Five things to watch in markets in the week ahead

- Inflation and rising interest rates dampening sentiment

- Stocks with solid fundamentals, reasonable valuations, high dividends likely outperform

- Philip Morris, Dow, and Chesapeake Energy should be on your radar.

Worries over sky-high inflation and the U.S. Federal Reserve’s aggressive plans to hike interest rates have been the primary driver of market sentiment this year.

So all eyes will be on today's consumer price index report and the Fed’s annual Jackson Hole symposium on August 25 when it is expected to increase rates another 75 basis points.

Rising interest rates tend to dent high-growth stocks with high price-to-earnings (PE) ratios so here are three stocks with relatively low price-to-earnings ratios poised to outperform in the months ahead.

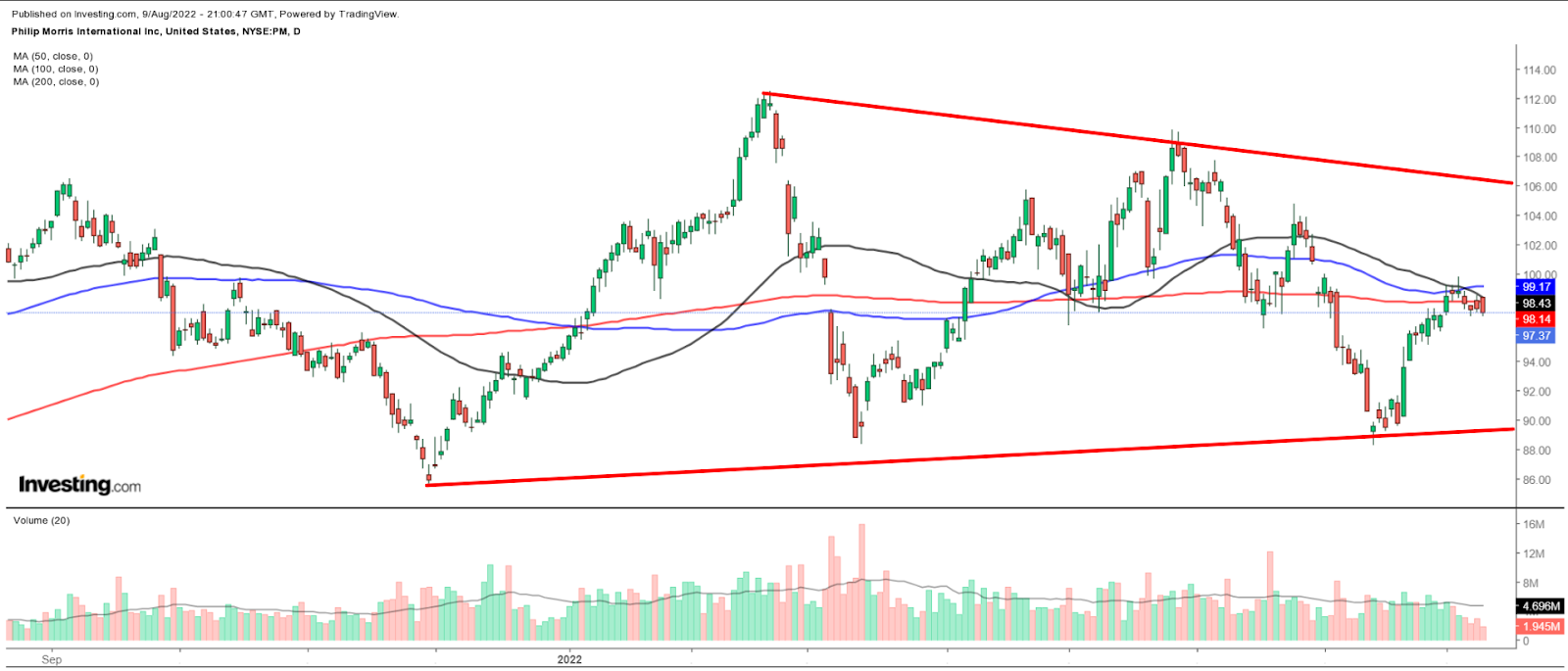

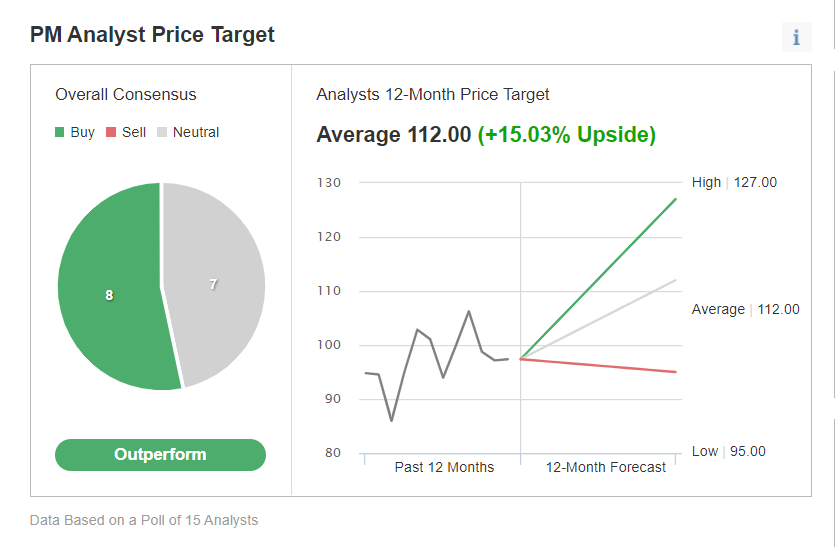

Philip Morris International

- P/E Ratio: 16.7

- Dividend Yield: 5.12%

- Market Cap: $150.9 billion

- Year-To-Date Performance: +2.8%

Philip Morris (NYSE:PM) is the world’s biggest tobacco company based on net sales. Its most recognized and best-selling product is the Marlboro brand.

We think shares of the New York-based company are a solid pick as high-quality blue-chip dividend stocks with relatively down-to-earth valuations tend to outperform in an inflationary environment.

The ‘Big Tobacco’ company, which trades at a PE ratio of 16.7 and has a yield of 5.12%, reported second-quarter earnings and revenue which far exceeded expectations, driven by the continued strength of its non-combustible IQOS smoke-free heated tobacco device.

It also raised its full-year profit guidance and now expects it to increase of 10%-12% year-on-year (yoy) due to further progress on operating cost efficiencies.

Per an Investing.com survey, eight analysts rate PM a ‘buy’, seven consider it a ‘hold’ and the stock has roughly 15% upside potential.

The quantitative models in InvestingPro points to a gain of about 11.3% from current levels, bringing PM closer to its fair value of $108.34.

