Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

Gold is at a crossroads, catching the attention of traders and investors worldwide as it hovers near record highs and reacts to a whirlwind of global events. The recent surge in gold futures—after a dramatic test of all-time highs on October 20, 2025—has set the stage for a potential reversal. With markets digesting shifting geopolitical tensions and surprising commentary from U.S. officials on the China trade conflict, gold has become the focal point in a story of uncertainty, risk, and opportunity.

Undoubtedly, gold futures started this week amid some signs of strain in the Israel-Hamas ceasefire, following attacks over the weekend. But Israel signaled that the ceasefire remained in place, and the aid for Gaza will resume from Monday.

On the geopolitical front, focus was also on Washington’s attempts to broker a Russia-Ukraine ceasefire, with Trump seen meeting Ukrainian President Volodymyr Zelensky over the weekend while reports said Trump urged Zelensky to cede territory to Moscow, and also declined some military aid for Kyiv.

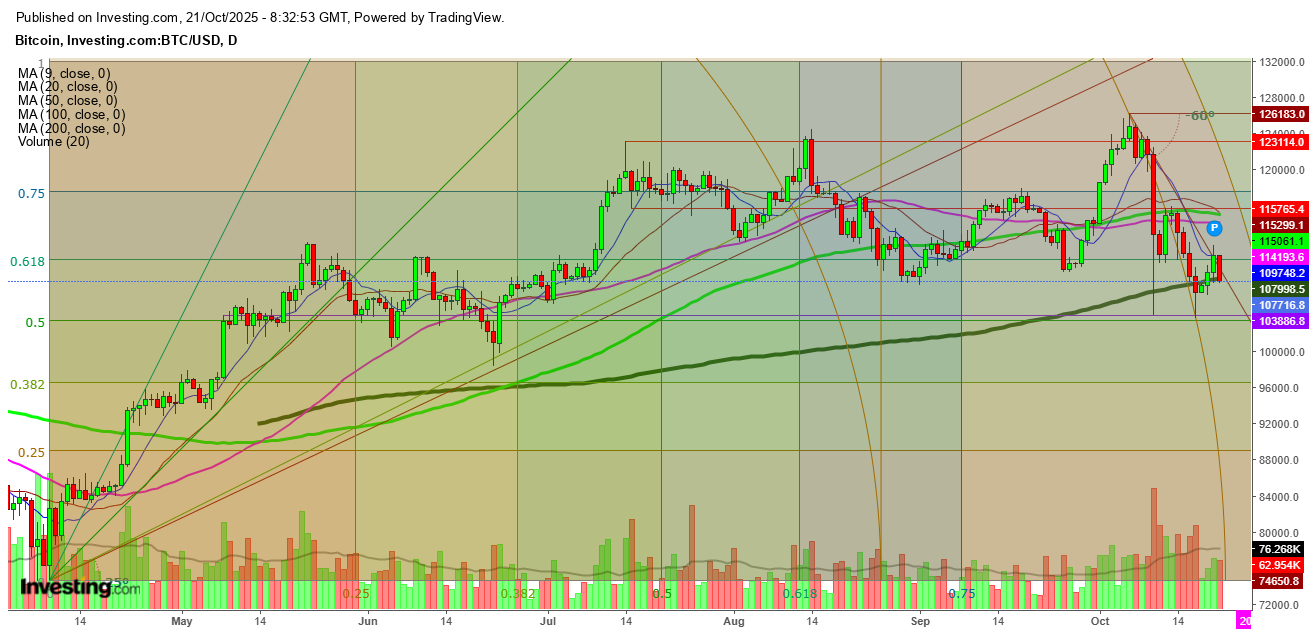

Geopolitical uncertainty, coupled with growing concerns over the U.S. economy, especially amid a government shutdown, kept haven demand for gold but I anticipate that the money flow is likely to shift from gold to other assets as Bitcoin are trying to sustain at a significant support at the 200 DMA at $107752, a level just above the next significant support at $103886 from where bulls turn active.

I anticipate that the global central banks could take a step back on buying gold as the geopolitical concerns seem to ease sooner, resulting in easing gold prices from the recently tested record highs, as seen last Friday after the advent of a selling spree.

Technical Levels to Watch

In a weekly chart, gold futures have formed an exhaustive hammer this week after testing a record high at $4309 which looks evident enough for a surge in bearish pressure, where a breakdown below the immediate support at $4216 will confirm the continuation of slide during the upcoming weeks where the gold futures could test the next support at the 9 DMA at $3858.

In a daily chart, gold futures look ready to test the immediate support at $4229, where a breakdown could push the futures to test the next support at the 9 DMA at $4183 in today’s session.

In a 1-Hr. chart, gold futures have found a breakdown below a significant support at the 100 DMA at $4288.89, and look ready to test the next significant support at the 200 DMA at $4183.55. I find that if the gold futures find a sustainable move below the 200 DMA in a day or two, it could make the momentum extremely bearish.

Disclaimer: Readers are advised to take any position in gold at their own risk, as this analysis is based only on observations.