e.l.f. Beauty stock plummets 20% as revenue and guidance fall short of expectations

- Bitcoin has been trading sideways around the $26,000 mark

- For the crypto to break its current trend, a series of events must have favorable outcomes

- Meanwhile, Ethereum needs to reclaim $1660 to initiate an uptrend

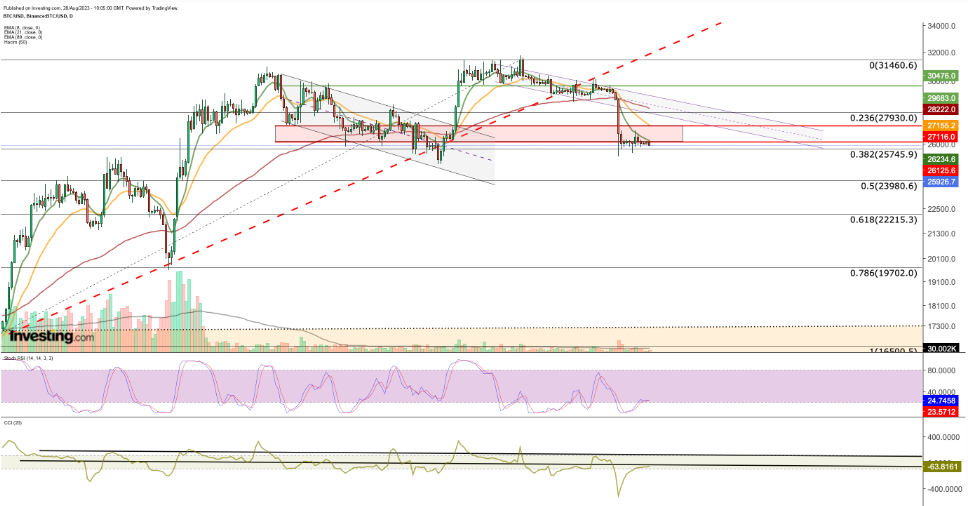

Bitcoin has maintained its sideways movement around the $26,000 level following a sharp decline in the first half of August.

Even with the closely watched Jackson Hole Symposium where Fed President Powell spoke last week, Bitcoin remained unmoved, and the largest cryptocurrency continued to experience price compression.

Powell's messages in his speech echoed his previous statements, resulting in no significant price fluctuations in the volatile crypto sector, as they were already priced in. Consequently, Bitcoin has entered the final days of August with a relatively calm outlook.

However, due to persistent selling pressure, there is always a risk Bitcoin could head lower.

The upcoming month of September is poised to bring about crucial events with implications for the cryptocurrency sector. Firstly, all eyes will be on the US Securities and Exchange Commission (SEC) for its decision on applications for spot Bitcoin ETFs.

Additionally, ahead of this decision phase, an outcome is expected soon in the case filed by Grayscale, which seeks to transform its existing Bitcoin fund into a spot ETF. A negative ruling in this case might have negative repercussions for the crypto market.

Among other significant economic data in the week, the GDP, unemployment rate, and nonfarm payrolls rate will be released.

These figures, crucially watched by the Fed following the inflation data in their interest rate decisions, could also be pivotal in steering the market's new direction. If the data suggests the US economy remains robust, it might imply that inflation is staying resilient.

This could subsequently heighten expectations for a 25-basis point interest rate hike by the Fed in September. While the current anticipation for a rate increase in September stands at 20%, it notably increased from 10% in the past week.

In light of this data, we can see that the bearish trend could continue if Bitcoin sees a daily close below $26,000 on price action as it slips below the support zone.

Technically, the next support zone seems to be in the range of $23,900 - $24,000, according to the 2023 trend. Below this support, a retreat to the $ 22,000 limit is likely.

While a negative sentiment is currently prevalent in the Bitcoin market, it may shift depending on developments in the near term. The closest upside resistance lies at $26,250, corresponding to the location of the 8-day EMA value.

A bounce above this level could lead to encountering a secondary resistance point at $27,200. Looking ahead, the potential for a broader Bitcoin market uptrend might hinge on establishing a support base above $28,250. Any attempts at upward movement leading up to this level might yield a limited impact.

Simultaneously, as the Bitcoin price experiences sideways movement, the Stochastic RSI's upward motion from the lower end on the daily chart could indicate a potential recovery. To achieve this, Bitcoin would need to start a bullish movement towards the $27,000 mark.

While the average trading volume in cryptocurrency markets has dwindled to a meager $20 billion, there's a significant reduction in risk appetite, lowering overall volatility.

Any unfavorable decisions in the aforementioned developments could become catalysts for heightened volatility.

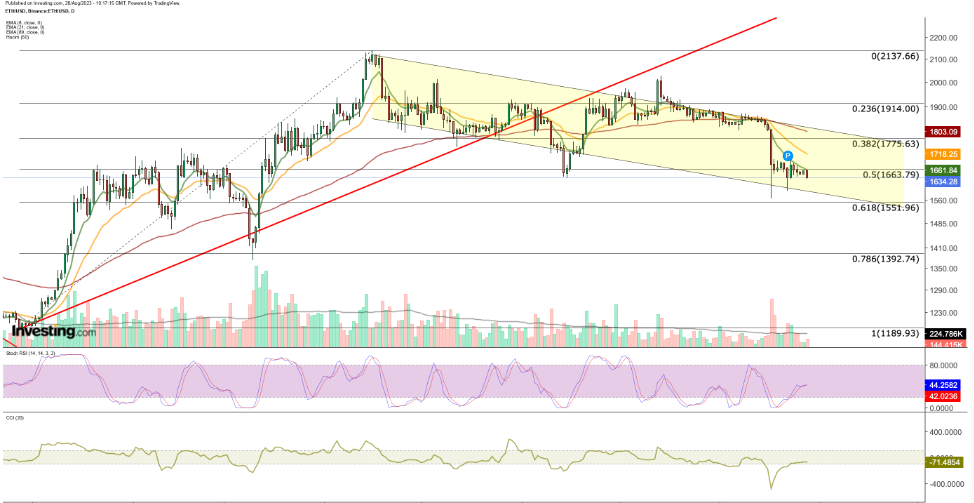

Ethereum: Important Levels to Watch

Following the significant decline on August 17, Ethereum has been trading below the $1,660 support in a sideways pattern. The prevailing momentum increases the chances of ETH retracing toward the next support level at $1,550.

If this support is breached, a pullback towards the $1,400 mark could come into consideration, given the formation of a gap.

To avoid further losses, it's crucial for the price to reclaim the $1,660 threshold. If a potential upward movement ensues, a decisive weekly close above $1,775 becomes essential to counter the prevailing negative outlook.

This move would entail breaking the descending channel that has emerged since the peak in April, marking an opportunity to try and build some positive momentum.

Consequently, it's possible that an upward trajectory could initiate for ETH, initially targeting around $1,550, followed by the potential to sustain this level with daily closes.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.