Aspire Biopharma faces potential Nasdaq delisting after compliance shortfall

Evercore ISI, a prominent investment banking advisory firm, indicated that the Federal Reserve is now poised to lower interest rates in September following a softer-than-expected Consumer Price Index (CPI) report.

The June CPI data showed a meager 0.06% increase in core inflation, which excludes volatile food and energy prices, suggesting a deceleration in the pace of inflation since the first quarter of the year.

The moderation in the core elements of the CPI, including a notable easing in the persistently high housing services inflation, supports the view that inflationary pressures are waning.

Despite some components of the CPI not aligning directly with the Federal Reserve's preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, Evercore believes the overall trend is indicative of a sustained reduction in inflation rates.

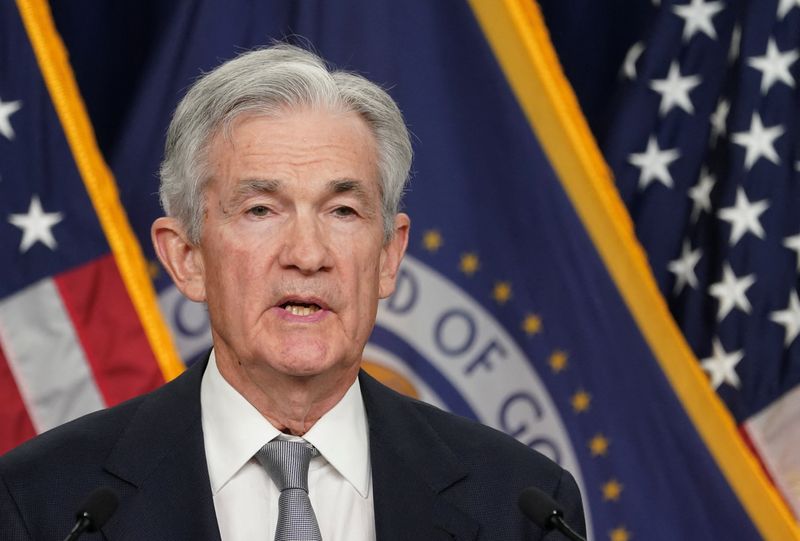

Federal Reserve Chair Jerome Powell, in his testimony earlier in the week, expressed concerns about achieving a 'soft landing' for the economy, balancing the cooling of inflation with a still robust labor market.

Evercore points out that the labor market has significantly cooled, reducing the risk of wage-driven inflation, while at the same time, the risks of higher unemployment are becoming more pronounced.

Previously, the strength and tightness of the labor market allowed the Fed the luxury of patience, waiting for clear signals of easing inflation before adjusting policy. However, Evercore suggests that the balance of risks has now shifted, making the cost of delaying rate cuts potentially higher.

Evercore anticipates that even if the June core PCE figure is slightly higher than expected, around 0.20% month-over-month, the Fed is likely to proceed with a rate cut in September.

The Fed will signal its intention to cut rates in September "with an upgrade to the statement language on inflation progress at its July meeting," Evercore ISI economists said in a note.