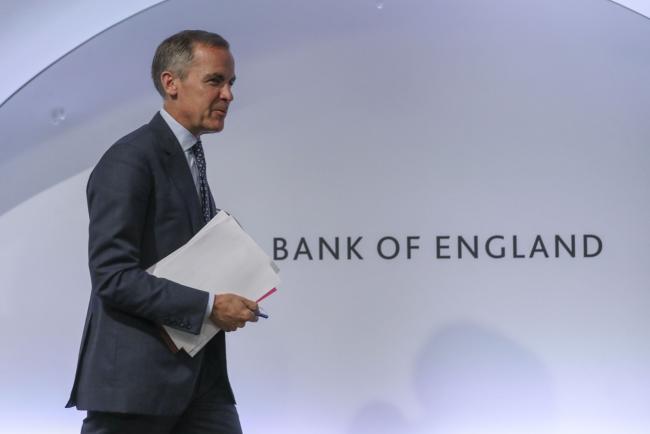

(Bloomberg) -- Bank of England Governor Mark Carney will confront the new realities of Brexit and the increasing likelihood of a no-deal departure from the European Union in the central bank’s interest-rate decision on Thursday.

A sinking pound and lower bond yields mean that BOE forecasts calling for gradual tightening, based on assumptions of a smooth Brexit, could be all but meaningless. Carney said last month that the BOE is looking at ways to address the unprecedented divergence between market rate-cut pricing and the BOE’s projections. The benchmark is expected to stay at 0.75%.

Here are some of the things the Monetary Policy Committee will be considering.

Currency Pain

The pound has slipped about 4% on a trade-weighted basis since the last round of forecasts in May, increasing the potential for faster inflation in the medium-term. A shaky second-quarter means lower near-term growth predictions, something the BOE might focus on if it wants to sound more dovish.

As the deadlock between Prime Minister Boris Johnson and EU negotiators continues, the pound has the potential to plummet further. Bloomberg economist Dan Hanson estimates that sterling could fall an additional 13% in a no-deal scenario.

Rate Cuts Ahead

A year ago, the BOE raised its key rate to 0.75% and said further gradual tightening would probably be needed if the economy performed as expected. But the situation has changed dramatically, and rates have been on hold since.

- For more insight from Bloomberg Economics, click here

Record Employment

The U.K. labor market remains the most buoyant part of the economy. Employment has continued to rise throughout 2019, and the jobless rate has fallen to levels last seen in the 1970s. That’s been complemented by an improvement in wage growth, which is now outpacing inflation. Usually, this would be a signal to think about raising rates, but there are other factors to consider.

Economic Payback

Economic growth is proving volatile this year, thanks in part to stockpiling by companies ahead of the original Brexit deadline at the end of March. Expansion accelerated to 0.5% in the first quarter, but the BOE anticipates payback, with zero growth in the three months through June.

Consumer spending is providing support for the economy, but weak business investment has persisted. The latter could improve if there’s a Brexit deal, giving clarity to companies, but there’s just three months left to secure that.