Moody’s downgrades Senegal to Caa1 amid rising debt concerns

- Navigating the stock market requires understanding its natural cycles and maintaining a long-term perspective.

- This article delves into key concepts such as the inevitability of bear markets, the benefits of volatility, and the cyclical nature of market trends.

- By grasping these principles, investors can develop a sound strategy to achieve long-term success.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

The stock market can feel like a rollercoaster ride, with periods of exhilarating growth followed by stomach-churning dips. While these downturns can be nerve-wracking, a historical perspective can help you weather the storm and stay focused on your long-term investment goals.

This article explores five key concepts that every investor should understand to navigate the stock market's natural cycles and maximize their chances of success. We'll delve into the inevitability of bear markets, the link between volatility and higher returns, the cyclical nature of market trends, the importance of holding for the long term, and the challenge of actively picking stocks that outperform the market.

By grasping these principles, you can gain a clear-eyed understanding of how the market works and develop a sound investment strategy for the future. So, here are the 5 key concepts to remember when investing in stocks for long-term gains:

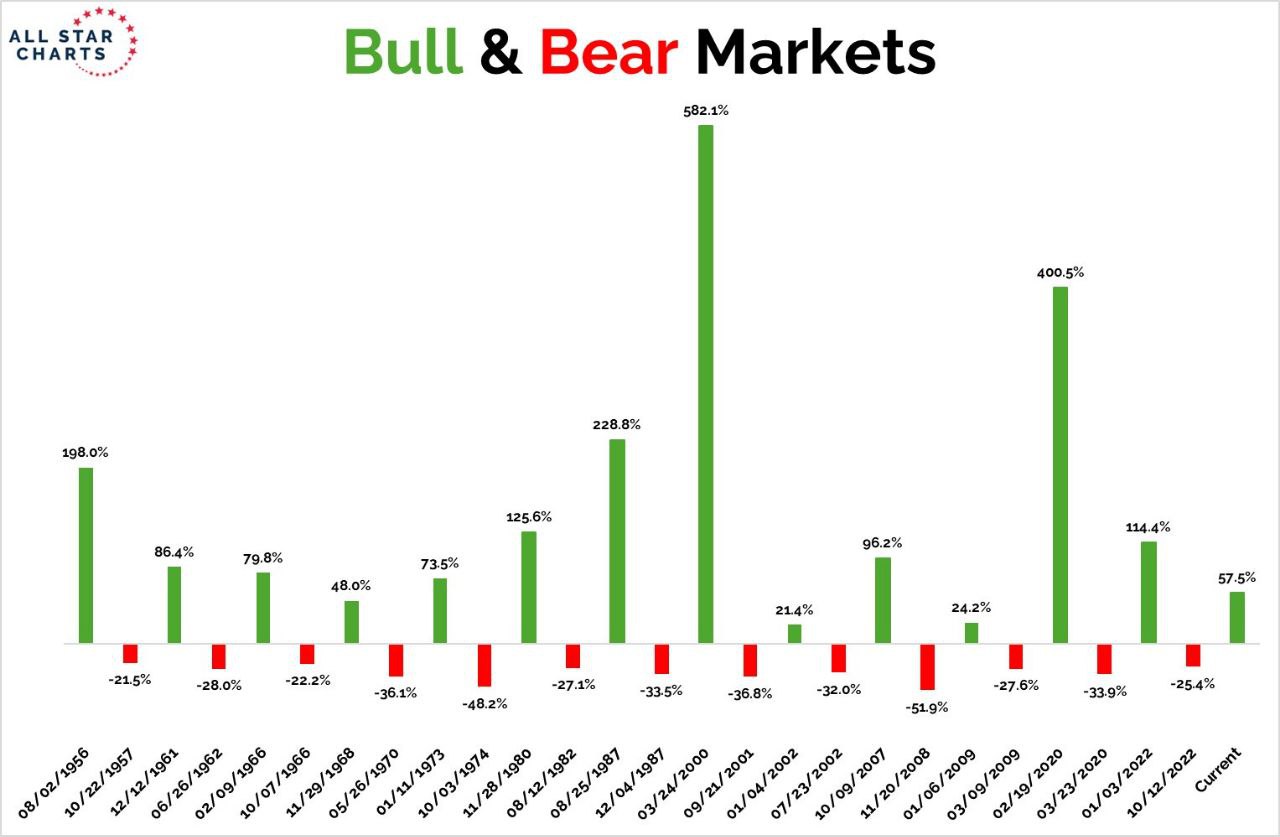

1. Embrace Bear Markets as Stepping Stones

Bear markets, periods of significant price decline, are inevitable. However, they tend to be shorter than bull markets (growth periods).

While these downturns can be nerve-wracking, remember: panicking and selling can lock in losses. A long-term perspective helps you weather these storms and capitalize on future opportunities.

