Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

- The S&P 500’s forward operating P/E ratio has fallen back to near 15

- Higher interest rates imply assets should be priced lower

- Is a much lower P/E reasonable?

Few topics get finance folks in a frenzy like discussing valuation and what’s a fair P/E multiple on the S&P 500 right now. Go back just a year—the so-called discounted cash flow (DCF) valuation method was laughed at by many new investors as so many non-income-producing assets surged in value. Cryptocurrencies, non-fungible tokens (NFTs), and even many non-profitable story stocks were the hot assets. Interestingly, value equities—those that produce near-term cash flows—actually did just fine then, too.

Arguments for A Much Lower P/E

Bring you back to the present, now the very mention that the stock market is a decent bargain gets met with reply and after reply that:

- We do not know what the 'E' will be in the price-to-earnings multiple

- Higher interest rates today make the S&P 500’s 15.1 forward operating P/E not cheap and, if anything, expensive.

So, all of a sudden, discounting cash flows is more important than ever. Who knew!

Studying History

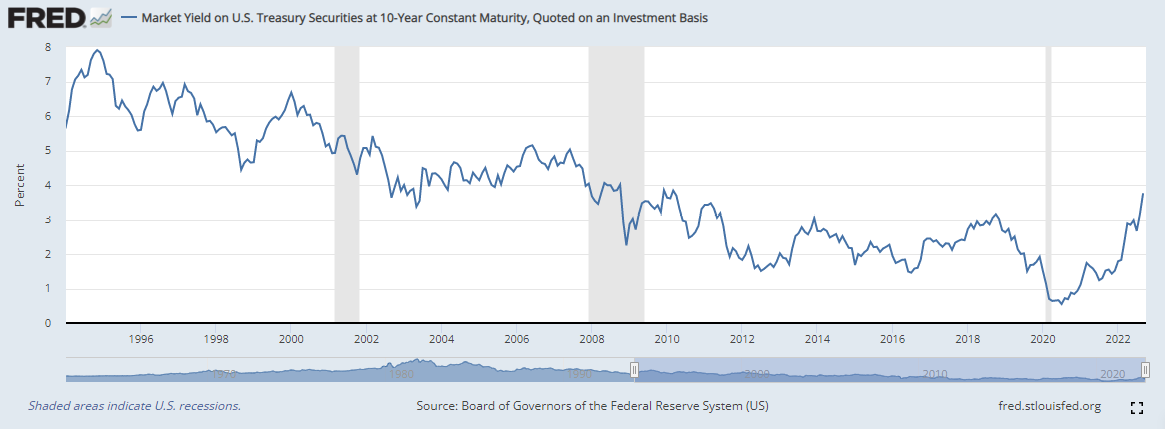

I went looking back into the data to see if I can suss out what is a real argument and what’s just fearmongering. It turns out that today’s 3.8% yield on the U.S. 10-year Treasury note is the exact average since 1994. In just the past 25 years, today’s benchmark rate is slightly higher than the 3.4% average. So, it is reasonable to surmise that a significantly lower P/E is warranted in October 2022 versus October 2021 when the 10-year was 1.5%.

