- Tomorrow, markets expect the Fed to have a similar message as the previous meetings.

- While rate cuts are highly unlikely, a hawkish surprise from Powell could jolt markets.

- Watch key indicators like US 2-year yields, EUR/USD, and small-cap stocks for market reactions to the Fed's stance.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

Tomorrow's Fed meeting is poised to be a pivotal moment for markets, but a sense of déjà vu hangs in the air.

Recent meetings have followed a familiar script: rates remain unchanged, inflation shows signs of slight improvement but appears sticky, and the labor market continues to rebalance. The Fed's dual mandate of full employment and price stability, with a 2% inflation target, seems to be playing out but in slow-motion.

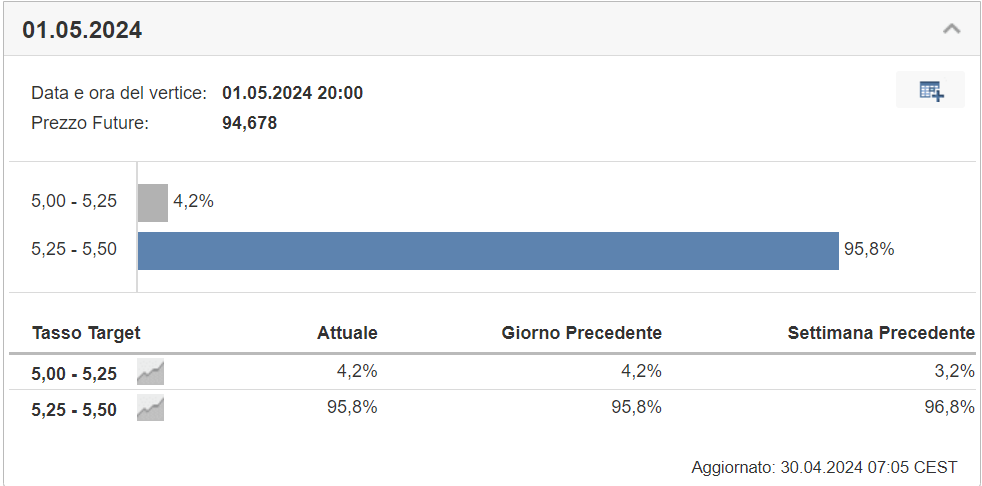

Market expectations for unchanged rates are nearly certain, with our proprietary tool indicating a 95.8% probability (down slightly from 96.8% last week). So, will tomorrow's meeting simply be a replay of recent meetings, or could the Fed appear more hawkish than the markets expect?

What to Expect From Powell

Let's delve into what Powell might discuss:

- Interest Rates: The Fed is likely to maintain current rates at the highest level in 23 years (5.25-5.5%). This aligns with their goal of curbing inflation, despite investor hopes for a swift rate cut. While inflation has retreated from its 2022 peak, it still exceeds the Fed's 2% target.

- Dot Plot and Projections: Powell will unveil the dot plot during the press conference, showcasing interest rate projections through 2026.

- Balancing Act: Powell faces the challenge of balancing a robust labor market with strong consumer spending.

Market Reactions to Watch

As asset classes and portfolios often react sensitively to Fed pronouncements, here are specific areas to monitor:

- United States 2-Year Yields: A rise in yields could signal an impatient market anticipating a higher for longer scenario.

- EUR/USD: A more restrictive outlook from the Fed, compared to the ECB's potential rate cut in June, could strengthen the US dollar against the euro.

- Small-Cap Stocks: A decline in small-cap indexes like the Russell 2000 could indicate market perception of tightening Fed policy.

Remember, Unforeseen events can always impact the Fed's decisions. While rate cuts in 2024 are a possibility, they are not guaranteed.

***

DISCOUNT CODE!

Stay up-to-date on analyst forecasts. Take advantage of a special discount to subscribe to InvestingPro+ and all our tools to optimize your investment strategy. (The link directly calculates and applies the discount of an additional 10%.

In case the page does not load, you enter the code proit2024 to activate the offer.)You will get several exclusive tools that will enable you to better cope with the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

And many more services, not to mention those we plan to add soon!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.