60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

The consumer price index data published this morning that showed a continuation of the disinflationary forces was well received by the markets initially as traders thought this leaves the door open for a soft landing, but we have seen how most of that rally has deflated during the trading session.

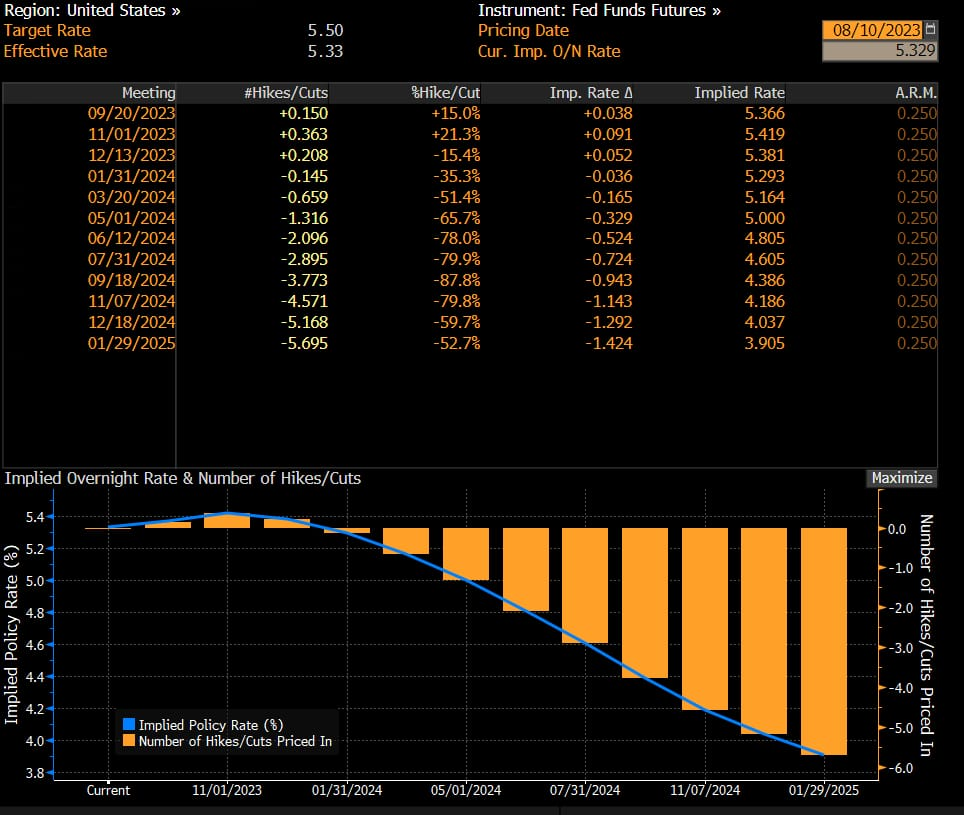

If we look at the bond market reaction, we get some important hints of what might have happened. The bond market is pricing increased odds of the FED pausing rate hikes in September, which is good news, but it was already the base case scenario for most traders. Also, if we look at rate cuts for 2024, the odds are also increasing for cuts at the beginning of 2024, but this has not become the base case scenario yet, so the report was good news, but not good enough to change the market narrative.

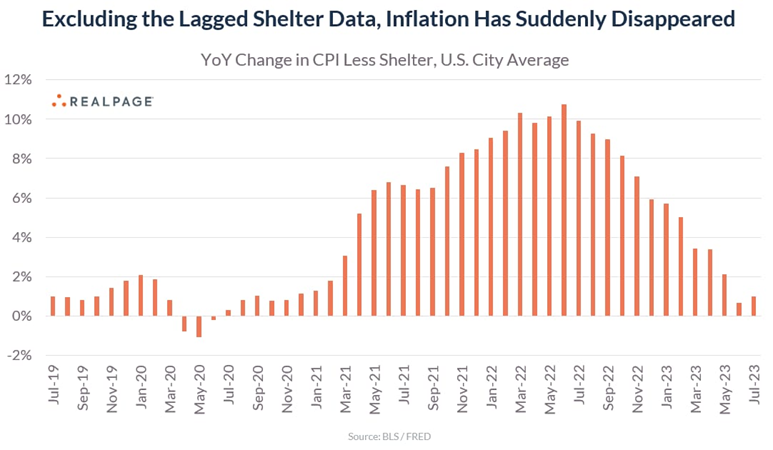

What this all means is that for the markets to have a lasting inflation-related rally, we need a bigger drop in service inflation, which right now is completely dependent on rental inflation dropping quicker. This is a possibility if we look at leading indicators. One example is how if we used Realpage rental data instead of the BLS rental data, we would have an inflation reading below 2%.

We know that the BLS has a delay in its data related to how they carry out their survey, so having data within the FED objective seems like something that should happen sooner rather than later. We will see if other variables like commodities don’t get out of hand, but if everything remains close to current levels and rental inflation finally drops, we could see some narrative changes that would give the perfect conditions for a stock market rally.