NHL signs licensing deals with prediction-market startups Kalshi and Polymarket - WSJ

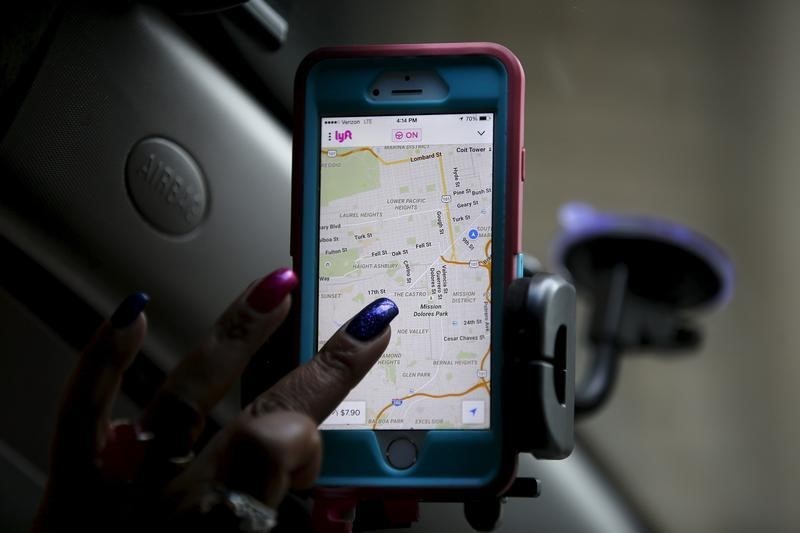

In recent transactions reported on February 27, Green Logan, a director at Lyft , Inc. (NASDAQ:LYFT), sold a total of 11,411 shares of the company’s Class A Common Stock. The ride-hailing company, currently valued at $5.28 billion, has shown profitability over the last twelve months according to InvestingPro data. The sales were executed under a pre-established Rule 10b5-1 trading plan, with prices ranging from $12.83 to $13.97 per share. The total value of these transactions amounted to approximately $152,243. The stock, which currently trades at $12.66, has experienced significant volatility in recent months.

Following these transactions, Logan now holds 297,640 shares of Lyft’s Class A Common Stock. Some of these shares are in the form of restricted stock units, which are subject to specific vesting schedules and conditions.

These sales were carried out in multiple trades, with the average sale prices being $13.2532 and $13.885 for the respective transactions. The transactions were part of a trading plan adopted in February 2024, allowing for systematic selling of shares over time.

In other recent news, Lyft’s financial performance and strategic decisions have garnered attention from several analyst firms. Lyft’s fourth-quarter earnings report revealed an adjusted EBITDA of $112.8 million, surpassing expectations, and a GAAP Net Income with Free Cash Flow of $140 million. However, the company’s guidance for first-quarter bookings growth between 10-14% has fallen short of expectations, prompting analysts from BMO Capital and DA Davidson to lower their price targets to $15.

RBC Capital Markets also adjusted its price target to $21, maintaining an Outperform rating, while expressing optimism about Lyft’s long-term potential despite current challenges. Bernstein and BMO Capital both maintain a Market Perform rating, citing concerns over competitive pricing and the impact of Lyft’s terminated partnership with Delta Airlines (NYSE:DAL). Benchmark, on the other hand, has maintained a Buy rating with a $20 price target, highlighting Lyft’s potential for growth and a new $500 million stock buyback program.

The ongoing competitive dynamics with Uber (NYSE:UBER), particularly in pricing strategies, have been a recurring theme in the analyses. Analysts remain cautious about Lyft’s ability to meet its long-term targets, yet some see opportunities for growth and efficiency gains. Lyft’s progress in autonomous vehicle technology and operating margins are noted as positive developments amid these challenges.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.