UnitedHealth tests AI system to streamline medical claims processing - Bloomberg

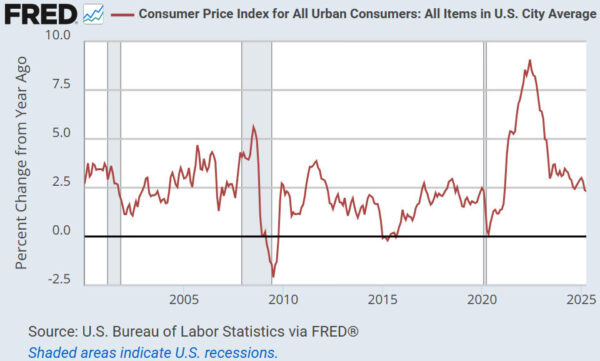

The US CPI numbers reported on Tuesday, 13th May, extended the downward trend that began in mid-2022. As illustrated by the following chart, the year-over-year growth rate of the US CPI has just made a new cycle low. The Core CPI’s growth rate is significantly higher and was reported to be unchanged at 2.8%, but its annualised growth rate over the past three months is only 2.1%. Therefore, the Core CPI also is moving in the right direction. However, the implications and the outlook are not clear.

The last time the CPI’s growth rate was as low as it was in April of this year was February-2021, at which time the Fed was inflating the money supply aggressively via its QE program and maintaining a target interest rate of around zero. Now, the Fed is still draining money via QT and expects to keep its targeted interest rate at 4.25%-4.50% in the short-term. Why?

The principal problem is that the Fed has no way of knowing what its monetary policy should be, because the correct interest rates and monetary conditions are those that would exist in the absence of the Fed. The Fed is the equivalent of a giant spanner that has been thrown permanently into the monetary works. The best that anyone reasonably can hope for is that the damage it does is counteracted partly by private industry.

A secondary issue is that having exacerbated the inflation problem by being so blatantly late in stopping its monetary easing and starting its monetary tightening during 2020-2022, the Fed is now being overly cautious with regard to any actions that would ease monetary conditions.

A related secondary issue is that the constantly shifting tariff situation is causing uncertainty at the Fed just like it is causing uncertainty everywhere else. The news that the US and China governments have agreed to slash tariffs by 115% — from 145% to 30% in the case of the US and from 125% to 10% in the case of China — is positive, but at this stage the reduced rates are for 90 days only and still leave the average tariff rate for US imports at around 18%, which is the highest since 1934.

The tariffs will be more negative for economic growth than positive for inflation, but they could cause an upward ‘blip’ in the official inflation numbers over the next few months if the economy doesn’t tank in the meantime. The decision-makers at the Fed are concerned about this possibility and therefore are reticent at the moment to make any moves in the easing direction.

Due to the uncertainty regarding the effects of tariffs, it’s possible that the US economy will have to become very obviously weak before the Fed makes its next decisive move to loosen monetary conditions. If so, this will magnify the severity of the recession that probably has started or will start soon, although the Fed’s slowness to loosen won’t be the primary cause of the recession. The recession will be the result of several years of malinvestment, with a final push coming from the “policy uncertainty” of the past few months.