Adaptimmune stock plunges after announcing Nasdaq delisting plans

- The Piotroski Score method has been helping investors pick stocks since 2000

- This method can be a powerful tool for an investor if used wisely

- Today, let's take a look at 4 stocks with the best Piotroski score using InvestingPro

Developed by Professor Joseph Piotroski in the early 2000s, the Piotroski Score method provides a systematic approach for selecting stocks to buy based on specific criteria.

It offers several advantages, including objectivity, simplicity, and ease of use, as it relies on data and numbers rather than subjective interpretation or prior experience.

The method uses the following nine criteria to assess the likelihood of long-term stock appreciation:

- ROA has to be positive in the current year.

- Positive cash flow in the current year.

- ROA must be higher than the previous year.

- Cash Flow has to be better than net income.

- Long-term debt must be lower than last year.

- Current ratio has to be higher than the previous year.

- There was no share increase during the year (capital dilution).

- Gross margin must be higher than last year.

- Asset turnover must be higher than last year.

For each criterion the company meets, a point is assigned to its score, making nine the highest possible score.

The method recommends only buying shares of companies with a score of seven or higher. Accordingly, if, over time, a company's situation changes and its score falls below that threshold, it would mean it's time to sell.

While the Piotroski Score method isn't infallible, it's a valuable and comprehensive tool that can complement other strategies in an investor's toolkit.

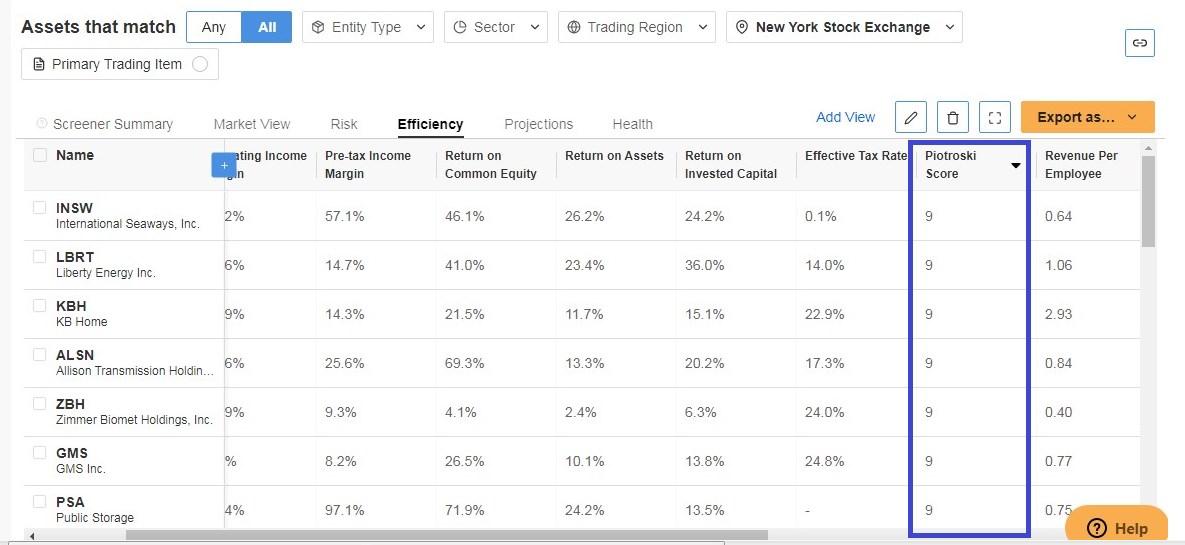

Below, we'll explore some stocks that have received the highest possible score of 9 using the Piotroski Score method, utilizing the InvestingPro tool to filter and rank stocks by sector, country, and stock market based on their Piotroski Scores.

