By Liz Moyer

Investing.com -- U.S. stocks are lower on the last trading day of the month. Here are the midday movers for Tuesday, May 31st:

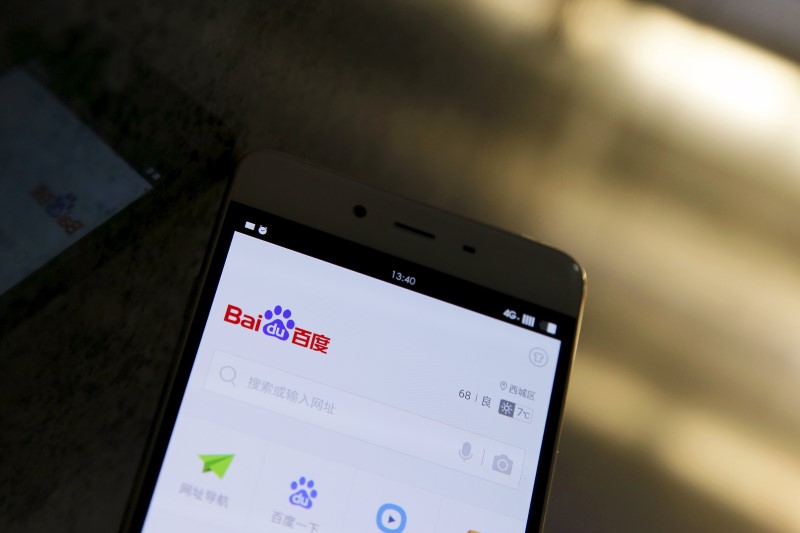

- Chinese Tech Companies rallied as China began lifting Covid-19 lockdown measures and reported better than expected manufacturing data for May. Shares of Pinduoduo (NASDAQ:PDD) rose 7%, Baidu Inc (NASDAQ:BIDU) rose 4.9%, and JD.com Inc (NASDAQ:JD) rose 6.5%.

- Unilever PLC ADR (NYSE:UL) shares continued to climb on Tuesday, rising more than 9% after activist investor Nelson Peltz joined the board. His Trian Fund Management has a 1.5% stake in the consumer products company.

- Amazon.com Inc (NASDAQ:AMZN) shares were up more than 3% on Tuesday as shareholders prepared for the stock to split on Friday. Shareholders approved the 20-for-1 split last week. Shares are currently trading around $2,386 each, down 30% so far this year.

- Marathon Oil Corporation (NYSE:MRO) shares rallied more than 4% as crude oil prices rose near $120 a barrel on Tuesday. The European Union's decision to ban most oil imports from Russia is pressuring oil prices higher.

- American Eagle Outfitters Inc (NYSE:AEO) shares fell 8% after Morgan Stanley cut the apparel maker to underweight from equal weight, with a price target of $8 from $22, citing the company's lowered guidance and the possibility of further downside momentum.

- AMC Entertainment Holdings Inc (NYSE:AMC) shares rose more than 5% on optimism that movie theater demand is improving after the weekend blockbuster Top Gun: Maverick blew away expectations for box office sales.