Swisscom profit drops 23% as Vodafone Italia costs weigh on results

In our last update from three weeks ago: see here, we found by using the Elliott Wave Principle (EWP) that ETH/USD

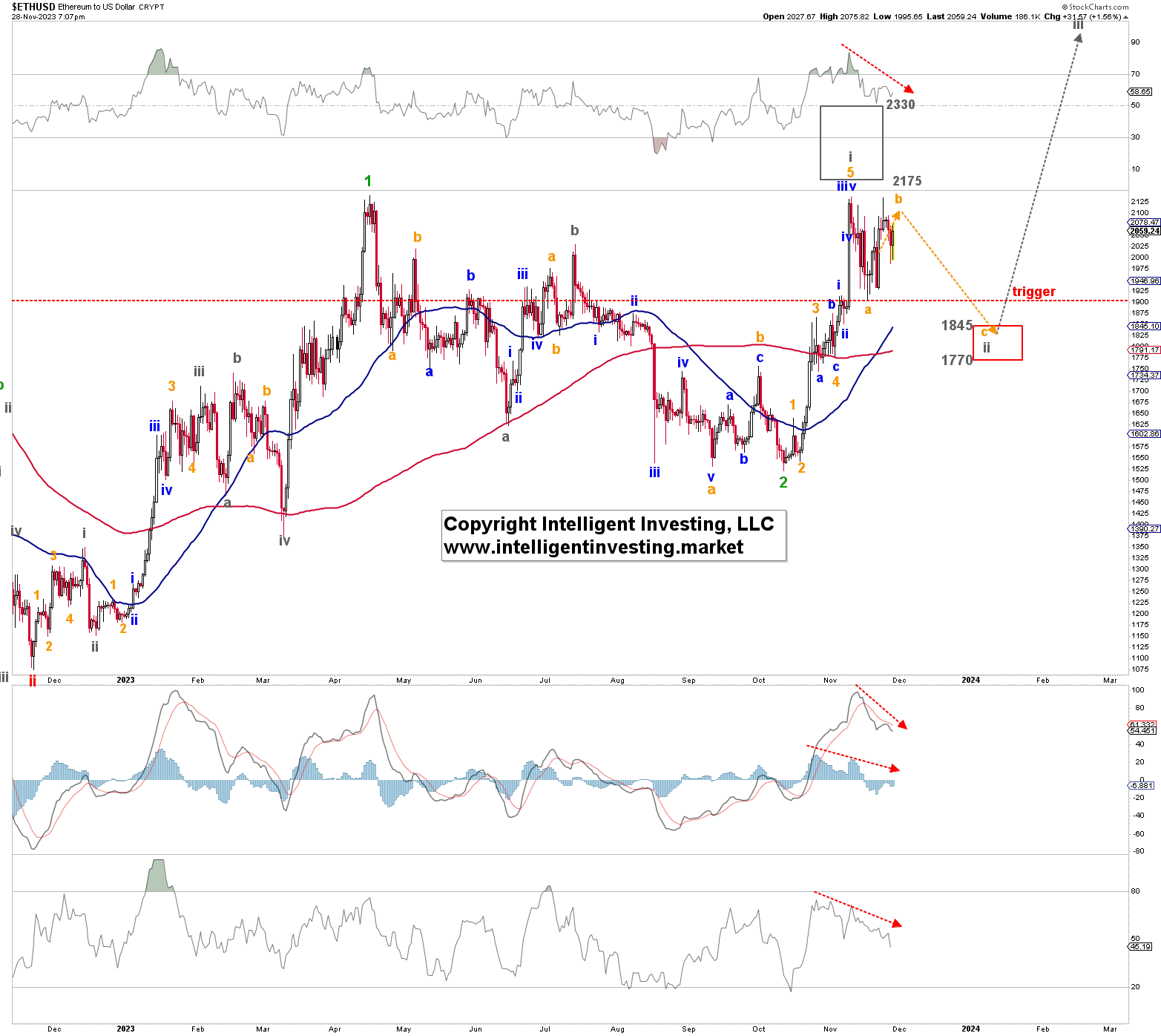

“Rally from the October 12 low, should be wrapping up its last (blue) W-iv and W-v to ideally $2125-2150, but possibly as high as $2175-2330. See Figure 1 below. Although extensions are always possible, at this stage, the upper end of that 2nd target zone seems a bit of a stretch, and our focus is thus on the happy intermediate: $2150+/-25.”

Fast forward, and ETH topped out at $2136 a day after our update was posted. It declined to $1916 a week later and now trades in the $2050s. Thus, our forecast for a local around $2150+/-25 and the anticipated subsequent decline was correct.

Figure 1. The daily resolution chart of ETH with several technical indicators

Moreover, in our previous update, we also found that:

“Once the grey W-i completes, we should expect a pullback for grey W-ii to ideally around the 50-62% retrace of W-i. A typical target zone for a 2nd wave, $1770-1845.”

Since corrections are often complex price patterns with lots of dips and rips (A, B, and C-waves), we have labeled the secondary price high at $2133 on November 24 as (orange) W-b of grey W-ii. We still need a daily close below $1910 to confirm this path. Still, given all the negative divergences on the daily Technical Indicators (TIs, red dotted arrows), the downside should be favored over the upside. Moreover, we would like to see these TIs become oversold to allow for better confirmation of W-ii and a better low-risk entry point.

Thus, our short-term expectation that ETH was wrapping up its more minor 4th and 5th wave to ideally $2150+/-25 followed by a pullback to ideally around $1800+/-50 was validated, and as such, we continue to expect Ethereum to reach that lower target zone. Once attained, it can launch into its “3rd of a 3rd wave” to new All-Time Highs. In the long term, the cryptocurrency must stay above the June 2022 low ($883), with a severe warning to the Bulls below the October 12 low at $1521, to allow this Bullish path to unfold.