Source: InvestingPro

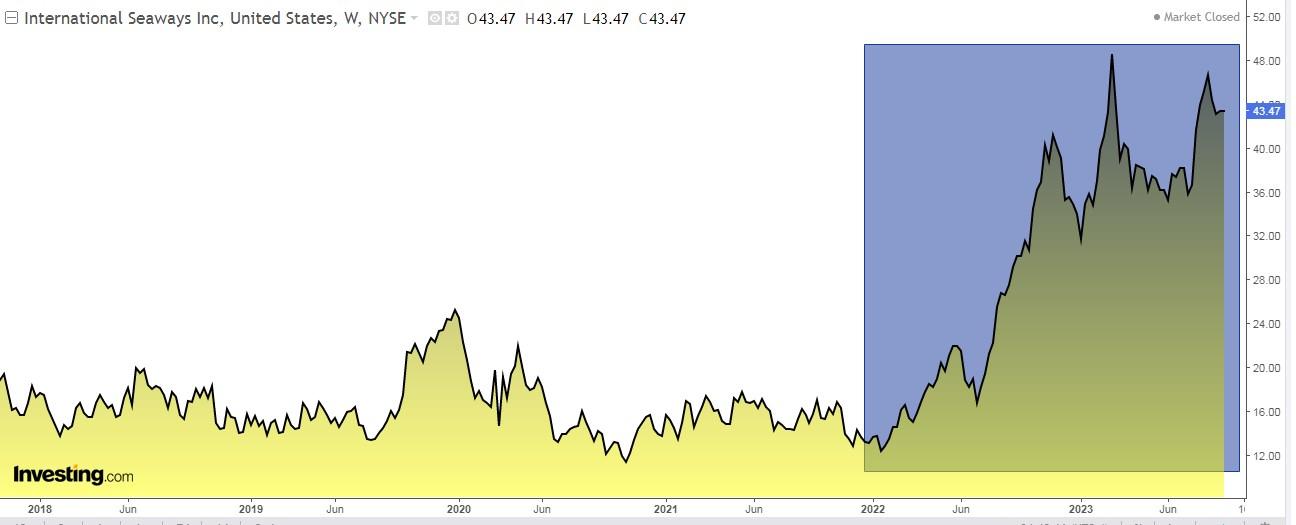

1. International Seaways

International Seaways (NYSE:INSW) is one of the largest oil companies in the world, operating with a fleet of 75 vessels. The company is headquartered in New York City. It began operating through its predecessor company in 2016.

International Seaways (NYSE:INSW) is one of the largest oil companies in the world, operating with a fleet of 75 vessels. The company is headquartered in New York City. It began operating through its predecessor company in 2016.

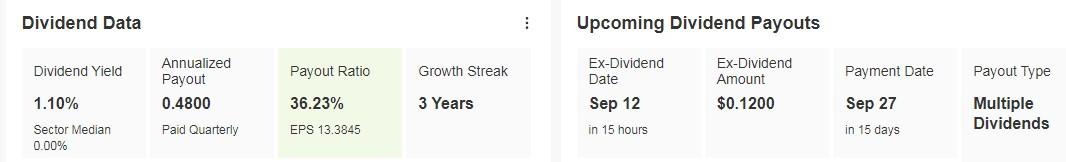

On September 27, it will distribute a dividend of $0.12, and in order to receive it, you must hold shares before September 12.

Source: InvestingPro

Source: InvestingPro

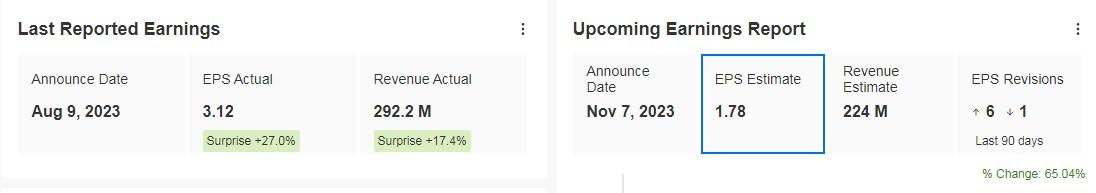

The results it presented on August 9 were very good, beating forecasts in both actual revenue and earnings per share (EPS).

The next financial results are expected on November 7, with a projected increase of 53% in revenue and 65% in EPS. Source: InvestingPro

Source: InvestingPro

The Piotroski Score gives it a rating of 9 which is the highest possible.

