Goldman Sachs expects Nvidia ’beat and raise,’ lifts price target to $240

The Fed cut rates by 25 bps at its meeting on Wednesday and announced that it would end QT on December 1. This wasn’t surprising to me—the only question was the timing of QT’s end, and it appears they chose the later date. Even so, the Fed’s actions will bring the balance sheet to a steady state. Additionally, Powell took a December rate cut off the table for now, saying no decisions have been made.

The announcement helped push interest rates and the US dollar index higher, but with the ECB meeting on Thursday, we’ll have to wait to see how those events impact the US dollar.

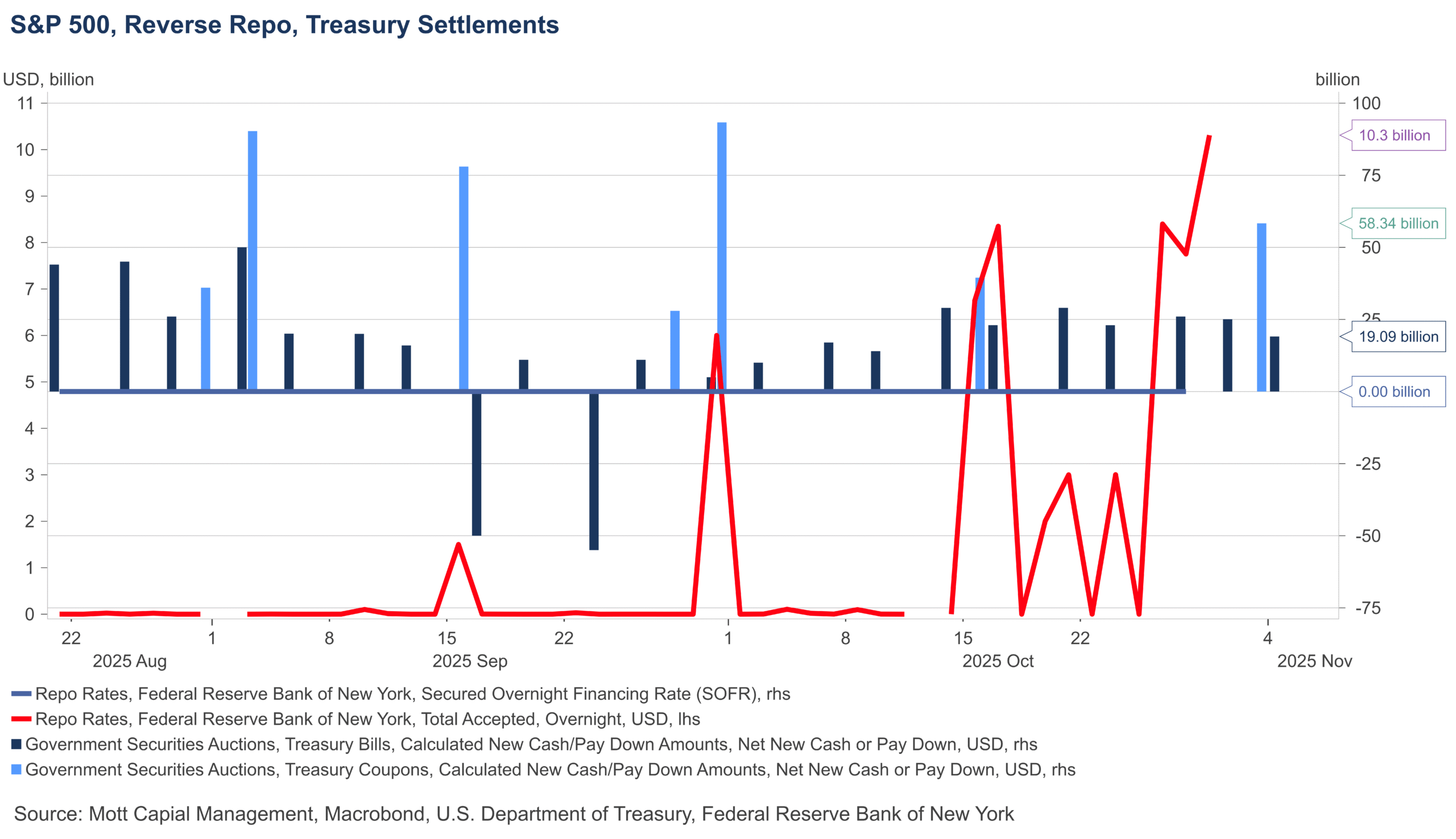

Thursday and Friday are settlement dates, and funding pressures are likely to rise, which probably means greater use of the standing repo facility as well. Surprisingly, the SRF is still used on Wednesday, with just over $10 billion running through it.