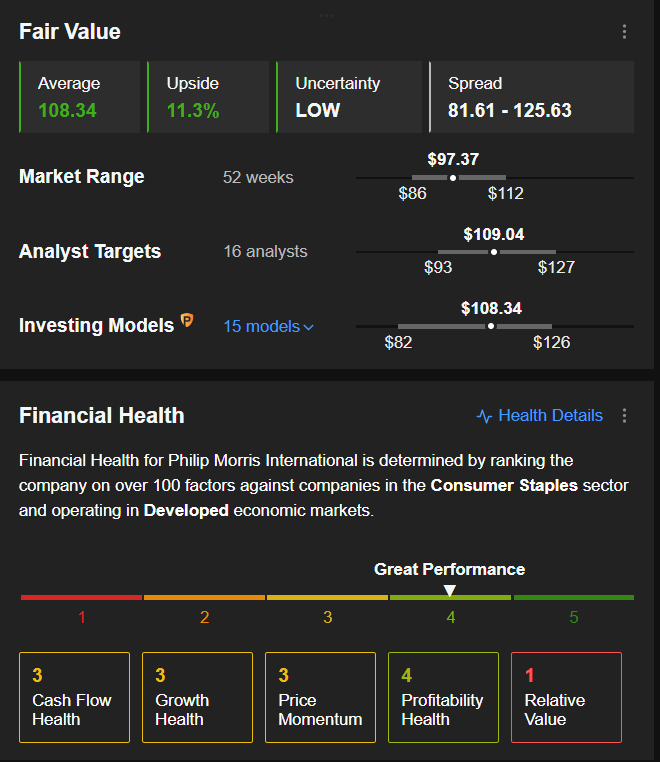

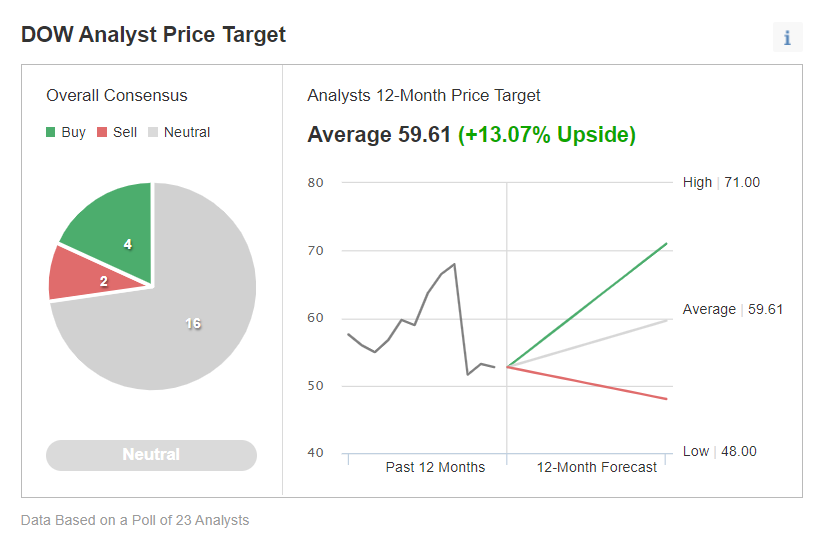

Dow Inc

- P/E Ratio: 5.9

- Dividend Yield: 5.37%

- Market Cap: $37.8 billion

- Year-To-Date Performance: -7%

Dow Inc (NYSE:DOW), which was spun off from DowDuPont in 2019, is one of the world’s largest commodity chemical producers. It provides a wide range of products, including plastics, coatings, and silicones, to customers in market segments, such as packaging, infrastructure, and consumer applications.

After climbing to a record peak of $71.86 on April 21, DOW fell rapidly to a low of $48.27 on July 14 amid worries over a slowing global economy. The shares have since staged a modest rebound, rising by 9% in the last four weeks.

With a PE ratio below 6, DOW comes at a substantial discount when compared to other notable chemical companies, such as Air Products and Chemicals (NYSE:APD), and DuPont (NYSE:DD), which trade at 26 times and 25 times forward earnings, respectively.

On July 21, Dow delivered better-than-expected Q2 results easing fears that demand for its products might be slowing.

As part of its constant effort to return capital to investors, in Q2 it completed an $800 million share buyback and paid $505 million in dividends. The shares have a yield of 5.37%, one of the highest in the sector.

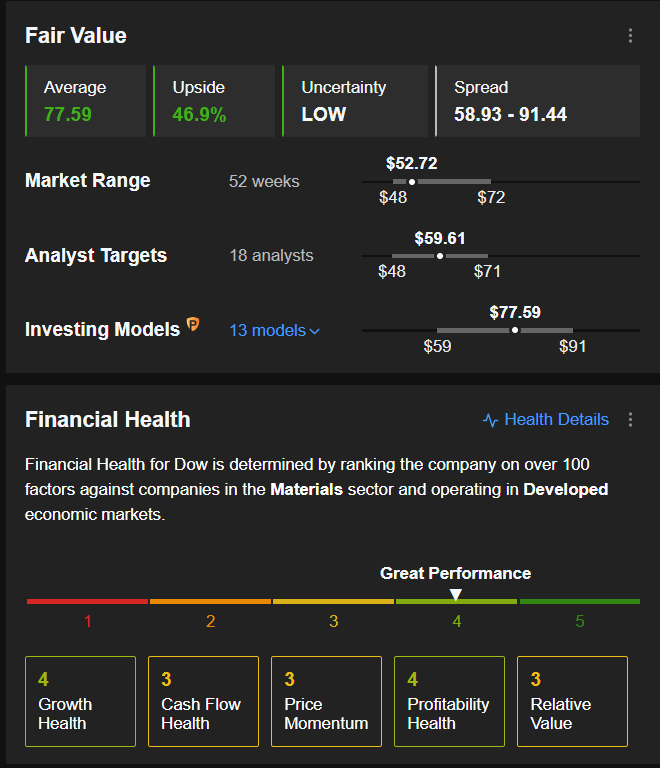

According to an Investing.com survey, 20 out of 23 analysts rate the stock ‘outperform’ or ‘hold’, with an average price target of around $60.

The average fair value on InvestingPro is $77.59, implying around 47% upside.

Chesapeake Energy

- P/E Ratio: 7.8

- Dividend Yield: 10%

- Market Cap: $11.4 billion

- Year-To-Date Performance: +52.2%

Chesapeake Energy (NASDAQ:CHK), which emerged from bankruptcy in February 2021, has been a standout performer in the booming energy sector this year, reaping the benefits of higher natural gas prices.

