Williams Wesley Hastie sells $328k in Cipher Mining shares

- Following a sharp fall post Trump's election as US president, Gold has posted a solid rebound.

- Several factors suggest that the metal will continue to rise in 2025.

- Let's take a look at 5 stocks that could benefit from gold's potential run.

- LAST CHANCE: InvestingPro is on sale up to -55% for the last few days of Extended Cyber Monday!

After reaching a 2-month low of $2565 on November 14, gold has rebounded strongly, marking a peak of over $2760 early this Thursday morning, up 7.6% in less than a month.

As a safe-haven asset, gold benefitted from the renewed risk appetite generated by Donald Trump's election (and the US Dollar's rise). But with Trump's victory sending equities to new all-time highs, investors abandoned safe-haven assets such as gold.

The impact on the yellow metal has been all the greater as the dollar has also risen thanks to Trump, due to the influx of foreign capital into US markets, and because the market fears that some of his policies will lead the Fed to slow the pace of rate cuts.

Towards another bullish year for gold in 2025?

However, the strong rally in the yellow metal in recent weeks, which this time came at the same time as record-breaking share prices, suggests that 2025 could be another bullish year for gold.

Indeed, although Trump's plans, including tariffs, are likely to drive inflation higher and worry the Fed, the slowdown in the job market that is beginning to emerge suggests that the Fed will continue to lower rates next year.

Analysts at Goldman Sachs, for example, expect the Fed funds rate to fall by more than 100 basis points to a range of 3.25% to 3.5% next year.

However, as gold is non-interest-bearing, it struggles to compete with interest-bearing assets when rates are high, a dynamic that is gradually reversed as borrowing costs fall.

It's also important to remember that gold purchases by central banks have played a key role in the yellow metal's rise this year, a trend that shows no sign of slowing down since 2022 after the restrictions imposed by the USA on Russia triggered a race to diversify reserves.

Indeed, many countries saw Western sanctions against Moscow as an incentive to diversify away from the greenback, stimulating gold purchases by central banks.

Last but not least, the still tense global geopolitical context as the new year approaches also increases the relevance of investing in gold, and its chances of advancing next year.

5 gold stocks to take advantage of gold's potential rise

Against this backdrop, it seems worthwhile to take stock of the best gold stocks to buy to profit from the yellow metal's rise.

So we set out to find the best opportunities in the sector. To do so, we've compiled the 5 biggest gold stocks by capitalization into an InvestingPro watchlist.

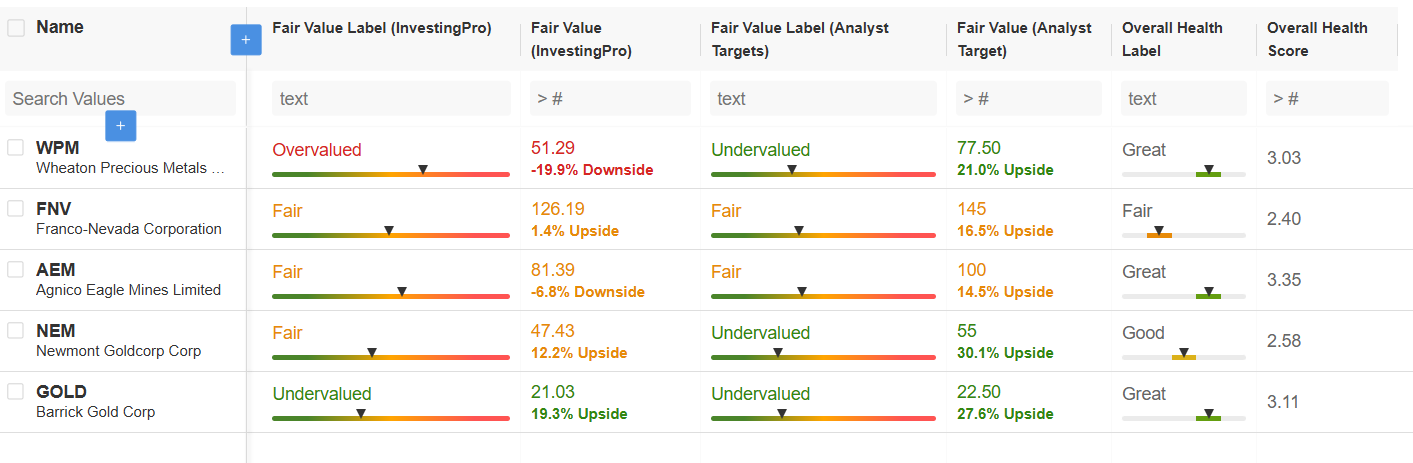

These 5 stocks are Newmont (NYSE:NEM), Agnico Eagle Mines (NYSE:AEM), Barrick Gold (NYSE:GOLD), Wheaton Precious Metals (NYSE:WPM) and Franco-Nevada Corp (TSX:FNV).

Source : InvestingPro

The only stock on the list considered undervalued by analysts and the InvestingPro Fair Value is Barrick Gold.

Remember that InvestingPro Fair Value calculates an intelligent synthesis of several valuation models for each stock on the market, in order to determine whether a share is over- or undervalued, and to get an idea of its potential.

Barrick Gold therefore has an upside potential of 19.3% according to InvestingPro Fair Value, and 27.6% according to analysts.

Moreover, the company has the second-highest financial health score among the stocks on the list, at 3.11/5, a score deemed "very good".

What's more, from a graphical point of view, conditions also look favorable for Barrick Gold.

As can be seen on the daily chart above, earlier this month the stock began a rebound from an uptrend line that has been stretching since mid-year, gaining enough ground to challenge the underlying bearish bias.

Conclusion

There are several indications that 2025 will be a bullish year for gold, after the yellow metal has already gained over 34% so far this year. Among the stocks that could benefit from this, Barrick Gold stands out as a relevant opportunity from both a valuation and technical point of view.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.