Five things to watch in markets in the week ahead

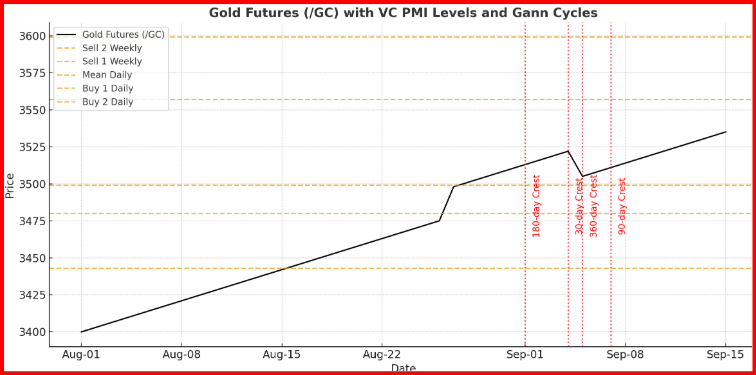

Gold futures are trading at 3581.2, pressing into the Sell 2 Weekly zone at 3599 after a decisive breakout from the daily equilibrium at 3499. This surge has carried the market through both the Sell 1 Daily (3536) and Sell 2 Daily (3555) levels, signaling powerful short-covering and fresh momentum flows. The market now rests in a highly sensitive band where time and price cycles converge, creating a potential turning point window.

VC PMI Framework

The VC PMI identifies a high-probability reversal area as price exceeds Sell 2 levels. On the daily timeframe, Gold has already stretched beyond Sell 2, where probabilities favor mean reversion back toward 3499. On the weekly scale, the Sell 2 pivot at 3599 defines the outer boundary. If rejected, this level should serve as resistance, triggering retracements to 3557 (Sell 1 Weekly) and deeper toward 3477–3499. However, a sustained close above 3622 would represent a breakout beyond distribution, opening Square of 9 harmonic projections toward 3660–3688.

Cycle Roadmap

The 30-day Gann cycle, anchored from the early August 1 swing low (3340), projects a crest into September 4–5, 2025. This short-term cycle indicates the current rally is nearing exhaustion. Supporting this, the 90-day cycle from June 5 (3250 low) also forecasts a crest in September 5–10, 2025, with the next trough in December. The 180-day cycle, anchored in March, points to a crest in late August–early September, then a decline into mid-November. Finally, the 360-day master cycle, anchored at the September 28, 2024 low, projects a dominant crest into August 28 – September 10, 2025, with the next major trough due in spring 2026.

The convergence of all these cycles highlights September 4–10, 2025 as a time/price window of maximum probability. This period overlaps with Gold testing the 3599–3622 resistance zone, suggesting a climactic setup where probabilities strongly favor a reversal or consolidation phase.

Market Implications

The surge in volume confirms institutional participation in this breakout, but the alignment of multiple cycles signals caution. If Gold rejects the 3622 Square of 9 harmonic, traders should expect mean reversion back to 3557 and 3499. However, if Gold decisively closes above 3622, it signals a cycle inversion breakout, unlocking upside targets of 3660–3688.

Directive: Scale profits into 3599–3622. Monitor September 4–10 closely as a high-probability reversal window. Maintain tight stops just above 3622 to manage breakout risk.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.