Let’s not forget that Friday is not only a settlement date but also a month-end, which means the greatest funding pressures are likely to occur then.

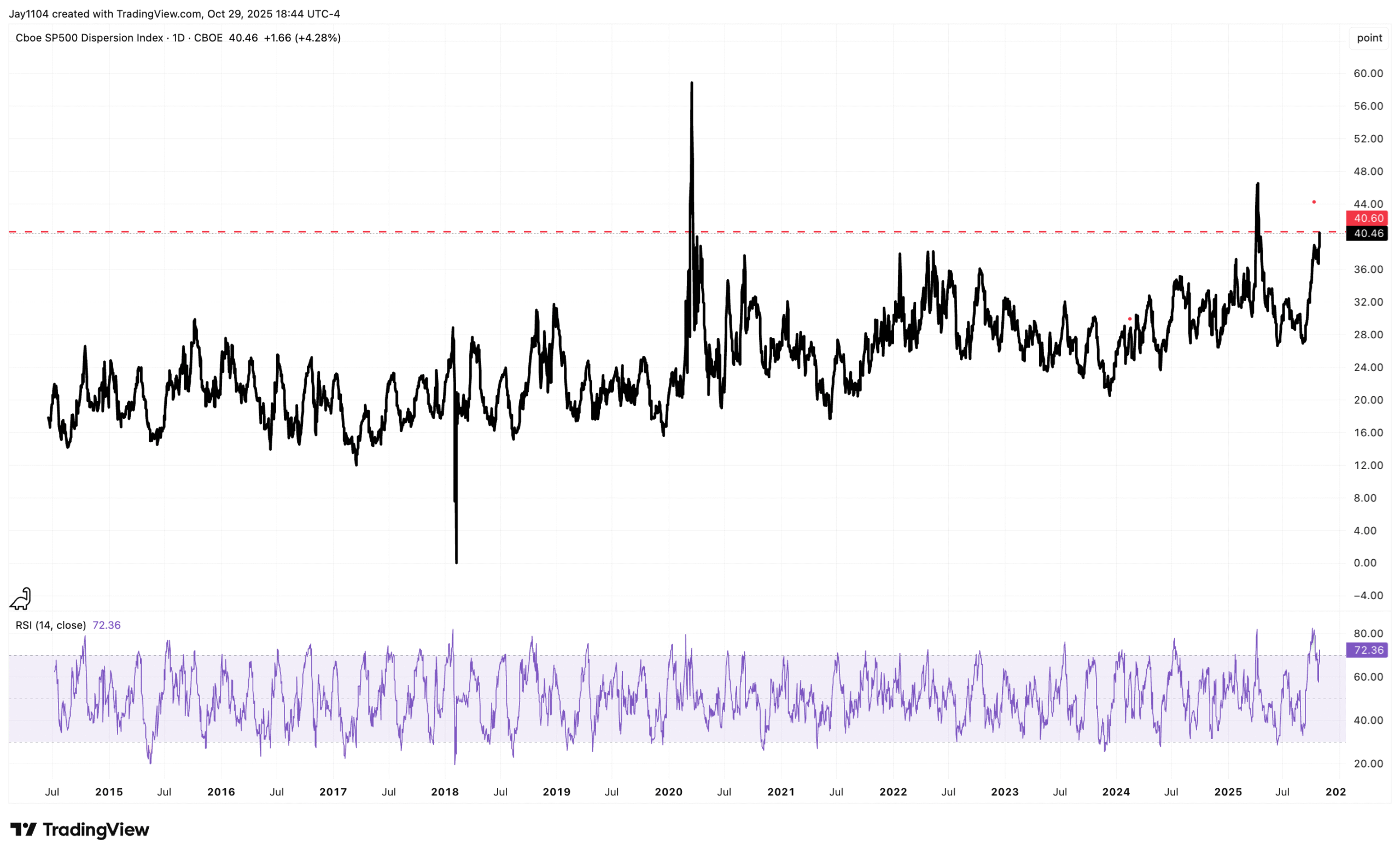

In terms of the stock market, the S&P 500 finished the day flat, while the RSP equal-weighted index fell by more than 1.1%. As a result, the S&P 500 Dispersion Index closed above 40, its highest level since April.

