Tesla could be a $10,000 stock in a decade, says longtime bull Ron Baron

It was a sleepy Sunday in the middle of summer. Most Americans were tuned in to Bonanza when President Richard Nixon interrupted the broadcast to announce that he was suspending the U.S. dollar’s convertibility into gold.

At the time, the “Nixon Shock,” as it came to be known, may have looked like a simple adjustment to the global monetary order.

In reality, it was the day the U.S. traded fiscal discipline for a floating exchange rate.

Before 1971, every dollar in circulation was tied to something real and tangible. Thirty-five dollars could be exchanged for one ounce of gold. After 1971, “printed paper currency really had no value of its own. It was artificial, and anything that’s artificial is temporary.”

That’s from 1971: How All of America’s Problems Can Be Traced to a Singular Day in History, a new book on the subject that I strongly recommend readers pick up. Its authors, Paul Stone and Dave Erickson, argue that the unraveling of the dollar’s link to gold is at the root of America’s inflation and exploding debt, not to mention “unfettered moral decay, racism, rampant drugs, the destruction of the family, war and famine,” and more.

The Law of Intended Consequences

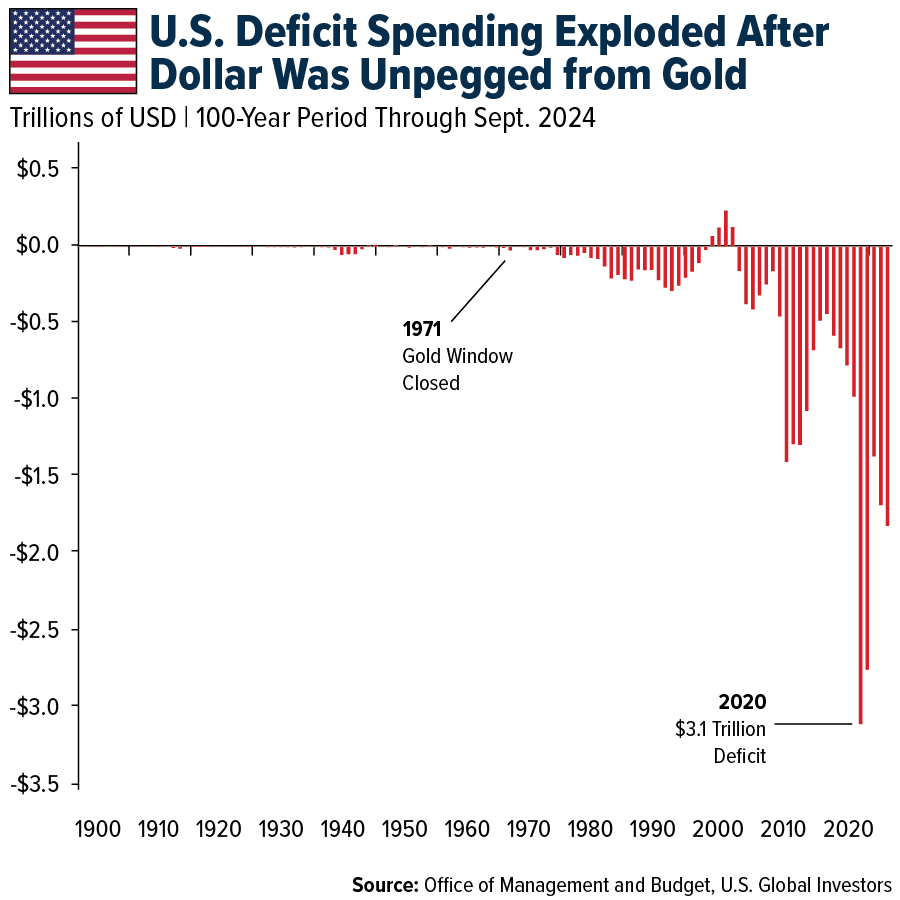

You’d be forgiven for challenging some of Stone and Erickson’s conclusions. There’s one thing, though, that we should all be able to agree on: Once the dollar was unpegged from gold, governments began to spend with abandon. Politicians no longer had to make hard choices. Instead of cutting spending or raising taxes, they could simply run deficits and let the Federal Reserve finance the shortfall. (To get the full story, read my timeline of the events.)

