Asia stocks upbeat on US tech rise; Japan reverses gains on BOJ ETF sale plans

CrowdStrike (NASDAQ:CRWD) is a beneficiary of higher demand for cybersecurity solutions due to the risk of cyberattacks has increased in recent years. Increased integration of digitalization, and adoption of flexible work, is putting more businesses and consumers at risk. Studies from the IMF report that cybercrime will cost the world $23 trillion in 2027, an increase of 175% from 2022.

Key Highlights

- CrowdStrike’s emphasis on AI-driven innovation, including initiatives like Charlotte AI, enhances its strategic position in the cybersecurity industry.

- The company’s expertise in cybersecurity combined with its focus on AI-driven solutions positions it to effectively secure AI workloads and defend against AI-driven threats. As more organizations adopt AI technologies, the demand for robust security measures tailored to protect these advanced systems grows, creating significant opportunities for CrowdStrike to expand its offerings and strengthen its market leadership in this emerging area.

- The introduction of Falcon Flex, CrowdStrike’s flexible procurement model, offers a strategic advantage by providing customers with more adaptable and scalable purchasing options.

- The July 2024 outage posed immediate challenges for CrowdStrike, potentially affecting customer trust and causing short-term disruptions to its growth trajectory. Such incidents often lead to increased customer scrutiny and may impact brand reputation.

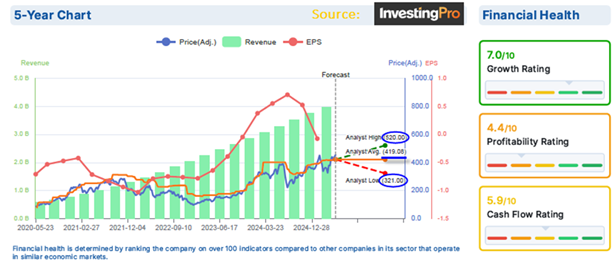

Source: InvestingPro

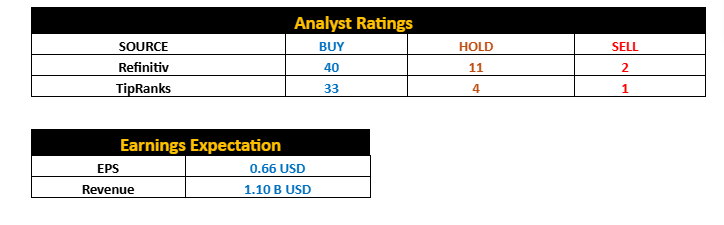

CRWD earnings after market Tuesday June 03, 2025

Technical Analysis Perspective

- CRWD is trading close to the upper resistance of a rising wedge formation at 482.35; the pattern carries bearish implications provided prices reject 387/89 obstacle pre and post earnings.

- If so then a drop to 439, 410 and 375 is likely in the coming future.

- The above breakout would initiate a strong rally to uncharted zones to with more room to 525.

- Having said the above, earnings are a good catalyst for the future direction. The highlighted rising wedge is technically a range trade between two rising lines followed by a bearish move.

Weekly Candlestick Chart

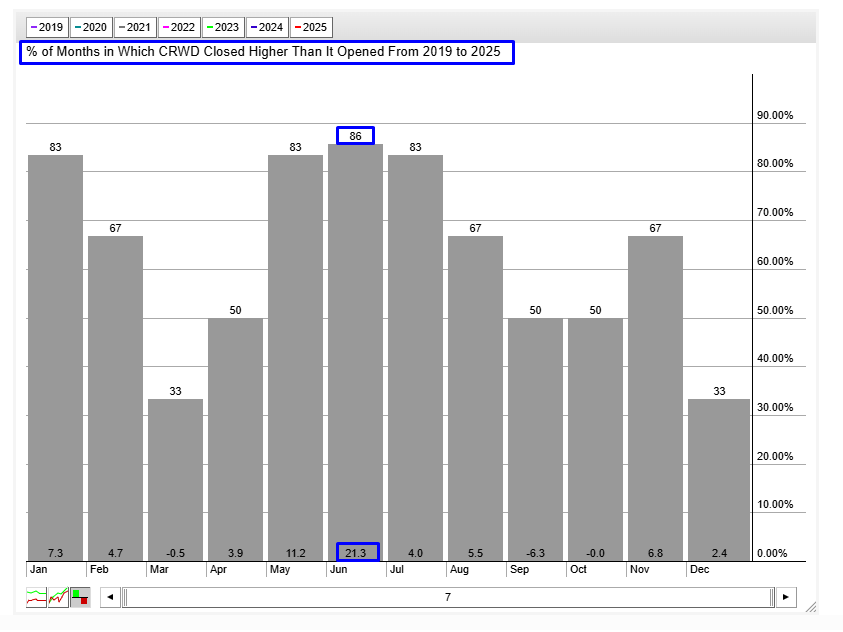

CRWD Seasonality Chart:

CRWD closes 21.3 % higher in June, 86% of the time since 2019.

***

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training.