Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

Gold has bounced throughout the past week, supported by war headlines in the Middle East; however, flows seem to change as the precious metal has failed to hold and break its intermediate $3,450 highs.

Gold is now trading below the key $3,400 level.

Quick reminder that US Markets are closed today for Juneteenth, which leads to some movements and flows being subdued.

Positioning had already been quite heavy on the long side, with many investors trying to capture the negative market sentiment.

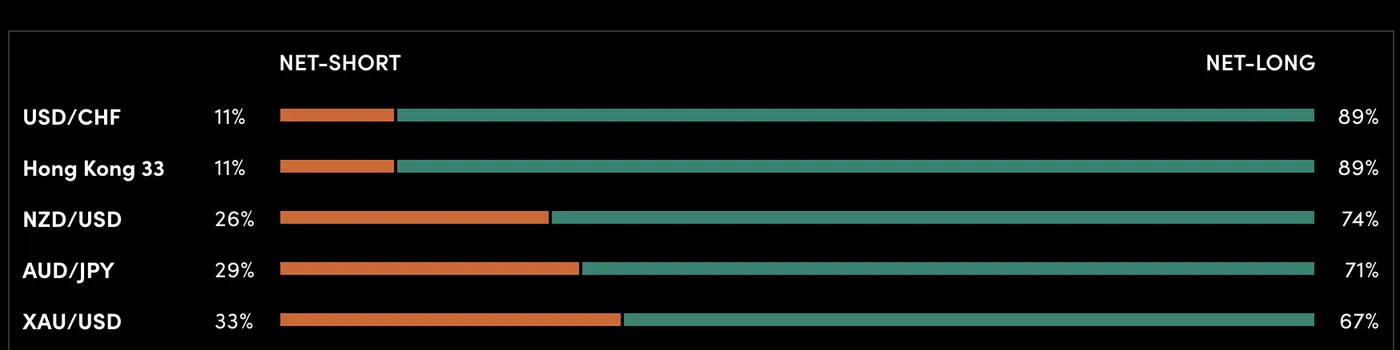

OANDA Labs Client Sentiment

Many traders already long the Bullion is not helping for new highs, as already positioned traders imply less available bullets for bulls to keep pushing up prices – One of the reasons why Client Sentiment tends to be a contrarian indicator.

However, markets in their current volatility tend to surprise participants and erratic moves are far from out of the picture.

Keep an eye on the performance of other Safe-Havens such as JPY and CHF leading on the Forex Currency board, and US Treasury Bonds up at a similar time as Stock Indices find lower levels.

Gold 4H and 1H Technical Analysis

Gold 4H Chart

Source: TradingView

The precious metal had tested the key $3,450 psychological level and consolidated close to the highs, although failure from bulls to push prices to test the higher Main Resistance Zone 3,470 to 3,500 led to some profit taking.

The more volatile 4H 20-period Moving Average has become resistance, currently at $3,384 – Any impulsive move above would invalidate any bearish scenario.

In the meantime, price action is pointing towards the 4H MA 200 located at $3,320 right in the confluence with the 3,300 key pivot zone mentioned in earlier analysis.

Gold 1H Chart

Source: TradingView

Hourly charts are showing similar signs of rejection of last week’s highs, with both the 1H MA 20 and 200 coming in as resistance – Something to keep a close eye on as these indicators act as pivots.

Any break above making the Moving-Averages turn into support, though the probabilities for this aren’t currently as high.

Another element to add to the picture is the RSI hanging mostly in the lower boundary and still far from oversold, giving space for movement.

One thing to keep in check is if any lack of downside correction is met with a rebound, which would happen if market anxiety catches up to the current price action.

Do not forget that any swift reversal in price action is always a possibility in trading. Always keep an eye on your biases and new headlines hitting the markets.