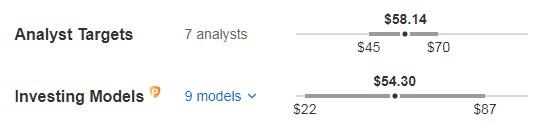

Out of 7 analyst ratings, all 7 recommend buying, and none suggest selling. The market gives it potential at $58.14, while InvestingPro models put it at $54.30.

Source: InvestingPro

2. KB Home

KB Home (NYSE:KBH) is a homebuilder based in Los Angeles, California. Founded in 1957 as Kaufman & Broad, it was the first company to list on the New York Stock Exchange as a homebuilder.

KB Home (NYSE:KBH) is a homebuilder based in Los Angeles, California. Founded in 1957 as Kaufman & Broad, it was the first company to list on the New York Stock Exchange as a homebuilder.

The results presented on June 21 were spectacular, beating all market forecasts (+24% in actual revenues and +50% in earnings per share).

The next results will be released on September 20. The actual revenue forecast for 2024 is +7.1%, and EPS is +9.5%.

Source: InvestingPro

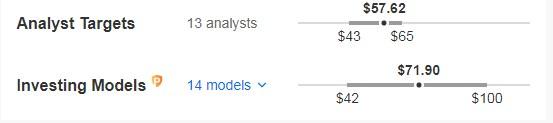

The Piotroski Score gives it a rating of 9, which is the highest possible. It has 16 analyst ratings, of which 5 are buy, 10 are hold, and 1 is sell. The market gives it potential at $57.62, while InvestingPro models put it at $71.90.

Source: InvestingPro

The asset has been relying on its support level to sustain its upward momentum.

3. Allison Transmission

Allison Transmission (NYSE:ALSN) is a U.S. manufacturer of hybrid electric propulsion systems for commercial vehicles.

Allison Transmission (NYSE:ALSN) is a U.S. manufacturer of hybrid electric propulsion systems for commercial vehicles.

More than 250 leading vehicle manufacturers use its products. The company is headquartered in Indianapolis, Indiana.

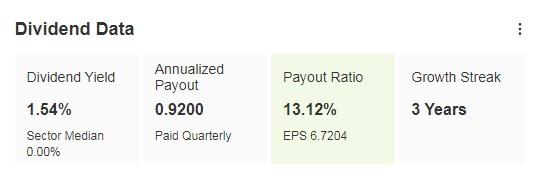

On August 31, it paid a dividend of $0.23 (an annualized dividend of $0.92). The annualized yield on that dividend is +1.54%.

Source: InvestingPro

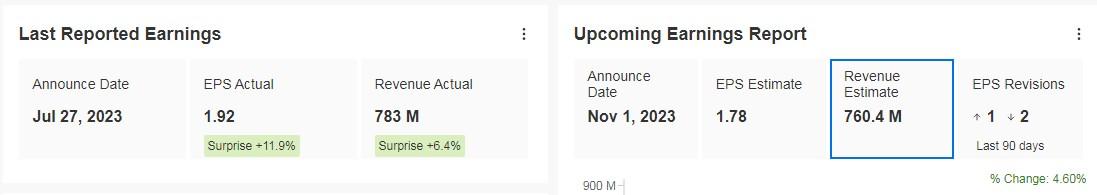

Good numbers were presented on July 27th, which exceeded market forecasts in terms of actual revenues (+6.4%) and EPS (+11.9%).

The next set of numbers is scheduled to be presented on November 1, with actual revenues expected to be favorable (+4.60%). The EPS guidance for this year is +20.2%, while the actual revenue is expected to be +9.3%.  Source: InvestingPro

Source: InvestingPro

The Piotroski Score gives it a rating of 9, which is the highest. It presents 10 ratings, of which 4 are buy, 4 are hold, and 2 are sell. InvestingPro models give it potential at $80.60.

Source: InvestingPro

4. GMS

GMS (NYSE:GMS) is a company that sells building products in the United States and Canada.

GMS (NYSE:GMS) is a company that sells building products in the United States and Canada.

It offers a wide range of roofing products that are primarily used in commercial and institutional buildings such as offices, hotels, hospitals, retail establishments, and schools. The company was founded in 1971 and is headquartered in Tucker, Georgia.