That may have been the point all along! Stone and Erickson write that Nixon and his advisors believe the gold standard was hamstringing U.S. power, and that by severing ties with gold, they could outspend the Soviet Union, dominate the world and, I quote, “control everybody.”

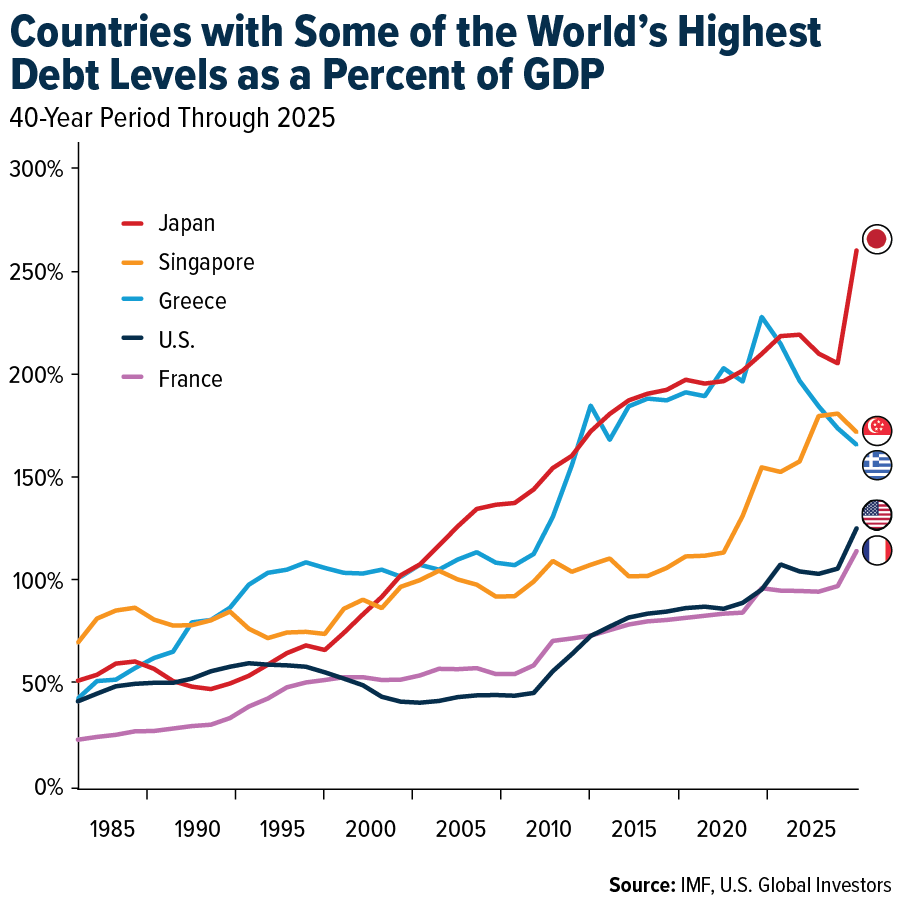

Fast forward 55 years, and U.S. government debt now stands at a jaw-dropping $37.5 trillion, equal to roughly 124% of GDP. Globally, debt has ballooned to $324 trillion, more than 235% of world GDP, according to the Institute of International Finance (IIF). For comparison’s sake, when Nixon closed the gold window, U.S. debt was around $400 billion, not even 40% of GDP.

Meaning that in just over five decades, we’ve gone from a system of fiscal restraint to a free-for-all.

Real Money Is Finite

For decades now, I’ve argued that gold is the ultimate hedge against runaway debt and monetary mismanagement. Back in 2020, I went on CNBC Asia and called for $4,000 gold, a target that’s now within reach. The yellow metal is trading above $3,800 per ounce for the first time ever, and traders are pricing in multiple rate cuts from the Fed.

Meanwhile, central banks continue to trip over themselves to add bullion to their reserves, purchasing a net 200 metric tons in the first seven months of the year. That represents a modest 4% increase over the amount purchased during the same period the previous year, according to World Gold Council (WGC) data. Bank governors understand that fiat can be printed at will, but real money—gold—is finite.