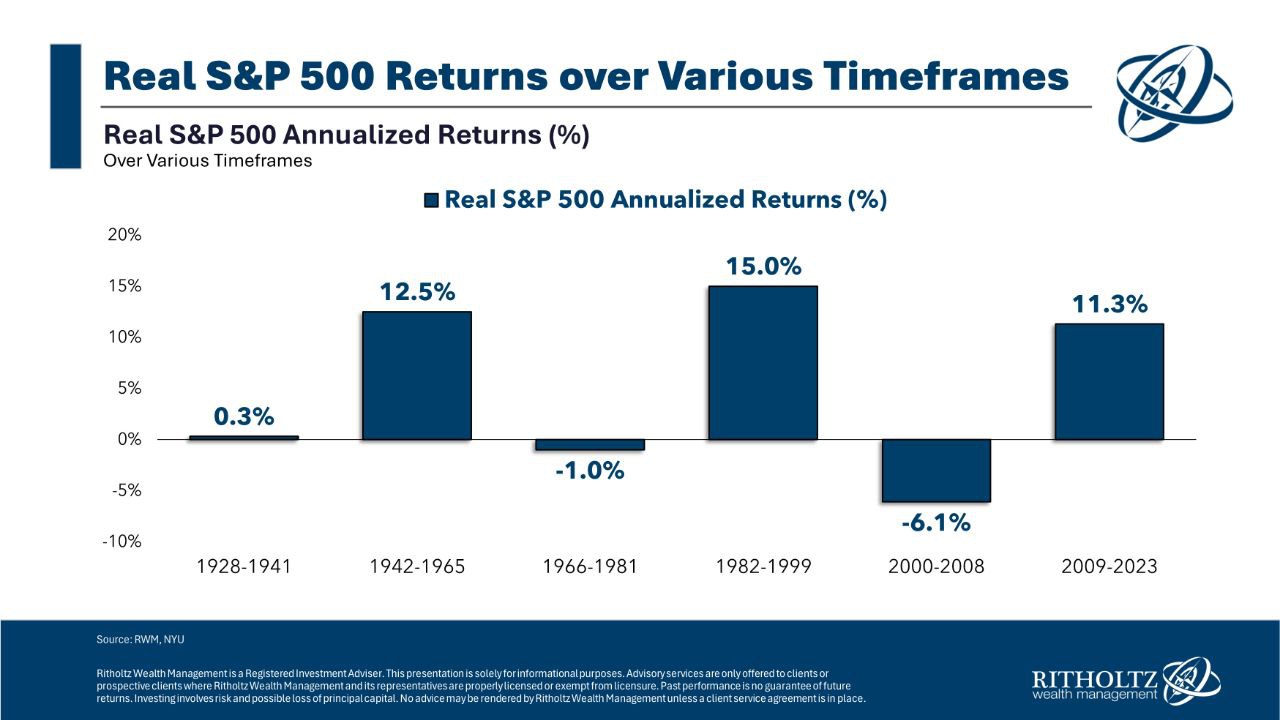

2. Volatility Can Create Opportunity

If the stock market (S&P 500) only experienced steady growth, its returns would be similar to those of a deposit account or short-term bond due to the limited risk.

Thankfully, the market's unpredictability and occasional major declines enable it to offer higher returns over the long term. This phenomenon, known as the risk premium, is especially significant during certain high impact events.

3. Everything Is Cyclical

Howard Marks aptly describes market movements as a pendulum, swinging between extremes rather than settling in the middle. This cyclical nature means that after periods of strong performance, markets often experience downturns, and vice versa.

During bullish phases, valuations soar and investor sentiment is euphoric, driving prices higher. However, this exuberance sets the stage for lower future returns as valuations become stretched. Eventually, the market corrects, prices fall, and fear replaces euphoria. This correction paves the way for the next cycle of growth.

Understanding this pendulum effect can help investors navigate market cycles more effectively, allowing them to anticipate shifts and adjust their strategies accordingly.

