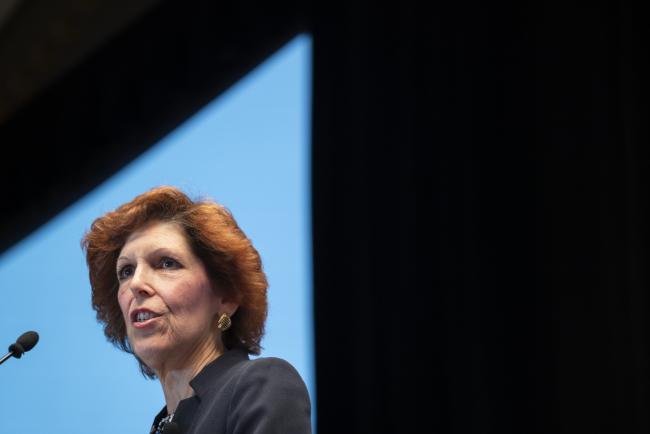

(Bloomberg) -- Federal Reserve Bank of Cleveland President Loretta Mester said Fed officials will need to raise interest rates “a little bit higher” and then hold them there for some time to bring inflation back toward their goal.

“We certainly are focused on inflation and making sure that inflation gets back down to 2% over time,” Mester said Wednesday during an interview with Bloomberg TV’s Michael McKee, adding that it’s too soon to say what officials will do at the Fed’s next policy meeting on May 2-3.

“I think we’re going to have to go a little bit higher from where we are, a little bit more,” she said, “and then hold there for some time in order to make sure inflation is on that sustainable downward path to 2%.”

That doesn’t mean policymakers will continue to raise rates until inflation hits their goal, Mester said. The Cleveland Fed chief said she expects to make “some appreciable progress” toward taming price pressures in 2023, and estimates a closely watched gauge of inflation will reach 3.75% by the end of the year. But she doesn’t see inflation returning to the Fed’s target until 2025.

“My own forecast is that it will take some time to get inflation back down,” she said.

Fed officials lifted interest rates by a quarter percentage point last month, bringing their policy benchmark to a target range of 4.75% to 5%, up from near zero a year earlier. Forecasts released at the same time showed the 18 officials expected rates to reach 5.1% by year-end, according to their median projection, implying one more interest rate increase.

Policymakers speaking since the meeting have said they are watching economic data to determine how much recent banking stress may tighten access to credit or slow the economy.

Mester, who does not vote in monetary policy decisions this year, said her outlook for interest rates was slightly above the median projection because she sees inflation persisting. But she said she is open to adjusting monetary policy based on how the economy evolves.

©2023 Bloomberg L.P.