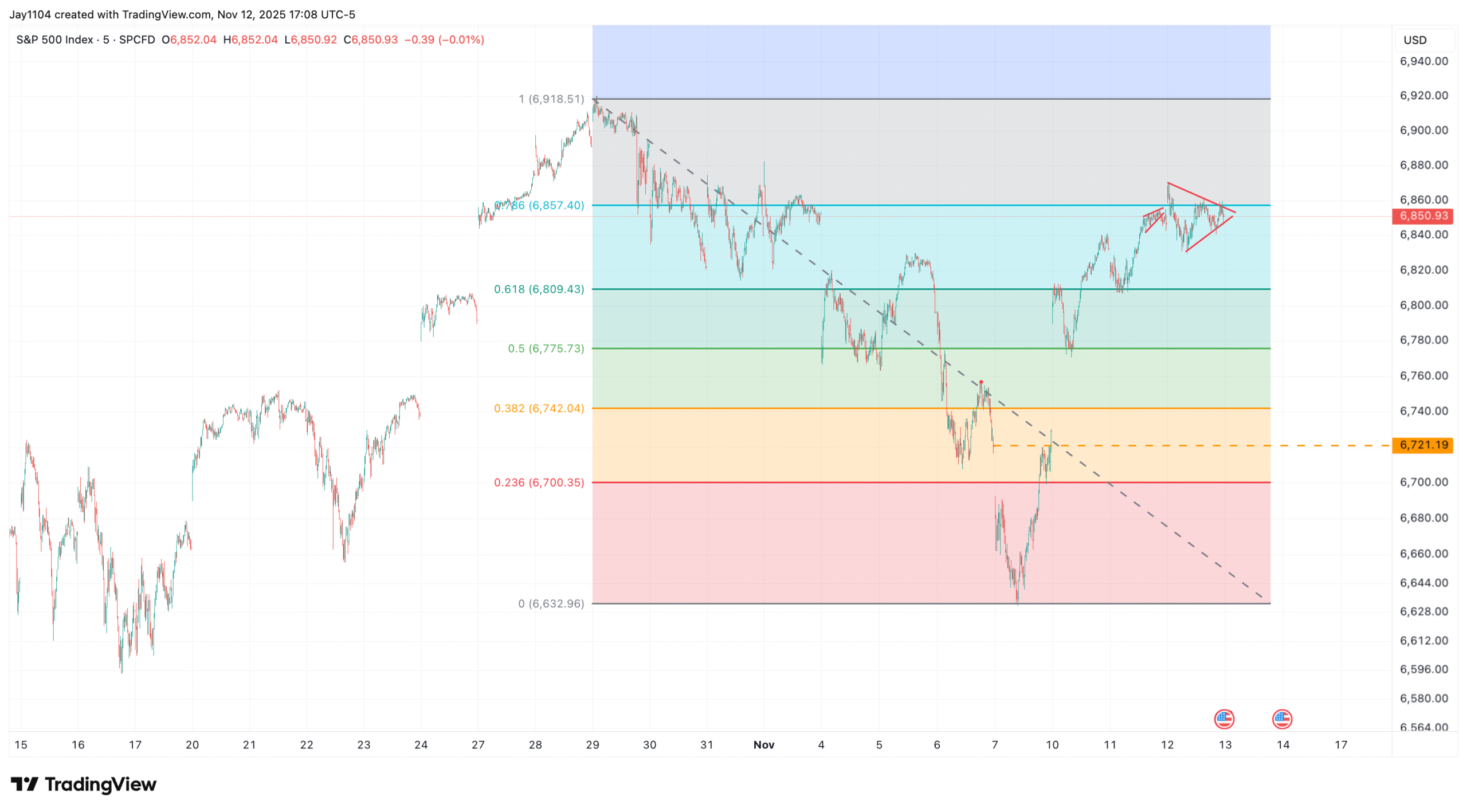

For now, the S&P 500 has stalled at the 78.6% retracement level, near 6,850. It will be interesting to see whether the recent pattern continues and the index moves lower, potentially refilling the gap down at 6,720 before the week is over.

In the meantime, we saw implied correlations rise on Wednesday and the S&P 500 dispersion index decline. This caused the spread between the dispersion index and the three-month implied correlations index to narrow and potentially break below an uptrend that began in mid-April.

This could be an important development because, historically, the S&P 500 tends to move in the same direction as this spread. At the moment, the two are diverging slightly, suggesting that if a real move lower is emerging in the relationship between dispersion and correlations, the S&P 500 should follow this spread lower.