I believe this is why gold is now the second-largest reserve asset in the world, behind only the dollar. But unlike the dollar, gold has no counterparty risk.

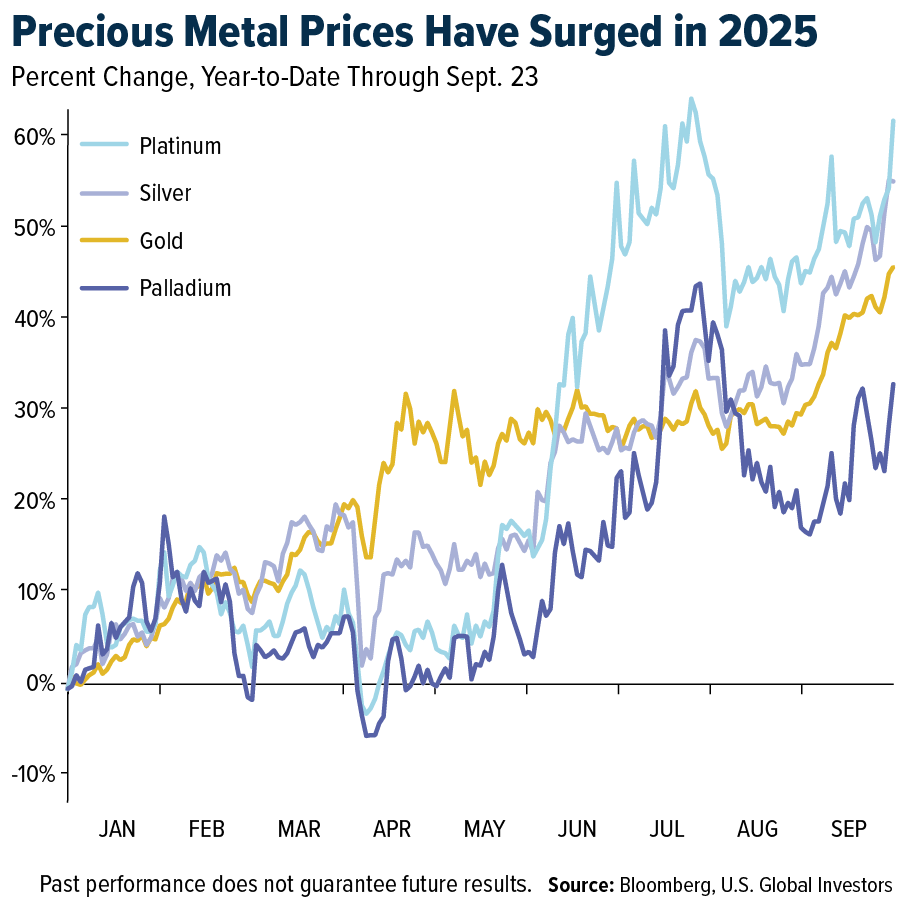

Don’t Sleep on the Other Precious Metals

It’s not just gold. Silver, platinum and palladium have also been on a tear this year. Barron’s recently noted that palladium, still trading at a steep discount to gold and platinum, could be in the early stages of another run higher, with Bloomberg’s Mike McGlone forecasting a move back toward its all-time high above $3,400.

