Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

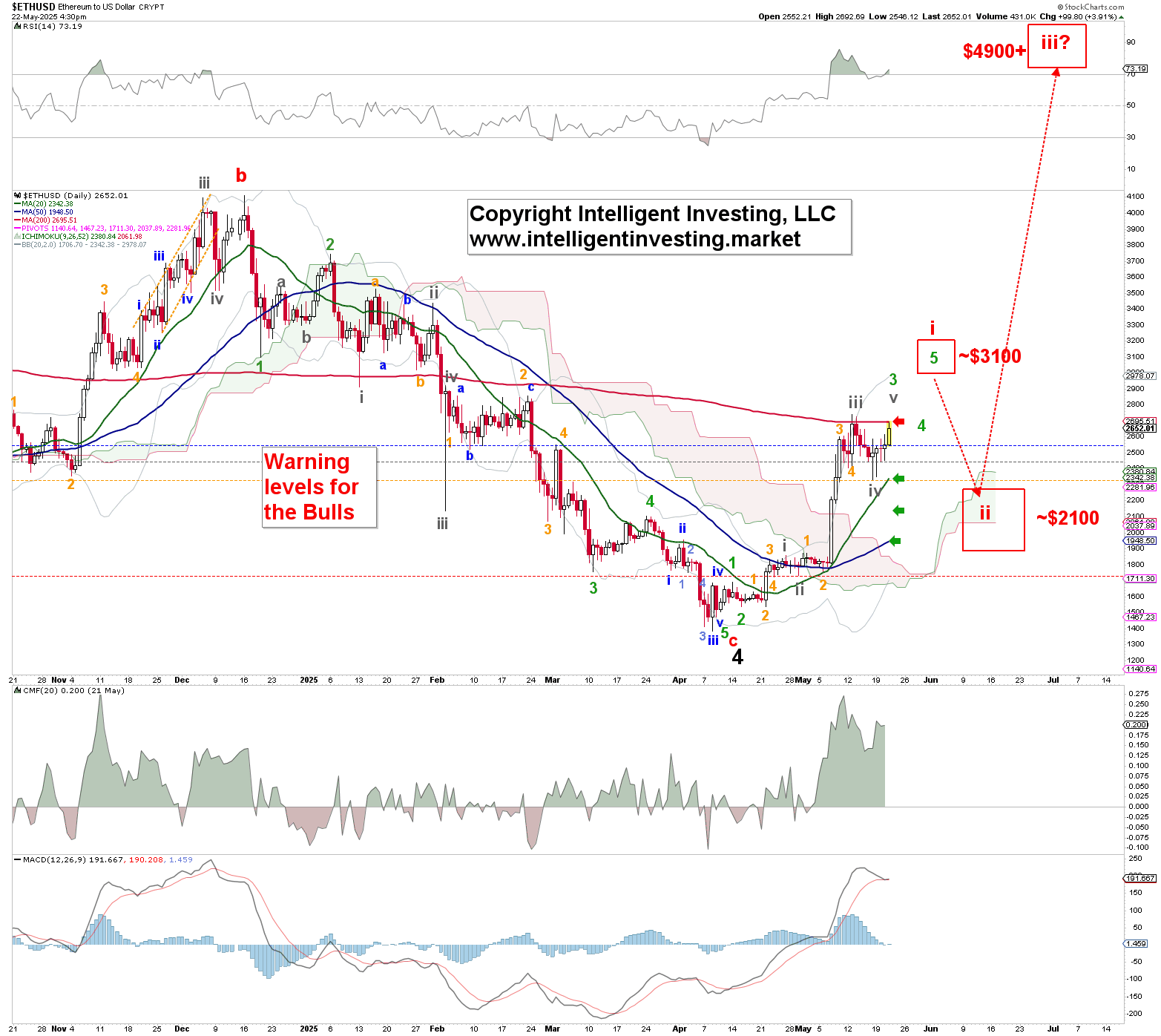

Our previous update indicated that, according to the Elliott Wave (EW) Principle, Ethereum (ETH) completed a larger 4th wave correction, which, from a technical pattern perspective, is referred to as a Bull flag, targeting over $6100. We also showed our preferred short-term wave count, suggesting that Ether was wrapping up several minor 4th and 5th waves to ideally reach around $3100 for the 1st wave of that larger move to over $6100. See Figure 1 below.

Figure 1. Our preferred short-term EW count for Ethereum.

Indeed, last week’s low was most likely the gray W-iv, and the gray W-v of green W-3 to ideally around $2900 should now be underway. However, ETH needs to clear its (red) 200-day simple moving average, as that has been resistance this month.

