Street Calls of the Week

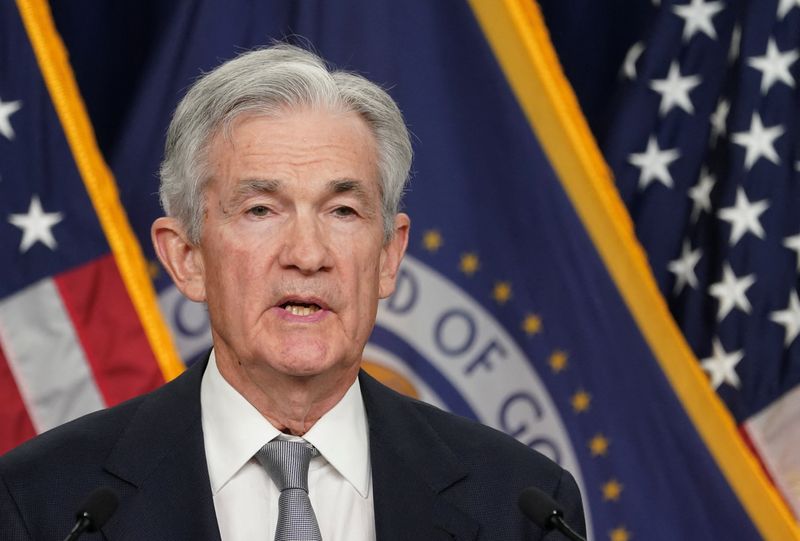

Investing.com -- UBS strategists believe there is room for the Federal Reserve to implement an additional 50 basis points (bps) rate cut later this year.

US stocks ended last week lower after a stronger-than-expected December jobs report fueled concerns about the Federal Reserve’s pace of interest rate cuts in 2025.

The S&P 500 fell 1.5% following the employment data, which revealed a net gain of 256,000 jobs last month, significantly exceeding the consensus forecast of 163,000. The unemployment rate dropped to 4.1%, down from 4.2% the previous month, matching its June level.

In the bond market, the yield on the 10-year US Treasury rose 10 basis points to 4.77%, the highest since 2023.

This report came on the heels of other robust economic data earlier in the week. The JOLTS survey showed job openings climbing to a six-month high, while the ISM survey indicated stronger-than-expected activity in the services sector.

Moreover, the 'prices paid' component of the ISM release reached its highest level since 2023, casting doubt on the progress toward disinflation.

According to UBS strategists, the latest batch of economic data “looks set to reinforce worries among top Fed officials that the task of returning US inflation to its 2% target is not yet completed, and there is no rush to cut rates further."

Minutes from the Fed’s final 2024 policy meeting reflected this sentiment, stating there was “more work to do on inflation.” At the December meeting, the median forecast for further easing in 2025 dropped to just 50 basis points, half the previous projection.

The unexpectedly strong economic performance of the US was a key theme in 2024, with investors shifting from recession fears to anticipating a soft landing, and ultimately, no landing at all.

UBS strategists observed that this resilience appears to be continuing into 2025. However, they expect the growth to moderate, allowing progress toward the Fed’s inflation target to resume.

"As a result, we believe there will be scope for the Fed to ease policy by a further 50bps later in the year," the strategists led by Mark Haefele added.

Investors await more key economic and inflation updates this week, with the consumer price index (CPI), producer price index (PPI), retail sales, and industrial production reports set to be released in the coming days.