U.S. 10-Year Treasury Rate Since 1994

Source: St. Louis Federal Reserve

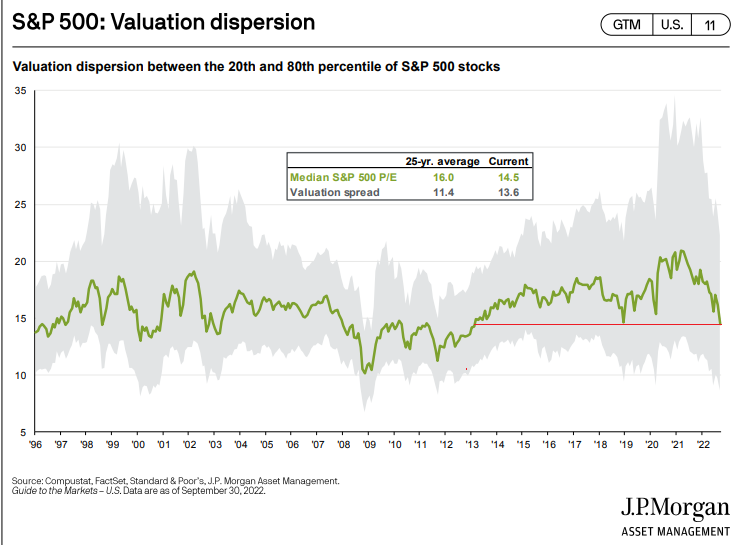

What’s interesting, though, is that the median S&P 500 company’s P/E ratio is just 14.5, according to J.P. Morgan Asset Management. That compares to a 25-year average of 16.0. This is an important perspective since the SPX is more top-heavy and tech-oriented today versus the average over the last quarter-century. Like any kind of good market analysis, you cannot assume the past looks exactly like the present and future. By this gauge, your average stock appears reasonably priced.

S&P 500 Valuation: The Median Stock’s P/E is the Lowest Since Early 2013

Source: J.P. Morgan Asset Management

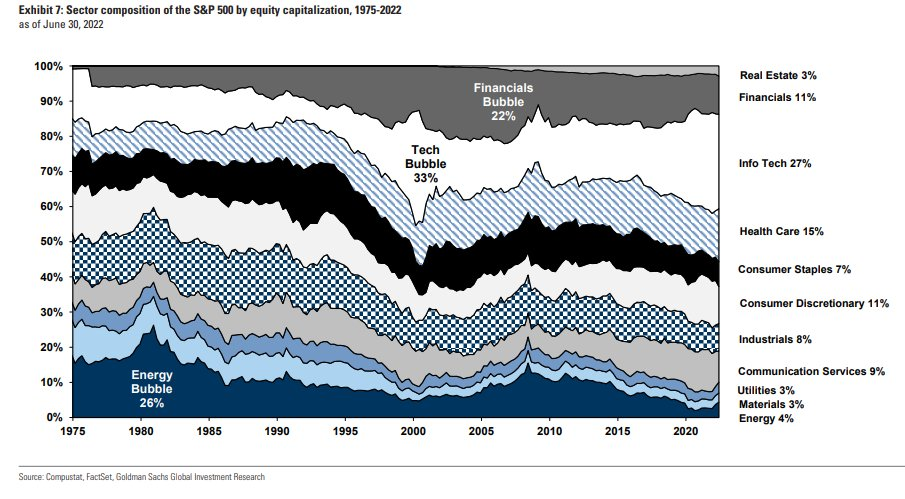

But just how much has the composition of the S&P 500 changed over time? There’s a chart I like to reference from Goldman Sachs Global Investment Research that shows how things have evolved since 1975.

Through mid-2022, the Technology sector took up a 27% chunk of the total market cap while low-P/E sectors like Energy and Financials comprise just 15% of the index. It used to be that those two now value niches were a much bigger piece of the market. The point here is that higher-multiple growth sectors are a bigger piece of the stock market pie these days, so a higher overall P/E is reasonable.

S&P 500 Sector Composition Since 1975

Source: Goldman Sachs Global Investment Research

The Bottom Line

Long-term investors should take some comfort in today’s stock and bond market valuations. A 15 forward operating P/E on the SPX is not a screaming buy, but it is not pricey. Today’s profit ratio is much different from the same valuation, say, in the mid-2000s. Moreover, the median S&P 500 company trades at an even lower earnings multiple versus the market average.

In advance of Halloween, the bears can point to one eerie stat as we head into the notoriously volatile month of October—the S&P 500’s P/E and dividend yield today (15.1 and 1.9%, respectively) are the same as when stocks peaked in October 2007. Boo!

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.