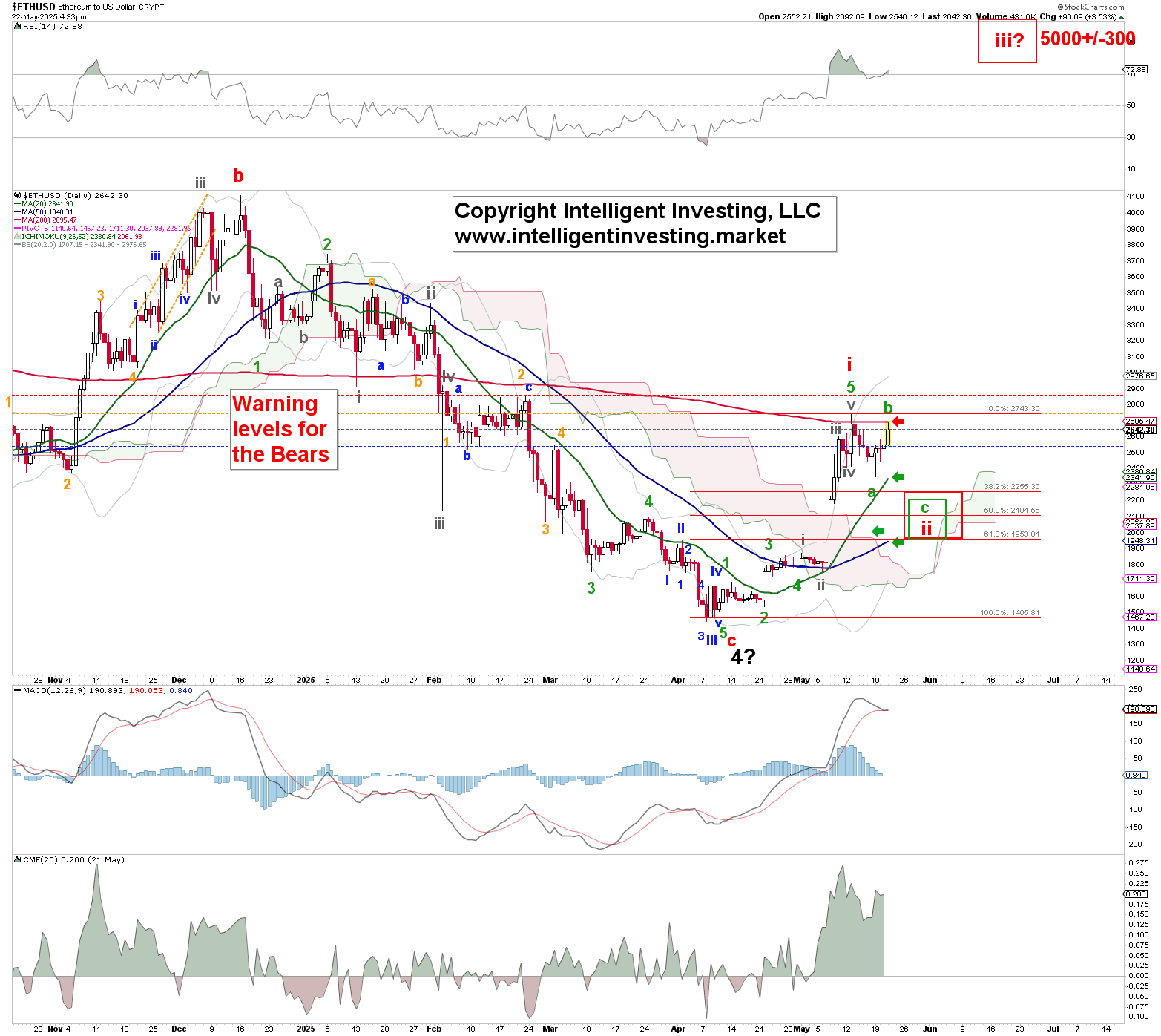

If the Bulls can’t clear the 200-day SMA and the price falls below last week’s low, then the red W-i of the new bull run to $6100+ has already peaked. See Figure 2 below. In that scenario, we can expect Ether to reach around $2100 a bit sooner, before the rally to approximately $5000 begins.

Figure 2. Our alternative, short-term EWP count for Ethereum.

Regardless, both roads lead to Rome, so to speak, and we must not lose sight of what matters: the third wave to ~$5000+. See the forest for the trees, so to speak. We present these two options not to confuse, but to clarify what we can expect if either the 200-day SMA is cleared, preferably, or if, alternatively, Ether’s price drops below last week’s low. We’re simply thinking ahead, and neither price movement will catch us off guard, allowing us to be prepared.