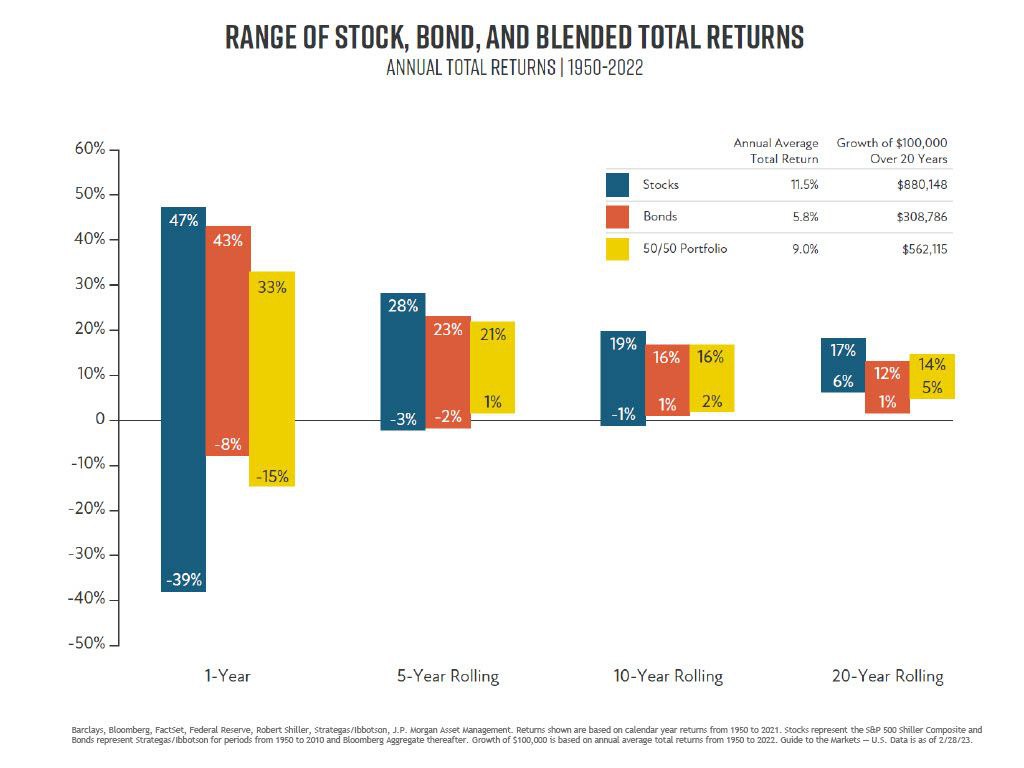

4. Time and Patience Are Crucial

Want to make money in the stock markets? Success requires time and patience. The longer you hold stocks in your portfolio, the higher your chances of making a profit. Currently, the average holding period for stocks is just six months.

This short-term approach often leads to financial losses, as illustrated by the chart below. Most investors fail to make money because they bet against the odds.

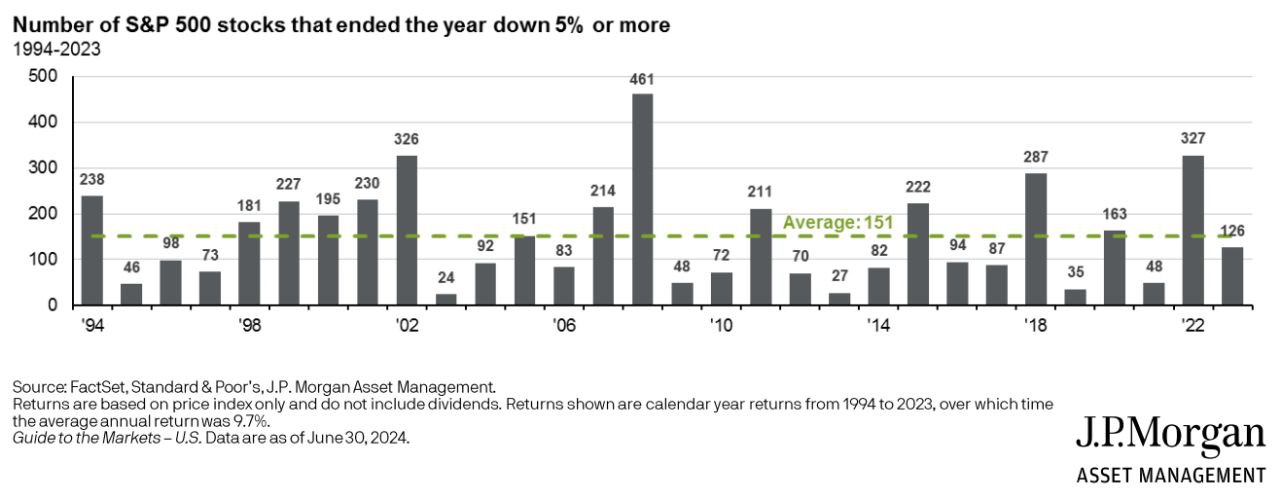

5. Can You Beat the Market by Stock Picking?

Stock picking to outperform the market is possible, but it's a formidable challenge. Nearly 90 percent of active managers fail to beat the market over periods longer than three years, despite having access to money, information, and skilled teams. So, can individual investors do it? Maybe.

Here's a tool that might help, available for a limited time during our summer promotion.

Keep in mind that out of the 500 companies in the S&P 500, about 151 (30%) typically end the year with negative returns. Only a few significantly outperform the market. What are the chances of picking those 20-30 stocks that will yield substantial extra returns? Slim.

As Warren Buffett said, "Investing is simple, but not easy." Everyone knows what would be the right thing to do, but few do it.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.