(Bloomberg) -- China onshore corporate bond defaults reached at least 14.4 billion yuan ($2.1 billion) from 14 notes in July, the highest level since the March peak. This brings the total year-to-date defaults to 70.9 billion yuan from 89 bonds.

- Real estate sector with 10.2b yuan defaults tops year-to-date default list, followed by wholesale (9.5b yuan) and retail sales sector (7.9b yuan)

- Investment companies topped last month’s defaults, accounting for 45% of monthly total amount

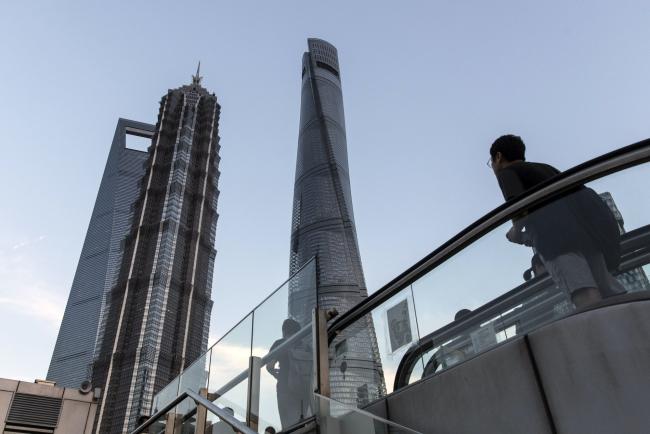

- Jiangsu, Anhui provinces and Shanghai City were among the top 3 default locations

- Small and medium-sized banks and non-bank financial institutions are cutting their holdings of lower-rated credit bonds after regulators assumed control of Baoshang Bank, according to Zhao Xue, head of fixed income at Shanxi Securities Co.

- Private-sector companies are still having hard time to obtain funding, as net financing of corporate bonds in private enterprises decline for three straight months, said Dong Dezhi, a fixed-income analyst at Guosen Securities

- Baoshang takeover is the first government seizure of a bank in two decades, which highlights the difficulty of cleaning up risky lending practices without triggering a loss of faith in banks

(Updates with analyst’s comment in fourth bullet point.)