OpenAI seeks government backing for AI chip investments

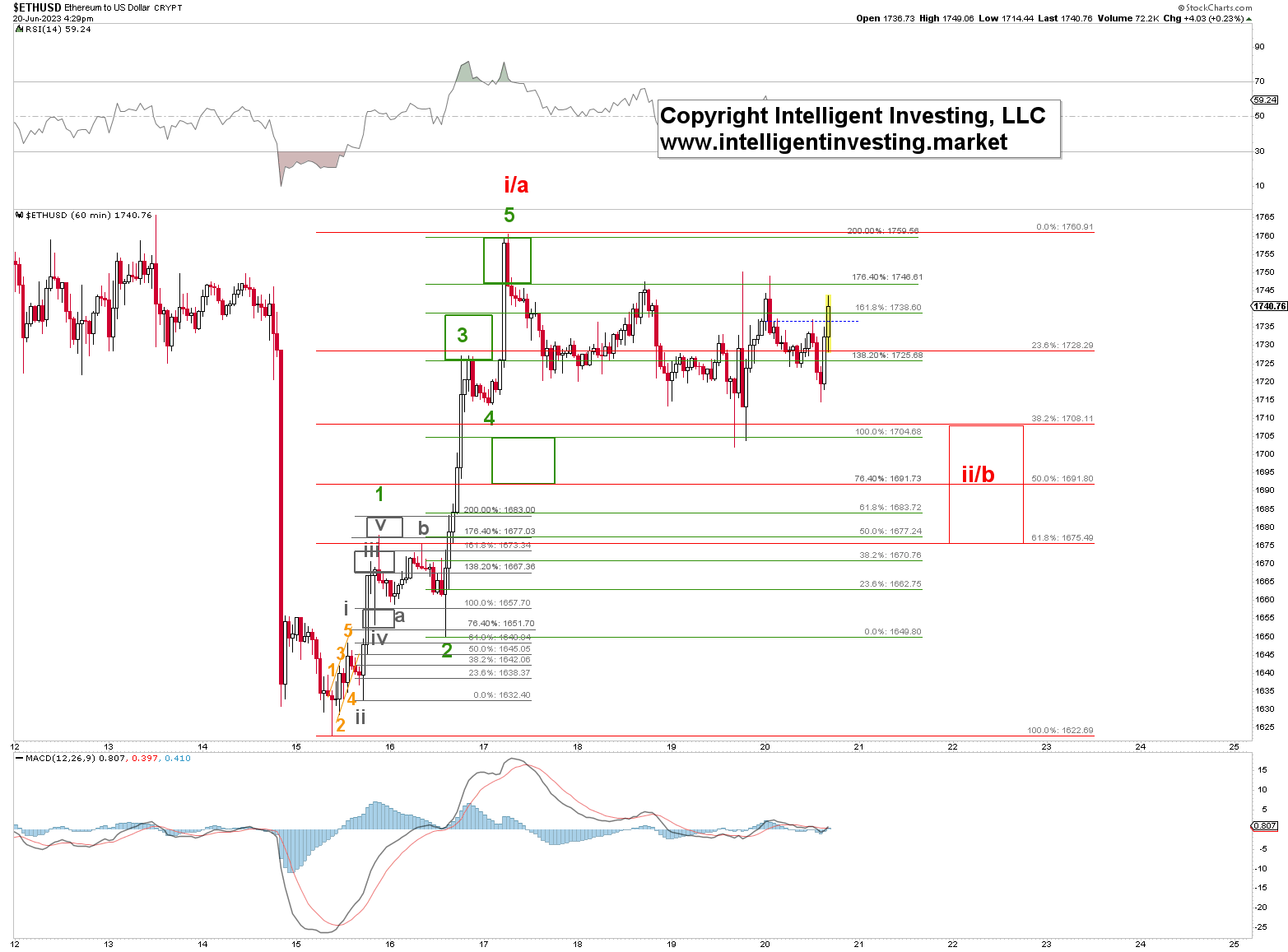

ETH/USD made an almost picture-perfect Fibonacci-based impulse pattern from last week’s low where green waves 1, 3, and 5 topped and bottomed almost precisely where they ideally should (green boxes). See Figure 1 below. Red W-ii/b should now be underway as the price action since the June 17 high at $1760 is messy, i.e., overlapping, and thus corrective. Note green W-1 comprised five (grey) waves as well, which also adhered well to the Fibonacci-based impulse pattern. This is the first time we have seen it this good and evident in a while.

Figure 1

So, red W-i/a has most likely topped, and red W-ii/b to ideally $1690+/15 should now be underway but may already have bottomed yesterday at around $1700. Thus, the next rally will announce itself on a break above $1760 and should then target at least $1800 but preferably ~$1925+ for red W-iii/c (not shown in Figure 1). Thus, a low-risk/high-reward setup is in play because ETH must hold last week’s low at $1622 to allow for this path to unfold.