e.l.f. Beauty stock plummets 20% as revenue and guidance fall short of expectations

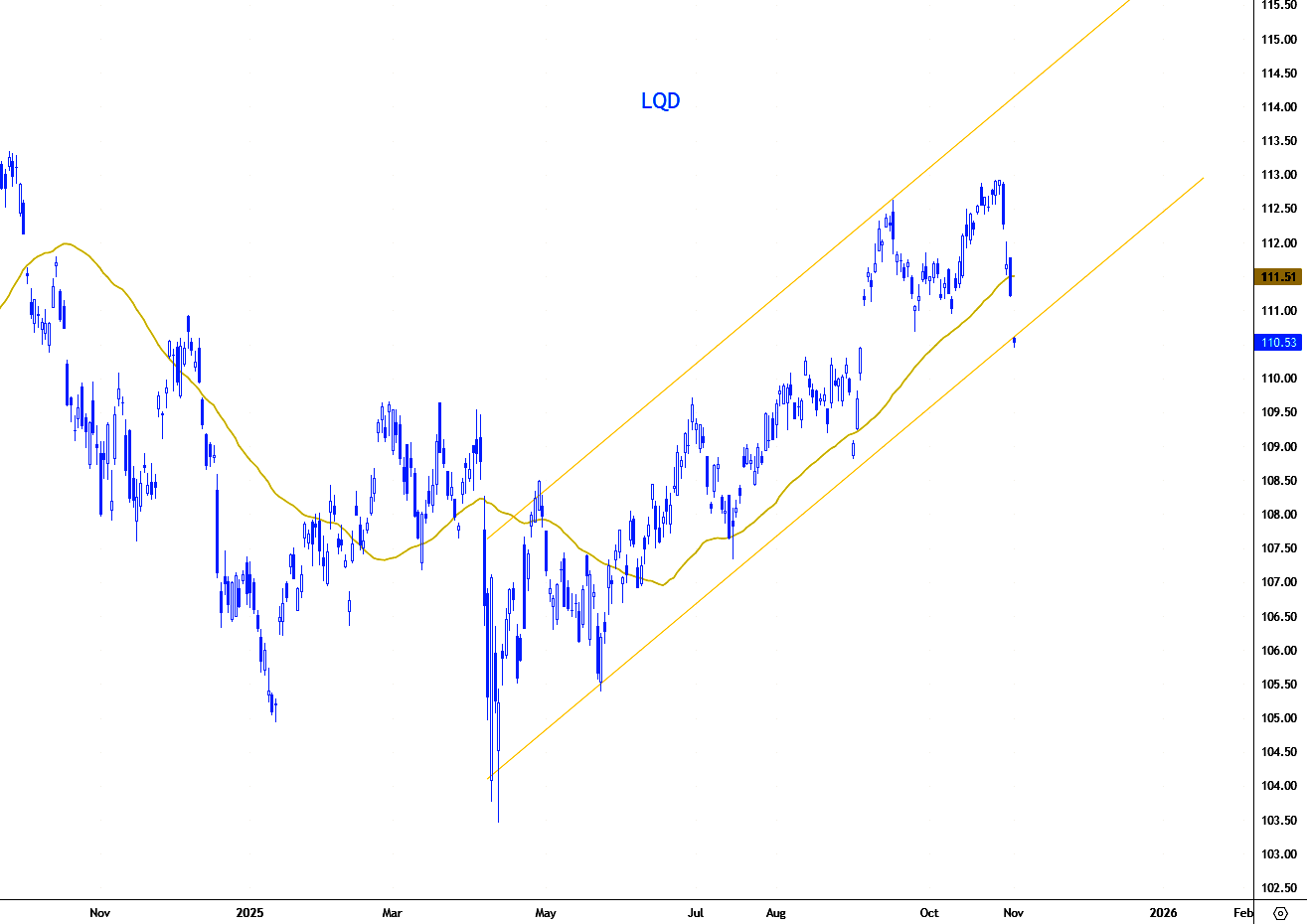

Every trading day, I play a good-cop, bad-cop routine when it comes to the AI gravy train. The good cop sees boundless upside — the new industrial age unfolding in teraflops, a productivity boom financed by silicon and sweat. The bad cop, meanwhile, glances at LQD sagging under the weight of new supply and wonders how long the credit market can keep swallowing it all. Both have a point.

Because this isn’t just another tech cycle — it’s the most capital-intensive build-out in modern market history, and the fuel isn’t earnings anymore, it’s debt.

The numbers are staggering. More than $200 billion of AI-linked issuance has already flooded the market this year — more than a quarter of total net U.S. corporate supply. Meta alone dropped $30 billion, drawing a record $125 billion in orders; Oracle’s (NYSE:ORCL) $18 billion sale in September was snapped up to fund data-center capacity leased to OpenAI. The credit market has become the primary financier of the AI revolution, and investors are lining up for a taste of the future, coupons and all.

But beneath the euphoria sits a strange symmetry — the circular nature of the money. Nvidia (NASDAQ:NVDA) sells the chips to Oracle. Oracle builds the racks for OpenAI. Microsoft (NASDAQ:MSFT) bankrolls OpenAI, allowing it to purchase even more computing power. Meta (NASDAQ:META) issues a paper to fund its own hyperscale empire.

Dollars spin through the system like current through a circuit board, each node feeding the next. Nothing leaves the ecosystem; it just recirculates between vendors, customers, and financiers, turning Wall Street into a kind of closed-loop liquidity engine.

So far, everyone’s happy. Credit spreads remain tight, the big names are pristine, and there’s still more cash chasing paper than paper chasing buyers. Yet the LQD tape tells a quieter story — not one of panic, but of indigestion. When this much duration hits the market at once, prices soften, ETFs cheapen, and dealers groan under the weight of inventory. It’s not credit risk; it’s plumbing pressure.

The larger question is sustainability. These aren’t light-capex stories. Data centers burn cash the way rocket engines burn fuel — with high thrust, a short burn, and constant refuelling. The assets depreciate faster than the returns come in. That’s fine when the cycle’s young and rates are steady, but once refinancing costs rise or growth stalls, the loop tightens. Someone in the chain — a vendor, a customer, a financier — ends up short of breath.

The good cop in me still buys the vision: AI as infrastructure, as the new rail network of the digital world. But the bad cop keeps a hand on the brake, reminding me that the returns on capital still lag the cost of capital. For now, the bond market is content to keep the punch bowl full — but the tab is growing fast.

The music’s still playing, the servers still hum, and the crowd still believes. But under the fluorescent light of those data centers, one truth glows brighter than all: somebody’s gotta pay for the AI party — and this time, it’s the bond market footing the bill.

Note: The street’s still buying the dream, but the tape’s telling you it’s getting full — liquidity’s fine until it isn’t, and right now, LQD’s the first place you’ll see the hangover start.