Wall St futures flat amid US-China trade jitters; bank earnings in focus

Last Thursday, we wrote,

"After today's PPI, we won't be surprised if Fed officials plant a story in The Wall Street Journal over the weekend titled something like "Fed Officials Might Vote To Pause Rate Cutting Following Hot Inflation Data." We were close. Nick Timiraos, the WSJ's ace Fed watcher, posted after midnight today an article titled "The Fed’s Game Plan on Interest-Rate Cuts Keeps Shifting." It was subtitled, "Investors widely expect a third-in-a-row rate cut this week. Officials are ready to slow—or even stop—lowering rates after that."

That doesn't rule out a federal funds rate (FFR) cut on Wednesday. Otherwise, if the FOMC votes for a rate cut, there might be more than one dissenter. The FOMC's dissenters will undoubtedly argue that the FFR isn't restrictive given the strength of the economy, stickiness of inflation, and record high prices for stocks, homes, bitcoin, and gold.

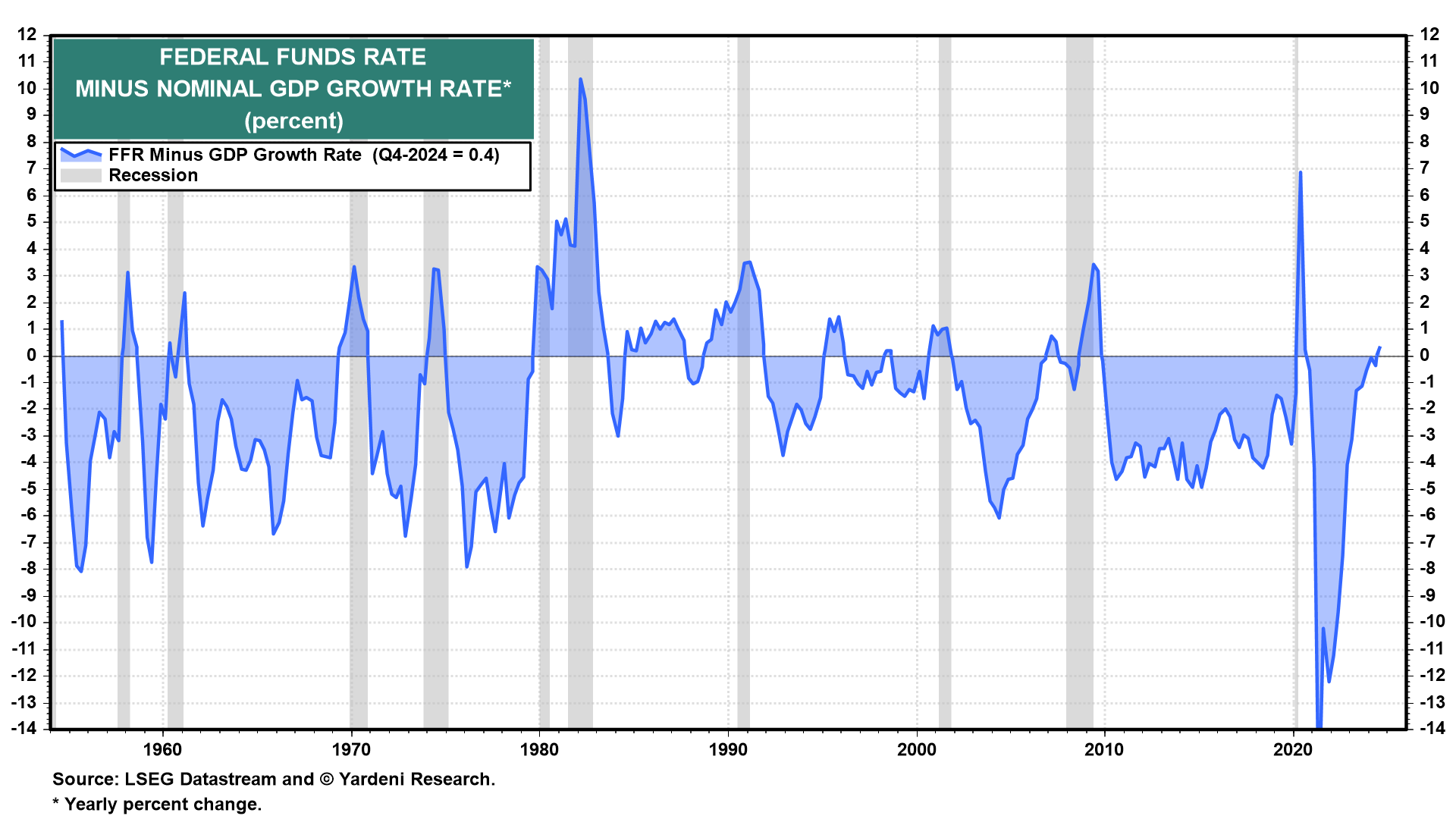

We agree with the dissenters. We devised a simple way to judge whether the Fed is restrictive. Recessions tend to coincide with periods when the FFR exceeds nominal GDP growth (chart). The spread is currently close to zero, suggesting that the FFR isn't too restrictive.

We can do a similar calculation to gauge whether the Bond Vigilantes are restrictive using the 10-year Treasury bond yield instead of the FFR (chart). They are not so far. They were too relaxed during the inflationary 1960s and 1970s.

They turned vigilant during the 1980s and 1990s. The spread between the bond yield and the growth of nominal GDP has been negative since the pandemic. So neither the FFR nor the bond yield is restrictive currently. Message to the Fed: Chill.