Moody’s downgrades Senegal to Caa1 amid rising debt concerns

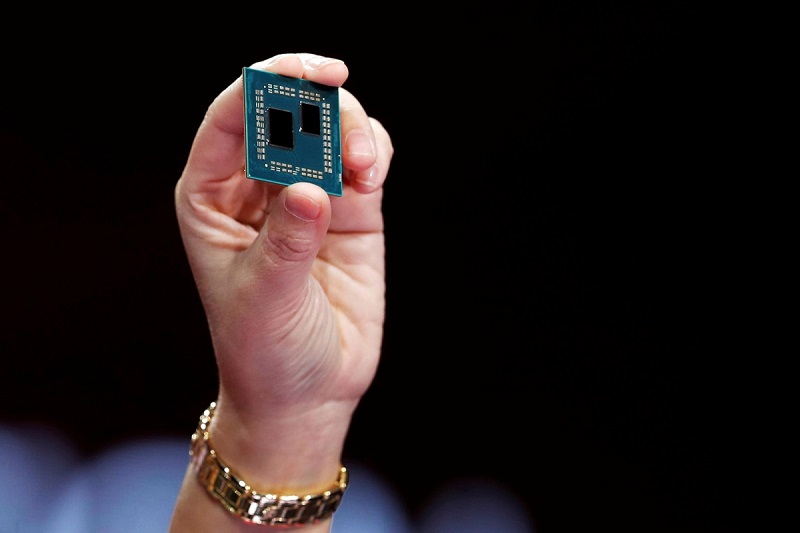

Investing.com -- Advanced Micro Devices Inc (NASDAQ:AMD) made an aggressive bid for dominance in AI inference at its Advancing AI event Thursday, unveiling new chips that directly challenge NVIDIA Corporation’s (NASDAQ:NVDA) supremacy in the data center GPU market. AMD claims its latest Instinct MI355X accelerators surpass Nvidia’s most advanced Blackwell GPUs in inference performance while offering a significant cost advantage, a critical selling point as hyperscalers look to scale generative AI services affordably.

The MI355X, which has just begun volume shipments, delivers a 35-fold generational leap in inference performance and, according to AMD, up to 40% more tokens-per-dollar compared to Nvidia’s flagship chips. That performance boost, coupled with lower power consumption, is designed to help AMD undercut Nvidia’s offerings in total cost of ownership at a time when major AI customers are re-evaluating procurement strategies.

“What has really changed is the demand for inference has grown significantly,” AMD CEO Lisa Su said at the event in San Jose. “It says that we have really strong hardware, which we always knew, but it also shows that the open software frameworks have made tremendous progress.”

AMD’s argument hinges not just on silicon performance, but on architecture and economics. By pairing its GPUs with its own CPUs and networking chips inside open “rack-scale” systems, branded Helios, AMD is building full-stack solutions to rival Nvidia’s proprietary end-to-end ecosystem. These systems, launching next year with the MI400 series, were designed to enable hyperscale inference clusters while reducing energy and infrastructure costs.

Su highlighted how companies like OpenAI, Meta Platforms Inc (NASDAQ:META), and Microsoft Corporation (NASDAQ:MSFT) are now running inference workloads on AMD chips, with OpenAI CEO Sam Altman confirming a close partnership on infrastructure innovation. “It’s gonna be an amazing thing,” Altman said during the event. “When you first started telling me about the specs, I was like, there’s no way, that just sounds totally crazy.”

Oracle Corporation (NYSE:ORCL) Cloud Infrastructure intends to offer massive clusters of AMD chips, with plans to deploy up to 131,072 MI355X GPUs, positioning AMD as a scalable alternative to Nvidia’s tightly integrated, and often more expensive, solutions. AMD officials emphasized the cost benefits, asserting that customers could achieve double-digit percent savings on power and capital expenditures when compared with Nvidia’s GPUs.

Despite the positive news, AMD shares were down roughly 2% ahead of market close. Wall Street remains cautious, but AMD’s moves suggest it is committed to challenging Nvidia’s leadership not only with performance parity, but also with a differentiated value and systems strategy.

While Nvidia still commands more than 90% of the data center AI chip market, AMD’s targeted push into inference, where workloads demand high efficiency and lower costs, marks a strategic front in the battle for AI dominance. With generative AI models driving a surge in inference demand across enterprises, AMD is betting that performance per dollar will matter more than ever.