(Bloomberg) -- China’s third-quarter slowdown continued into October, with only a few signs of stabilization evident amid the weakest pace of expansion in almost thirty years.

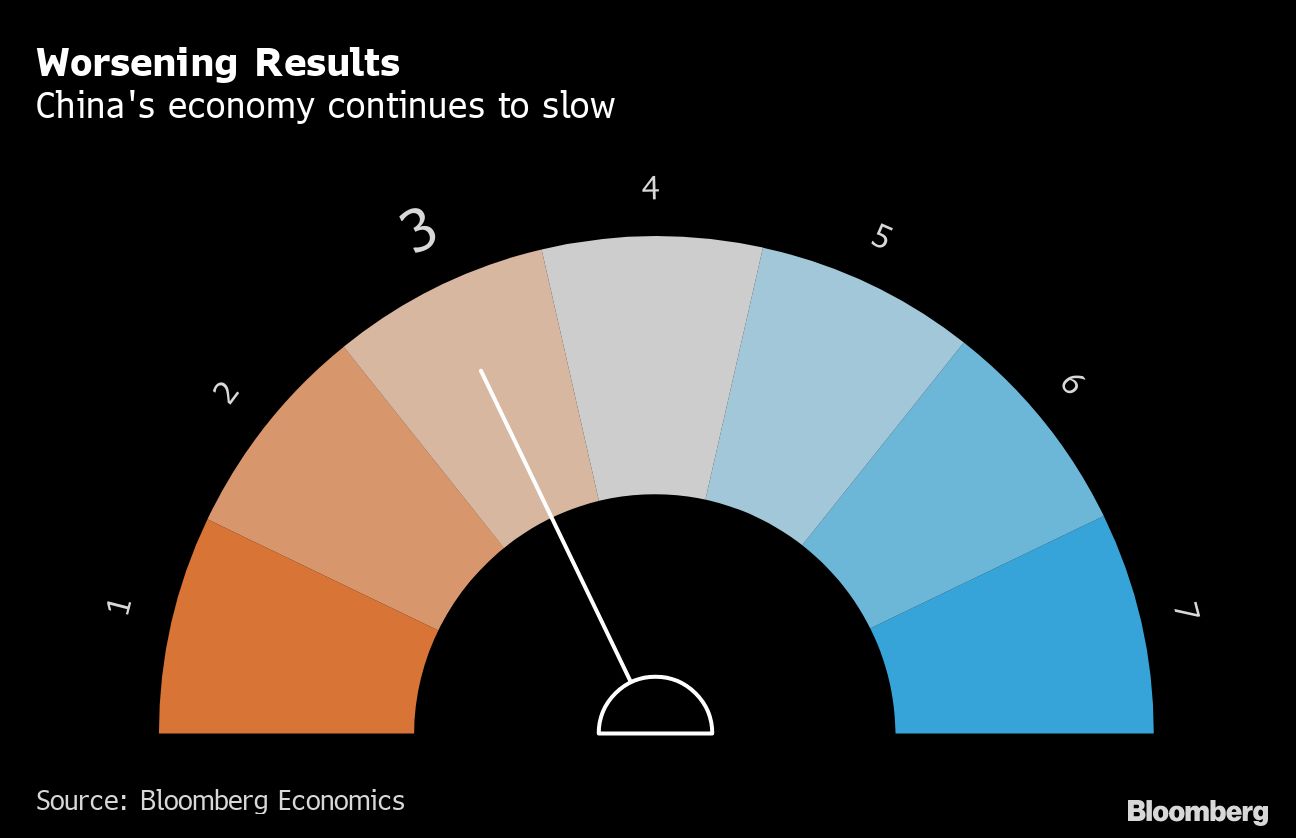

Bloomberg Economics’ gauge aggregating the earliest available indicators from financial markets and businesses showed the economy cooling for a sixth month, with indicators for trade, factory prices, iron ore and copper all worsening.

Easing tensions with the U.S. in September and October are too recent to have any effect on trade, which continues to worsen on slowing global demand and the effects of the tariff war. South Korean exports in the first 20 days of October, a leading indicator for intra-Asian trade and for the tech cycle, dropped almost 20%, extending their decline to 10 months.

Factory prices dropped faster than in September, according to Bloomberg’s producer price tracker, which was at the lowest since mid-2016. The tracker is a leading indicator for the official price data, which is due early next month, and shows that there will be no immediate improvement to the price declines which hurt both company profits and their ability to repay debt.

Solid signs of stabilization remain elusive. Sales managers were the most confident they’ve been in 19 months, though sub-indices including market growth and staffing indicate still-weak activity, according to World Economics, which compiles the data. Data for small and medium-sized companies did show signs of improvement in October, according to Standard Chartered (LON:STAN) Plc.

“Sub-indices for ‘current performance,’ ‘expectations,’ and ‘credit conditions’ rose during the month, increasing the likelihood of a tepid recovery in the fourth quarter on continued counter-cyclical policy measures,” Economists Lan Shen and Ding Shuang from Standard Chartered (LON:STAN) wrote in a note. “Domestic demand recovered slightly, driven largely by a strong performance in the construction and manufacturing sectors,” although external trade remains a major headwind, they wrote.

Stock prices also rebounded in the month, with a strong recovery in real-estate stocks, on the back of resurgent investment into the property sector. Iron ore prices dropped as supply increased.

“Higher tariffs and trade war uncertainties may continue to hurt corporate earnings and manufacturing sector investment,” UBS Economist Tao Wang wrote in a recent note. “We expect policy support to strengthen in 2020 but with less monetary easing. We see more financing for infrastructure investment, support for SMEs and social safety net, and further structural reforms and opening up of the domestic market.”

Note on Early Indicators construction

Bloomberg Economics generates the overall activity reading by aggregating the three-month weighted average of the monthly changes of eight indicators, which are based on business surveys or market prices.

- Major onshore stocks - CSI 300 index of A-share stocks listed in Shanghai or Shenzhen

- Key property stocks - All the constituents of CSI 300 Index that are in the real-estate industry

- Iron ore prices - Spot price of iron ore for shipment to Qingdao port

- Copper prices - Spot price for refined copper in Shanghai market

- South Korean exports - South Korean exports in the first 20 days of each month

- Factory inflation tracker - Bloomberg Economics created tracker for Chinese producer prices

- Small and medium-sized business confidence - Survey of companies conducted by Standard Chartered (LON:STAN) Bank

- Sales manager sentiment - Survey of sales managers in Chinese companies by World Economics Ltd.