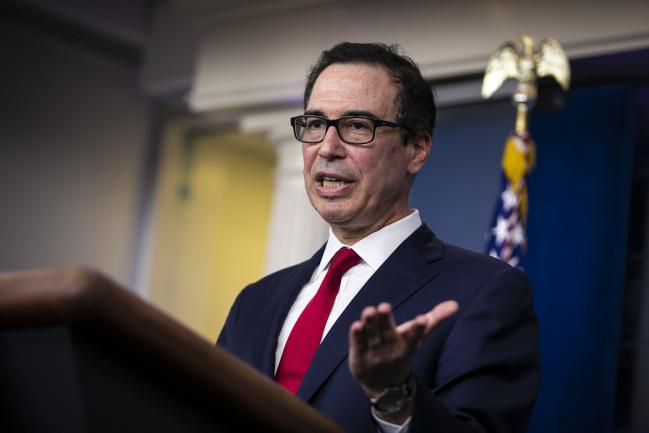

(Bloomberg) -- Treasury Secretary Steven Mnuchin said a strong dollar is good for the U.S. economy in the long term and that he wouldn’t advocate for a weak-dollar policy in the near future.

“I do believe in a strong dollar, which signifies a strong U.S. economy, a strong stock market and particularly because of the president’s economic policies, we have growth in the U.S. that has outpaced everywhere else,” Mnuchin said Wednesday on CNBC.

The Trump administration has softened the long-held U.S. stance of supporting a strong dollar, favoring a stable exchange rate instead as it battles China in a trade war and threatens tariffs on other countries.

President Donald Trump’s goal is not a weaker dollar but to lower interest rates, which he believes will unleash more economic growth, according to one person familiar with the matter. That person asked not to be named to speak about a matter that is not public.

Trump has repeatedly criticized the Federal Reserve for not lowering rates, and has attacked other central banks for weakening their own currencies by cutting rates.

Last week, Mnuchin said during an interview following a Group of Seven finance ministers’ meeting in Chantilly, France, that there has been “no change to the dollar policy.” He added that “this is something we could consider in the future but as of now there’s no change to the dollar policy.”

(Updates with Trump administration approach in third paragraph.)