Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

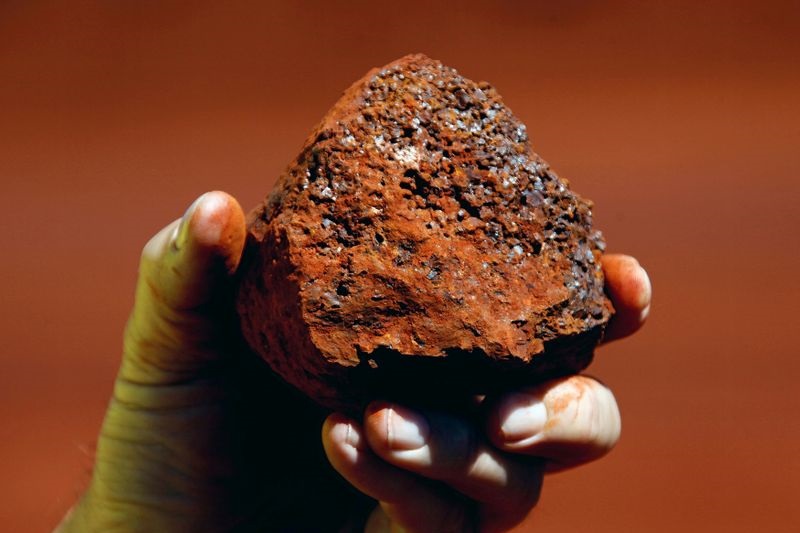

Investing.com -- Goldman Sachs in a note dated Monday has revised its iron ore price forecast for the fourth quarter of 2024, lowering the expected price to $85 per ton from $100 per ton.

This adjustment reflects growing concerns over an oversupply in the global iron ore market, exacerbated by persistently strong shipments and weakening demand from China.

Goldman Sachs analysts warn that without substantial supply cuts, the market will remain imbalanced, leading to further downward pressure on prices.

The 62% Fe iron ore spot price recently dropped to a nearly two-year low of $90 per ton, a 20% decline since July 2024.

However, global iron ore supply remains robust, with daily shipments running 2% higher than the same period last year.

This steady supply, coupled with sluggish demand, is driving the market into a surplus.

“While India has reduced exports, without a significant demand recovery (which we see as unlikely), we believe that producers further down the cost curve will also need to cut output in order to re-balance the market (as port stocks remain 30Mt above the 2016-2023 September average),” the analysts said.

While Chinese iron ore consumption has shown signs of stabilization, overall demand remains subdued. The weak macroeconomic outlook for China, including a downgraded GDP growth forecast to 4.7% for 2024, signals that domestic demand will not provide enough support for a recovery in iron ore prices.

Additionally, Chinese steel production, which is closely tied to iron ore demand, faces significant risks. After two months of decline, August saw a 21% month-over-month increase in steel exports, but the longer-term outlook remains uncertain as the potential for falling exports threatens to further depress demand.

Given the persistent oversupply, Goldman Sachs analysts argue that producers lower on the cost curve will need to implement supply cuts to restore balance to the market.

The brokerage suggests that prices may need to fall even further, to around $80 per ton, to eliminate excess supply from India and other marginal producers.

This price point would pressure supply further down the cost curve, leading to the necessary production cuts.

In the near term, Chinese steel mills may engage in restocking ahead of the "Golden Week" holiday in early October, which could provide temporary support for iron ore prices.

Recent data showed a 2.6% week-on-week increase in steel mills' in-plant iron ore stocks, marking the largest jump since the pre-Lunar New Year period.

However, this restocking is unlikely to offset the broader surplus in the market.