Adaptimmune stock plunges after announcing Nasdaq delisting plans

This article was written exclusively for Investing.com.

Oil prices have been all over the place recently. On Thursday, for example, WTI initially slumped by more than $1 on news China released some of its strategic crude reserves in an unprecedented intervention in the oil market. But then it made back all of those losses as the US reported a record crude production plunge and a sizeable drawdown in gasoline stocks…before turning lower again late in the day.

After Thursday’s drop, crude oil prices have rebounded in the first half of today’s session, along with some of the other risk assets. But as has become a trend for many markets, the second half of today’s session could be completely different.

As the supply and demand dynamics play out, prices have been coiling inside a narrow range over the past several days. This means that we will see a breakout in one or the other direction soon. As traders, it is important not to fixate your minds on a particular direction. Traders need to be open-minded at all times, as no one will ever know for sure, or with very high degree of confidence, which direction the markets are heading. You can, however, prepare yourself tactically to take advantage of short-term movements in prices. Obviously, you can always have a stronger view, but it is important to drop that view if the market is telling you something else.

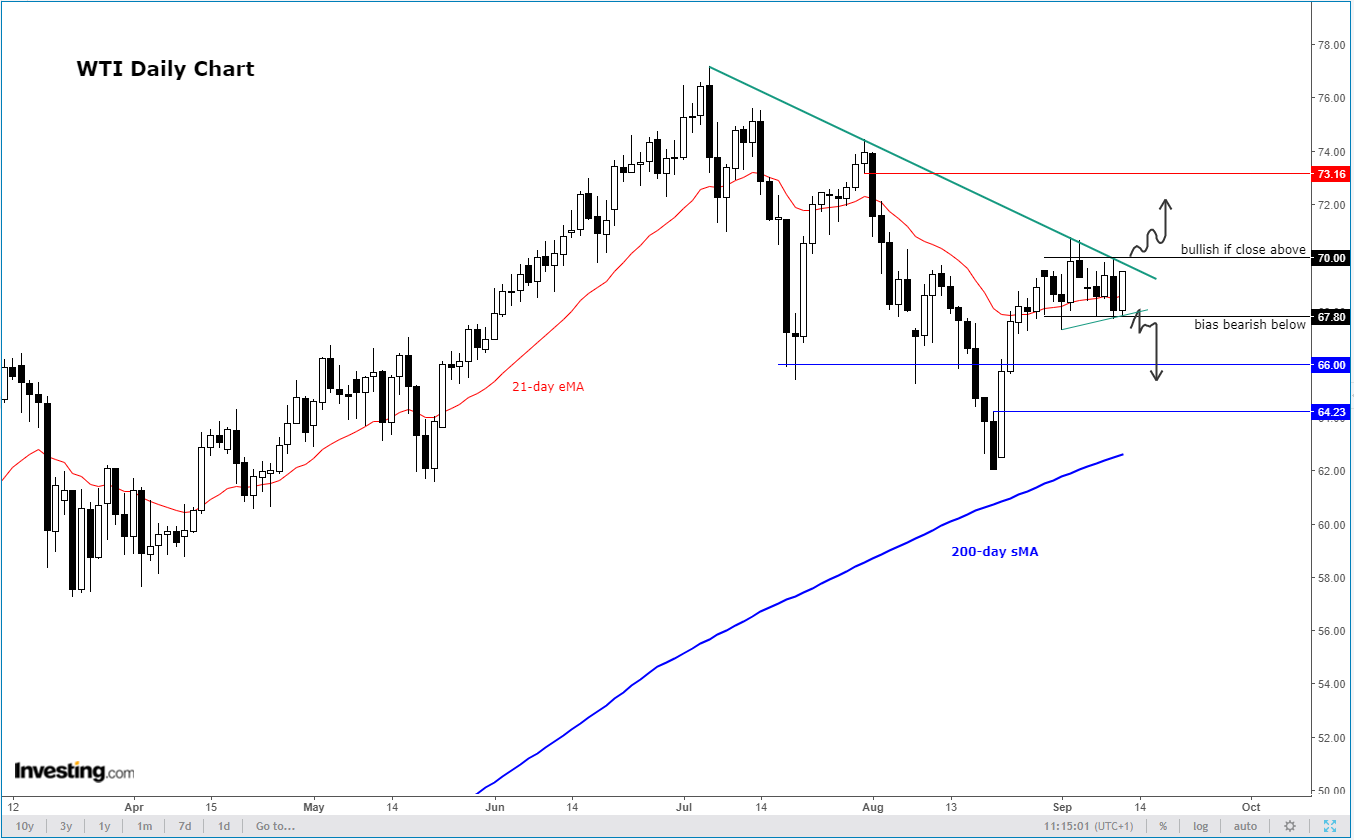

With that in mind, range-trading is currently the most appropriate strategy for short-term traders in crude oil, as prices are stuck between a rock (around $67.80) and a hard place (around $70.00). But if this is not your trading style, then it is imperative to wait for prices to break out of this range and look to trade in the direction of the trend.

Given the recent lower highs and the bearish trend line in place, it appears as though the risks are skewed to the downside. But for confirmation, we need to see the breakdown of the $67.80 level first before potentially looking for bearish trades. If that happens, oil prices could make a move towards the low $60s, where the prior lows and the 200-day moving average converge. On the way to those levels, we may see some support around $66.00 and $64.20 where previously prices had found resistance.

However, if the bearish trend breaks and WTI closes above $70.00 in the coming days, then this would negate the short-term bearish bias. In this case, we could see further technical buying in the subsequent days towards $72.00 initially, ahead of $73.15 next.