With earnings from Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) today, we should start to see this dispersion index begin to decline as implied volatility levels fall and the volatility dispersion trade unwinds.

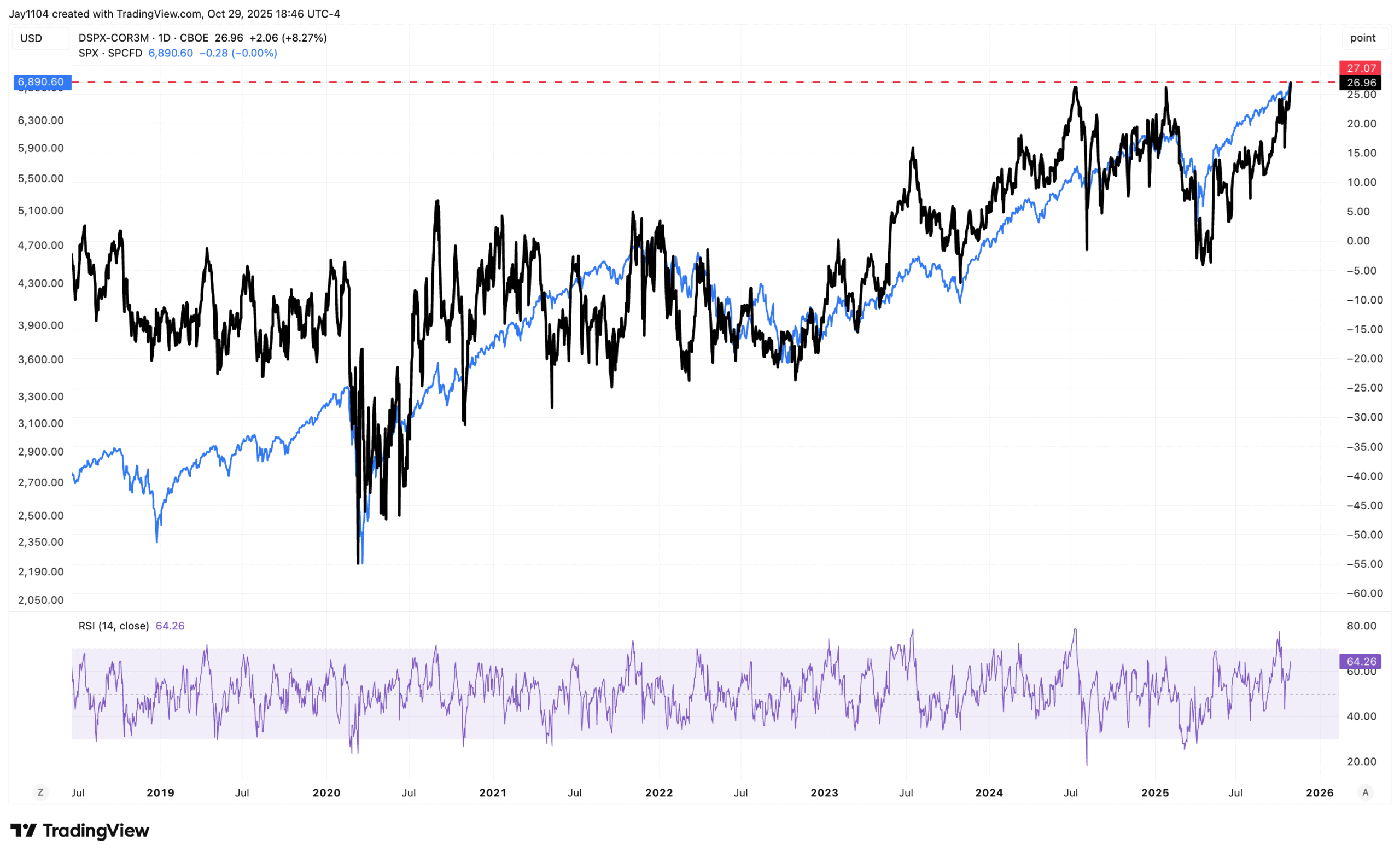

That should lead to implied correlations rising as the trade unwinds, and the spread between the Dispersion Index and the Implied Correlation Index beginning to narrow, which could result in the stock market reversing its recent rally.

We just have to wait and see, because everything I have laid out since July has finally come together.

There is not much left for me to say.