Shares of the Oklahoma City, Oklahoma-based fracking company have jumped by approximately 52% in 2022, far outpacing the Dow Jones Industrial Average and the S&P 500.

CHK stock's all-time high is $105 reached on May 31 this year but despite a strong year-to-date performance, it remains worth owning due to its ongoing efforts to return excess cash to shareholders.

The energy company, which posted triple-digit yoy growth in Q2 profit and revenue, boosted its annual dividend 10%, thanks to its increasing free cash flow and rapidly improving balance sheet. It now offers a sky-high yield of 10%. The company also recently doubled its stock buyback program to $2 billion.

Chesapeake has a comparatively low PE of 7.8, compared to other prominent names in the oil & gas space including EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), and Continental Resources (NYSE:CLR).

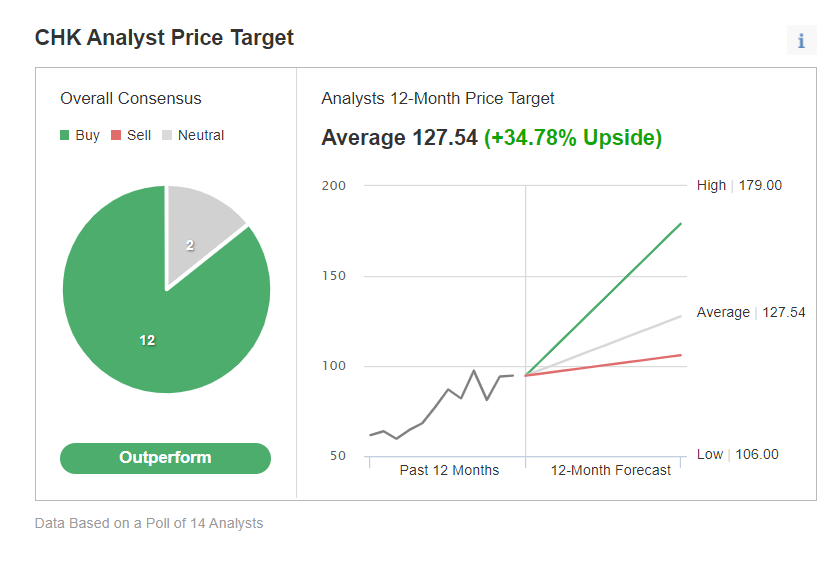

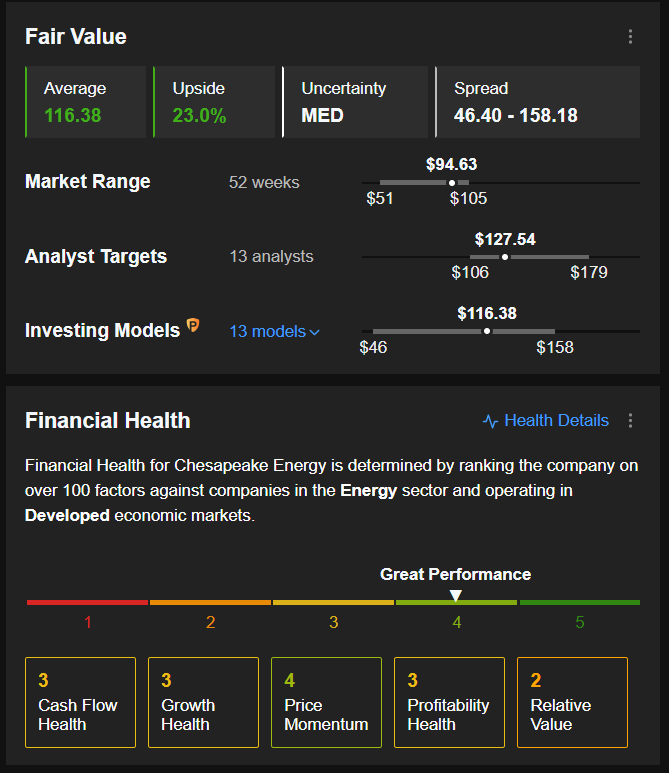

Most analysts remain generally bullish as per an Investing.com survey, which revealed that 12 out of 14 rate it as a ‘buy’ with an average price target of $127.54.

Most analysts remain generally bullish as per an Investing.com survey, which revealed that 12 out of 14 rate it as a ‘buy’ with an average price target of $127.54.

According to the Investing Pro model, it has a fair value of $116.38.

Disclaimer: At the time of writing, Jesse had a position in CHK shares. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.