Trump to impose 100% tariff on China starting November 1

21e6 Capital's report suggests that Bitcoin maximalism has been the optimal way to invest in crypto.

Regarding the crypto market, it appears that the simplest investing method – holding Bitcoin (BTC) – is at the top. According to 21e6 Capital, a Swiss-based crypto investment adviser facilitating hedge funds, derivatives and index funds, these crypto offerings underperformed.

Contrasted against Bitcoin’s 83.3% gains in H1 2023, crypto funds only performed at 15.2% in the same period. Even directional funds, divided into long and short funds based on a long or short position against the crypto market, had slightly better returns at 21.9%.

The worst performers were crypto funds with a market-neutral approach, yielding merely 6.8% returns.

Bitcoin Vs. Crypto

In the aftermath of serial crypto bankruptcies (BlockFi, Celsius, 3AC), crypto-oriented bank shutdowns, and the FTX crash, it seems that a clear delineation between ‘crypto’ and Bitcoin showed its hand. This was further evidenced when US investors drove the Bitcoin rally amid the US banking crisis during Q1 ‘23.

As ‘crypto winter’ shut down 13% of crypto funds globally, out of 700 that 21e6 Capital tracks, Bitcoin became a scarce asset divested from centralized entities and intermediaries.

“It is plain to see that a simple buy-and-hold investment into bitcoin would have outperformed all of these fund baskets. Bitcoin added about 80% in value by the half of the year,”

Jan Spörer, 21e6 Capital’s Due Diligence Manager

Does this mean crypto investors are better off avoiding traditional investment strategies like hedge funds? Or, to put it differently, should crypto investors adopt Bitcoin maximalism?

FTX Had a Bigger Impact Than Just Naked Fraud

To differentiate itself from other exchanges, FTX successfully ran derivatives trading, including leveraged tokens, perpetual swaps, futures, and options. At least, FTX was successful in technical terms of providing high liquidity and low latency trading.

When the once 3rd largest exchange collapsed, that liquidity suffered as well. 21e6 Capital points to this event as the main cause of low crypto-derivatives funding rates.

“As funding rates stay low, these trades are not an option for managers currently.”

Based on 21e6 Capital’s tracking of crypto funds, the sentiment among liquidity providers and investors is still lower than expected, despite the Bitcoin rally. Moreover, due to Operation Chokepoint 2.0, even solidly performing crypto funds had to shut down as the supply of banking partners was cut off.

Why Did Directional Crypto Funds Perform Best?

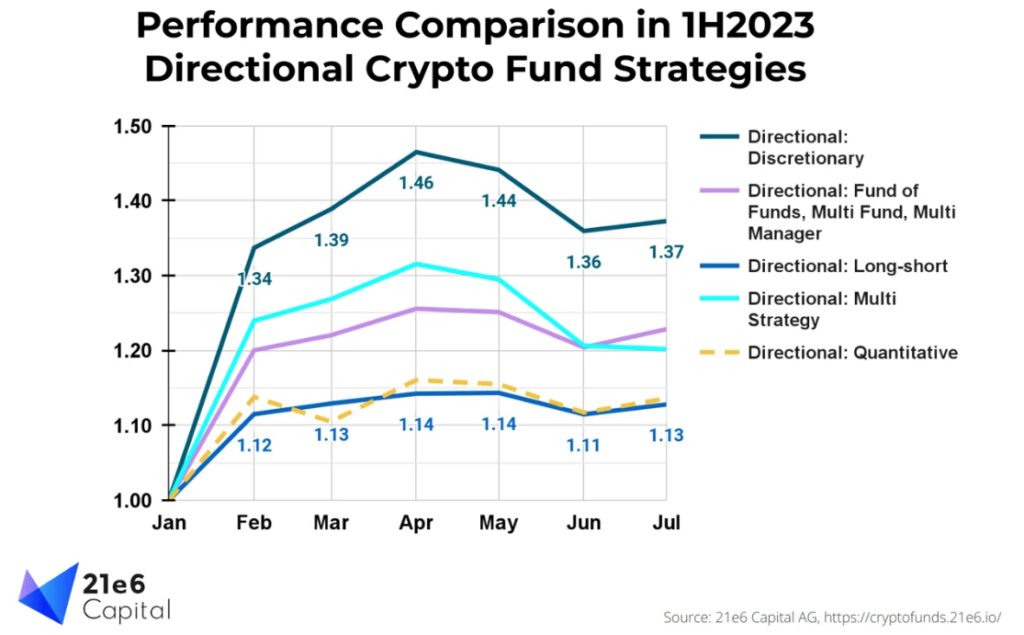

When assessing the performance of crypto funds, 21e6 Capital divided them into directional and non-directional. Because the latter category employs an active strategy against the crypto market, offering higher risk alongside higher returns, directional funds outperformed non-directional by 15.1%.

However, within the directional fund's category, the discretionary subgroup had the highest performance. These are manually directed by managers with the discretionary freedom to direct investments based on their market analysis.

Image courtesy of 21e6 Capital

In addition to this flexibility, discretionary funds are less reliant on banks, as fewer requirements are needed. At the same time, directional quantitative funds performed the worst. These funds employ statistical analysis and machine learning to detect market patterns and act accordingly.

21e6 Capital attributed the failure of its trading algorithms to an abundance of false signals. After all, drained liquidity post-FTX crash created a more volatile market. Likewise, more complex quantitative funds were more affected by the loss of crypto banks and custodians, such as Silvergate.

In the end, surviving crypto funds have turned positive in 2023. But given Bitcoin’s rise in dominance to over 50%, exposure to altcoins, futures, and momentum signals proved to be a detriment compared to just ‘hodling’ Bitcoin.

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

***

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.