SoFi shares rise as record revenue, member growth drive strong Q3 results

When treasury bond yields are rising, bond prices are falling. It’s an inverse relationship.

And so it makes sense that the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) has fallen sharply during the Federal Reserve’s rate hike cycle.

“The Facts, Ma’am. Just the facts.” – Joe Friday

During the current rate hike cycle, the 10-year treasury bond yield has risen to over 4.4%! And this has put pressure on treasury bond prices.

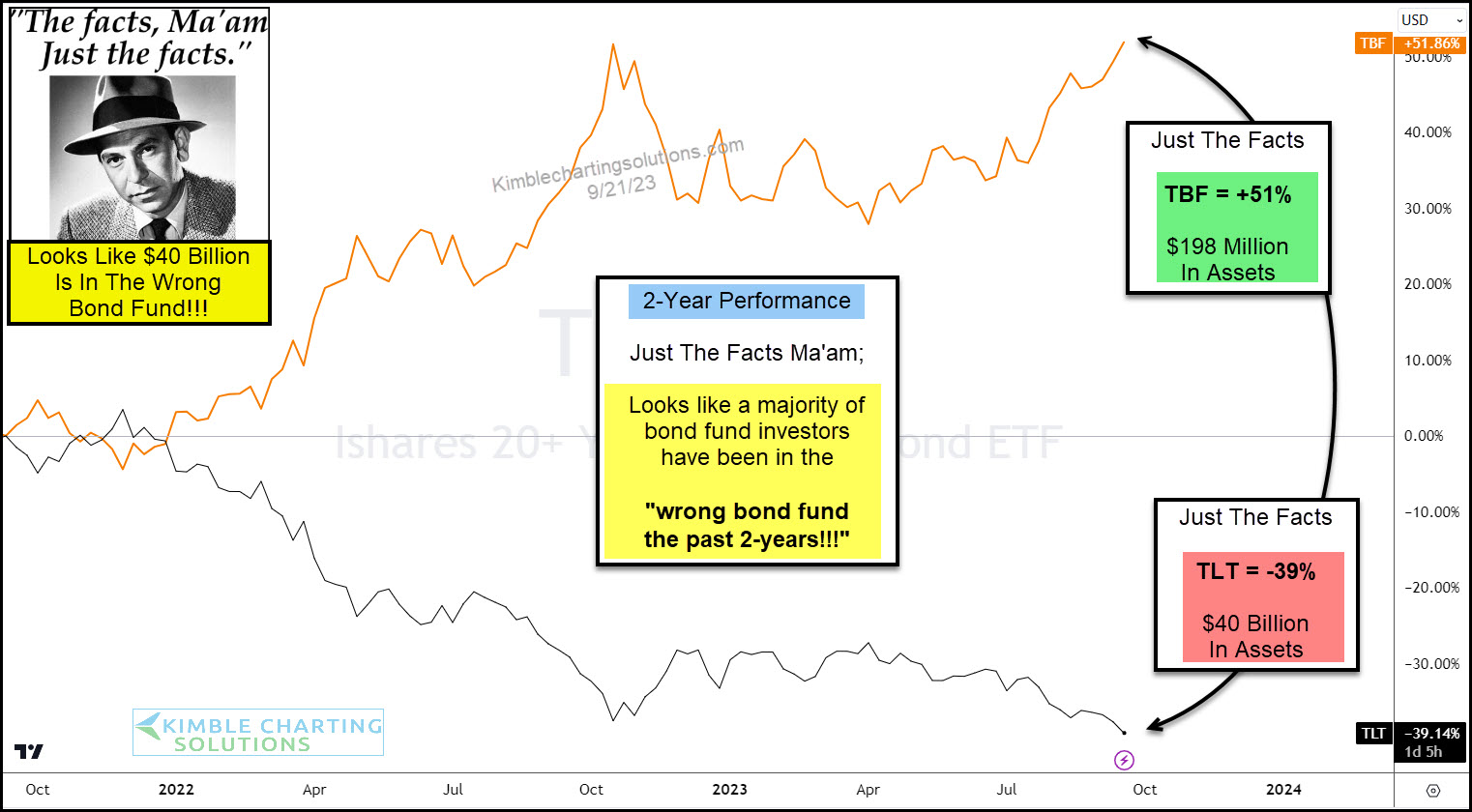

Today’s chart takes a look at the performance of one of the largest and most popular bullish (long) treasury bond ETFs, the 20+ year ETF (TLT) versus its counterpart, the bearish (short) 20+ year treasury bond ETF (TBF).

As you can see, TBF (with only $198 million in assets) is up +51% over the past 2 years. In contrast, the much larger TLT (with $40 billion in assets) is down -39%.

Two Takeaways:

It would have paid to watch the trends and simply stay out of TLT over the past several months.

It also looks like the majority of the world (and $40 billion!) has been in the wrong bond fund for the past 2-years.