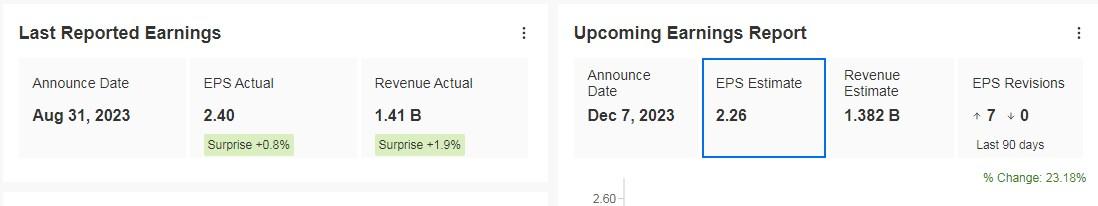

At the end of August, it presented its earnings, which managed to beat forecasts by a small margin (EPS +0.8% and actual revenues +1.9%).

The next earnings report on December 7th is expected to yield better results, with a 32.18% increase in EPS and a 13.04% increase in actual revenues. Source: InvestingPro

Source: InvestingPro

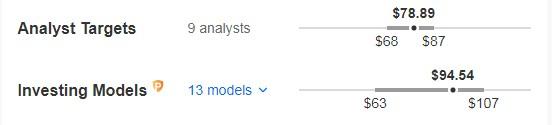

The company in question has received a Piotroski Score of 9, which is the highest possible rating. Out of the 8 ratings it has received, 4 are buy, and 4 are hold.

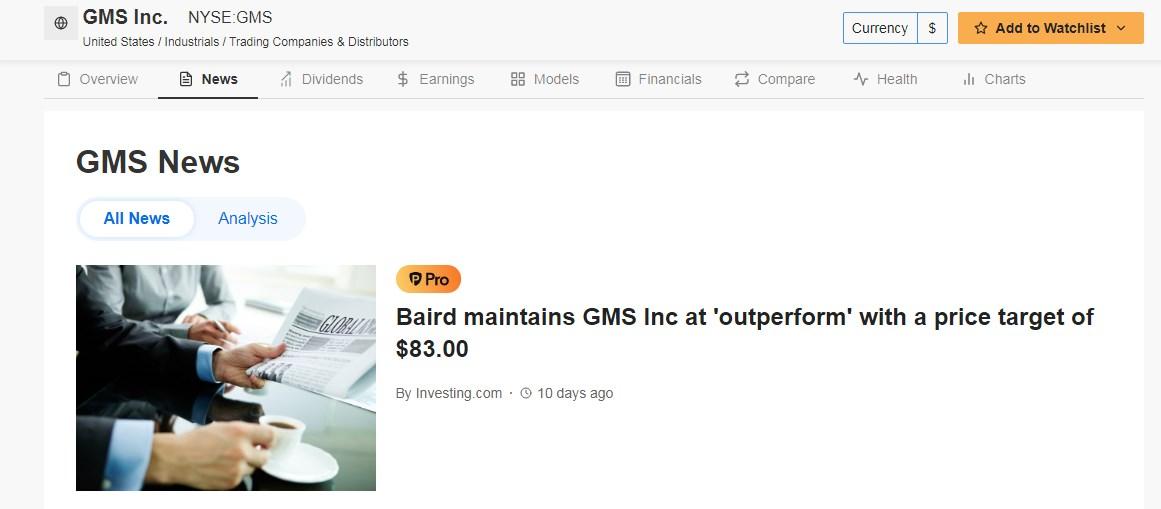

According to InvestingPro models, the company has the potential to reach $94.54, while the market prediction is $79. The latest forecast by Baird suggests the stock could hit $84.

Source: InvestingPro

Source: InvestingPro

***

Disclaimer: This article is for information purposes only; it is not intended to encourage the purchase of assets in any way, and does not constitute a solicitation, offer, recommendation, opinion, advice or investment recommendation. We remind you that all assets are considered from different angles and are extremely risky, so that the investment decision and the associated risk are specific to the investor.