The Era of Record Debt Levels

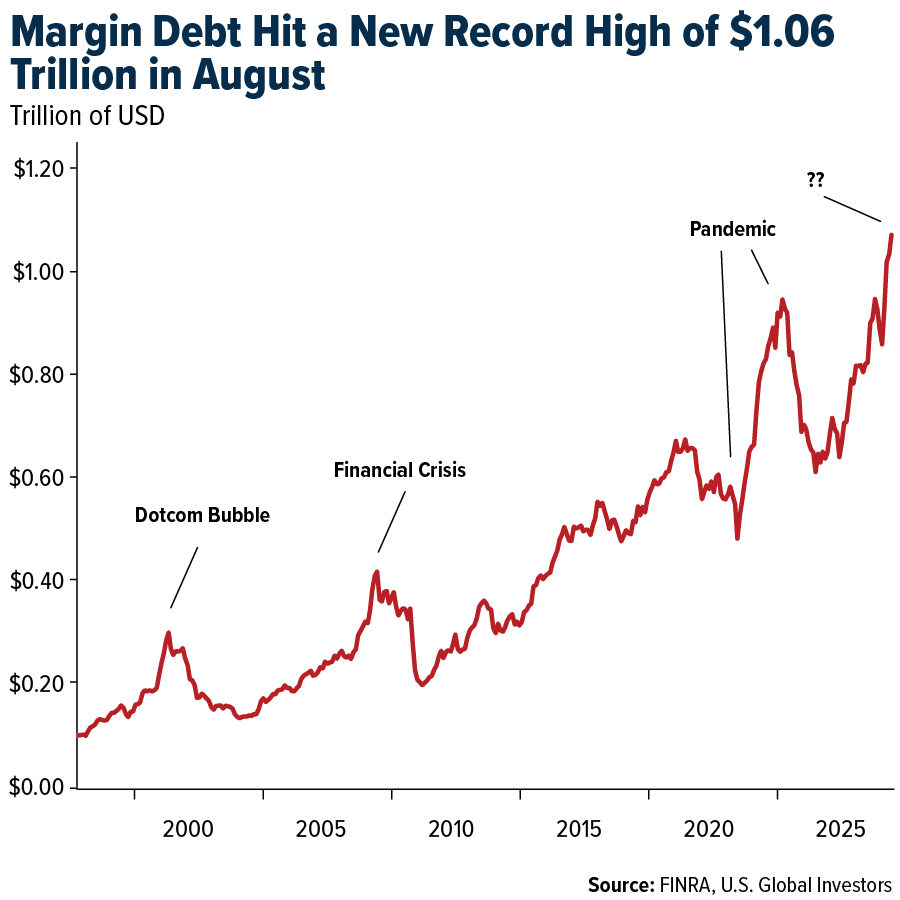

Contrast that with today’s overextended, tech-fueled stock market. Margin debt, or money investors borrow from their brokers to speculate, has soared to a record $1.06 trillion, up nearly 33% from a year ago. As you can see in the chart below, spikes in margin debt have often preceded major market corrections. I’m not suggesting we’ll see a similar crash this cycle, but it’s worth keeping in mind.

Governments are overleveraged, households are sitting on a record $18.39 trillion in debt and investors are trading on an inadvisable amount of margin to keep the party going. As I see it, you want to be holding gold.

My New Projection: $7,000 Gold

So where does the yellow metal go from here?

My new projection is $7,000 per ounce, potentially by the end of President Trump’s second term.

My reasons are simple. The debt pile is unfathomably massive, and it’s accelerating. Fiscal imbalances are widening, and monetary policy is being constrained. The Fed can’t raise rates aggressively without bankrupting the government, but it also can’t make deep cuts without tanking the dollar.

Both options support higher gold prices, in my opinion.

Meanwhile, central banks continue to buy record amounts of physical bullion. Net inflows of North American gold-backed ETFs are having their second strongest year on record, according to the WGC. And retail demand in countries like India and China remains robust, driven by the Love Trade, which accounts for an estimated 60% of all gold purchases.

The 10% Golden Rule

As investors, we don’t have the luxury that Washington does. We can’t run endless deficits or print our own cash. (Life would be so much easier if we could!) On the contrary, we have to live within our means and balance our checkbooks.

That’s why I’ve always viewed gold as real gold. Over the centuries, it has helped preserve wealth across every empire through history. Like Ray Dalio, I recommend a 10% weighting in gold, with half in physical bullion (coins, bars, jewelry, gold-based ETFs) and the other half in high-quality gold mining equities. Remember to rebalance on a regular basis.

I called for $4,000 gold, and we’re nearly there. Looking ahead, I now see $7,000 gold on the horizon. That may sound bold, but in today’s high-debt environment, I believe the bold call might also be the prudent one.

***

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the links above, you will be directed to a third-party website. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.