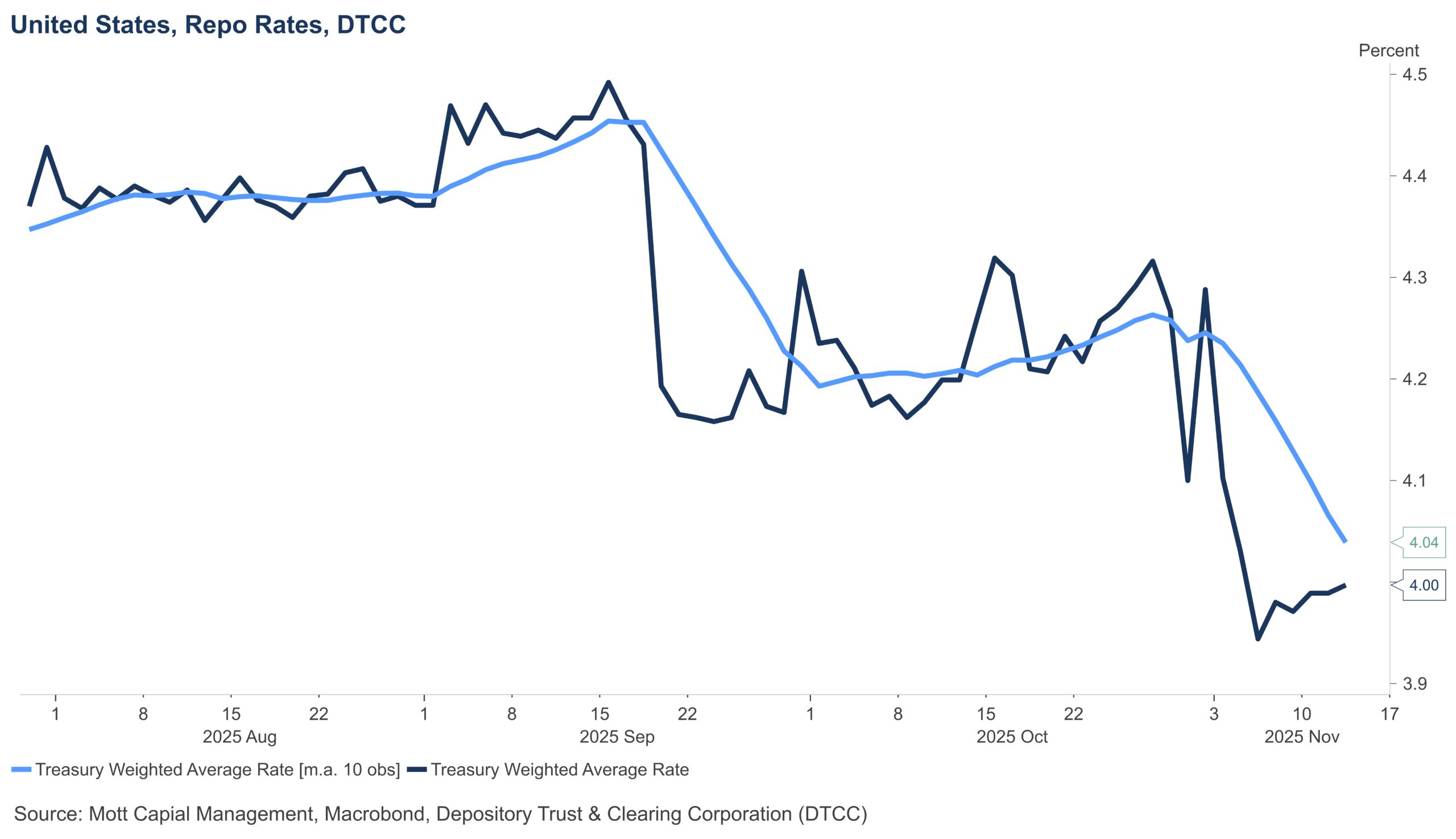

There will be another Treasury settlement today, totalling about $23 billion. That will likely create additional liquidity pressures. We already saw some of that on Wednesday, with repo activity trading at elevated levels and overnight funding rates moving higher. The GC rate averaged around 4% according to DTCC. Given all of this, SOFR rates are likely to push higher on Wednesday morning.

Additionally, we saw high-yield credit spreads move higher on Wednesday, along with investment-grade spreads. Most notably, Oracle’s (NYSE:ORCL) five-year credit default swap widened to 87.1 on the bid side, up from 82.4 previously. This now marks the highest level for Oracle’s CDS spread since early 2023.

The USD/JPY rose sharply today, pushing the yen through resistance at 154. It could now be on its way to 156, and potentially even higher.

This has happened despite the interest rate differential continuing to contract and easing dollar funding costs. It’s all a bit of a mystery to me at this point.

Finally, the equity financing cost for the S&P 500 total return index in January has surged to 113 bps, well above the December contract at 80.5 bps. Financing costs are expected to decline in February and March. It’s surprising because last year these costs peaked in the December contract, not the January contract, so it’s unclear why the pattern is different this year.