Verizon to cut 15,000 jobs amid growing competition pressures - WSJ

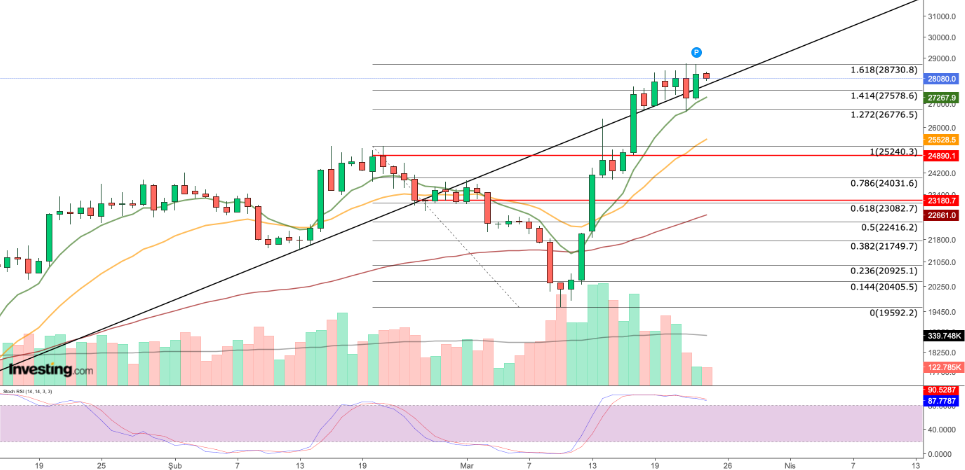

- Bitcoin recently lost bullish momentum, trading in the $26,750 - $28,730 range, with $28,000 as critical resistance

- A potential pullback may lead to a retreat toward the $27,250-$27,500 support and a sharp correction toward $25,000

- Fed's interest rate hike put pressure on banks, and escalation of banking crisis may help spur a rally to $30,000

Bitcoin has lost bullish momentum after reclaiming the 2023 trend line with last week's bounce. This past week, BTC prices reflected increasing volatility.

Among the technical indicators we have been following based on Bitcoin's February-March pullback, the $26,750 - $28,730 range has been crucial in recent weeks. These are Fibonacci expansion levels.

Lately, BTC has been trading in this range. Since last week, the $26,700 level has been acting as support. And it has made weak attempts to breach the $28,700 level. Meanwhile, $27,500 (Fib 1,414) continues to act as a short-term pivot level.

Bitcoin's $28,000 Resistance Critical

Meanwhile, BTC continues to attempt to break above the $28,000 level, and the failure to gain traction in this region is starting to create stress in the BTC market.

Next week, we may see increased selling pressure if the $28,700 level is not breached in weekend trading.

The current trend for Bitcoin continues to be suppressed after breaking into the $27,000 band. If buying interest wanes, this pressure could turn into a sharp correction. The first support zone for a potential pullback is the $27,250-$27,500 area. This support is at the 8-day exponential moving average (EMA) at $27,500, which is the pivot level.

BTC could quickly retreat toward the $25,000 area on a potential breakout. The $25,000 area was a major resistance zone in February, along with the 21-day EMA.

Finally, based on the short-term price action, the $22,800 - $23,000 area will be a key support zone for Bitcoin.

For Bitcoin's uptrend to be technically triggered, it is important to break $28,700, which I have been highlighting for some time, on volume or weekly close. BTC can rally to $34,000 on high volume if this break occurs.

This week saw the announcement of the most critical Fed decision in months. And the message regarding the banking crisis that began in the U.S. and spread to Europe at the FOMC meeting was extremely important.

The expectation that the Fed would raise rates by 25 basis points had already been priced in before the decision.

However, after Powell's speech at the press conference, Bitcoin retreated slightly. The Fed reaffirmed its commitment to its inflation target and put pressure on the banks by continuing to raise interest rates.

Continuing Banking Crisis Could Help Support Bitcoin

On the other hand, Powell said that they have enough tools to support banks. He signaled that the Fed could take steps to expand the bank's balance sheet if necessary while implementing a tight monetary policy.

Currently, the price is defending the $26,000 support level amid mixed reactions in the Bitcoin market. The banking sector is once again on the agenda.

Today, shares of Deutsche Bank (ETR:DBKGn) fell by more than 10%, which was interpreted as a further escalation of the crisis in the banking sector.

As at the beginning of the process, all these developments may further increase the demand for Bitcoin-based crypto assets.

With fresh buying interest at the weekly close above $28,700, we may see Bitcoin rally toward the $30,000 band next week. However, failure to break through resistance will trigger a correction to $25,000.

Disclosure: The author doesn't own any of the securities mentioned.