United Homes Group stock plunges after Nikki Haley, directors resign

Despite shares in Morgan Stanley (NYSE:MS) returning 124.5% over the last year, the financial services behometh's forward P/E of 14.04 is only slightly higher than its main competitors, Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), and JPMorgan Chase (NYSE:JPM).

In the last few months many bank stocks have stagnated or fallen as investors' concerns about rising interest rates receded compared to earlier this year.

Going forward, short term performance of bank stocks will be largely determined by any signals from the Federal Reserve on interest rates.

Longer-term, Morgan Stanley's strategy is to aggressively build out its wealth management business and to that end it has acquired ETrade and Eaton Vance to bolster this division. Wealth management is a key growth channel for big banks as they rush to keep up with the evolution of financial services driven by developments in fintech.

Schwab (NYSE:SCHW) which offers banking services and wealth management has a forward P/E of 22.17 so MS shares have some room to run in terms of valuation.

Source: Investing.com

In the past 3 months, MS has returned almost 19%, far more than financials as a whole. The iShares U.S. Financials ETF (NYSE:IYF) has returned 4.1% over this period, for example. Over this 3-month period, Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup (NYSE:C) have returned 3.7%, 6.5%, 7.5%, and 0.52%, respectively.

It is clear that the market has responded to Morgan Stanley’s strong earnings performance in recent quarters—the bank has substantially beaten expectations for the past 5 quarters. In addition, investors are enthusiastic about management's plan to build out the wealth management side of the business.

Source: ETrade. Green (red) values indicate amount by which EPS exceeded (missed) expected values.

MS has beaten the consensus expected EPS by substantial margins—in Q2 2020 EPS was 75.5% above expected value and in Q4 of 2020 it was 42.6% above expected value.

To form an opinion on MS, I rely on two forms of consensus outlooks, along with the fundamentals. The first is the well-known Wall Street analyst consensus rating and 12-month price target. The second is the market-implied outlook, which reflects the consensus opinion of buyers and sellers of options. The price of an option represents the market’s consensus estimate for the probability that the price of the underlying security or index (SPY in this case) will rise above (call option) or fall below (put option) a specific level (the strike price) between now and when the option expires.

By analyzing calls and puts at a range of strike prices and a common expiration date, it is possible to calculate a probabilistic outlook for the underlying security that reconciles the options prices. This is the market-implied outlook. For those who are unfamiliar with the concept, I have written an overview post, including links to the relevant financial literature.

Wall Street Consensus Outlook for MS

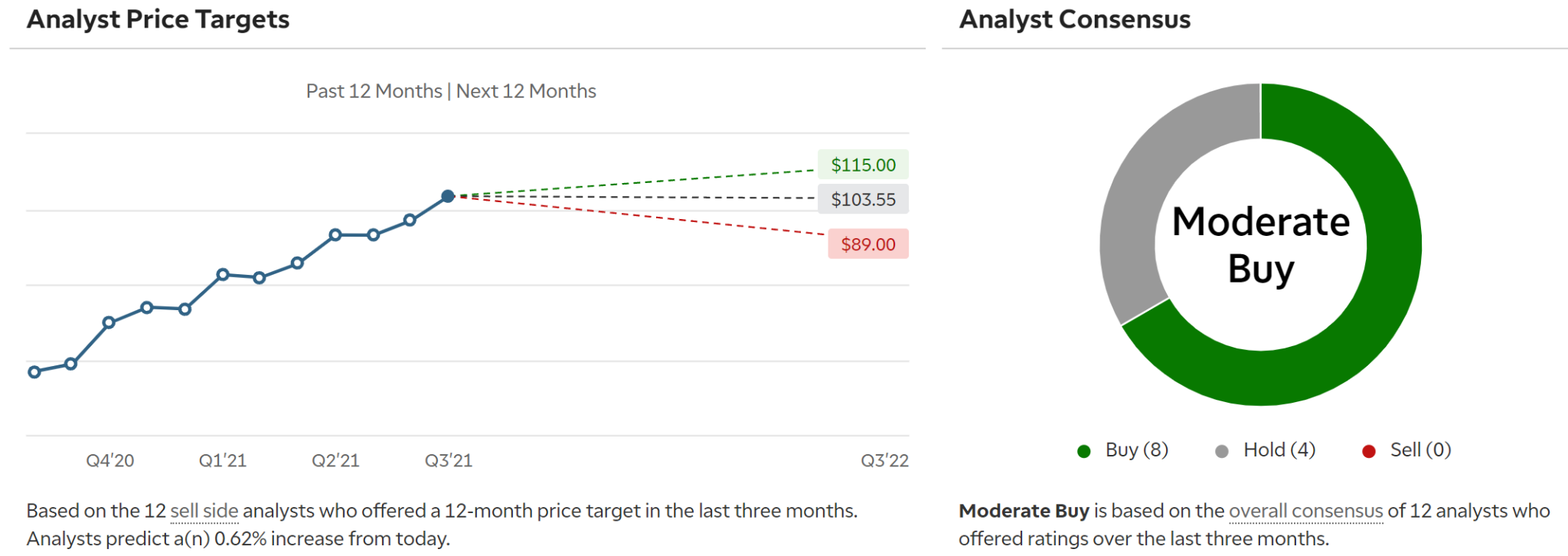

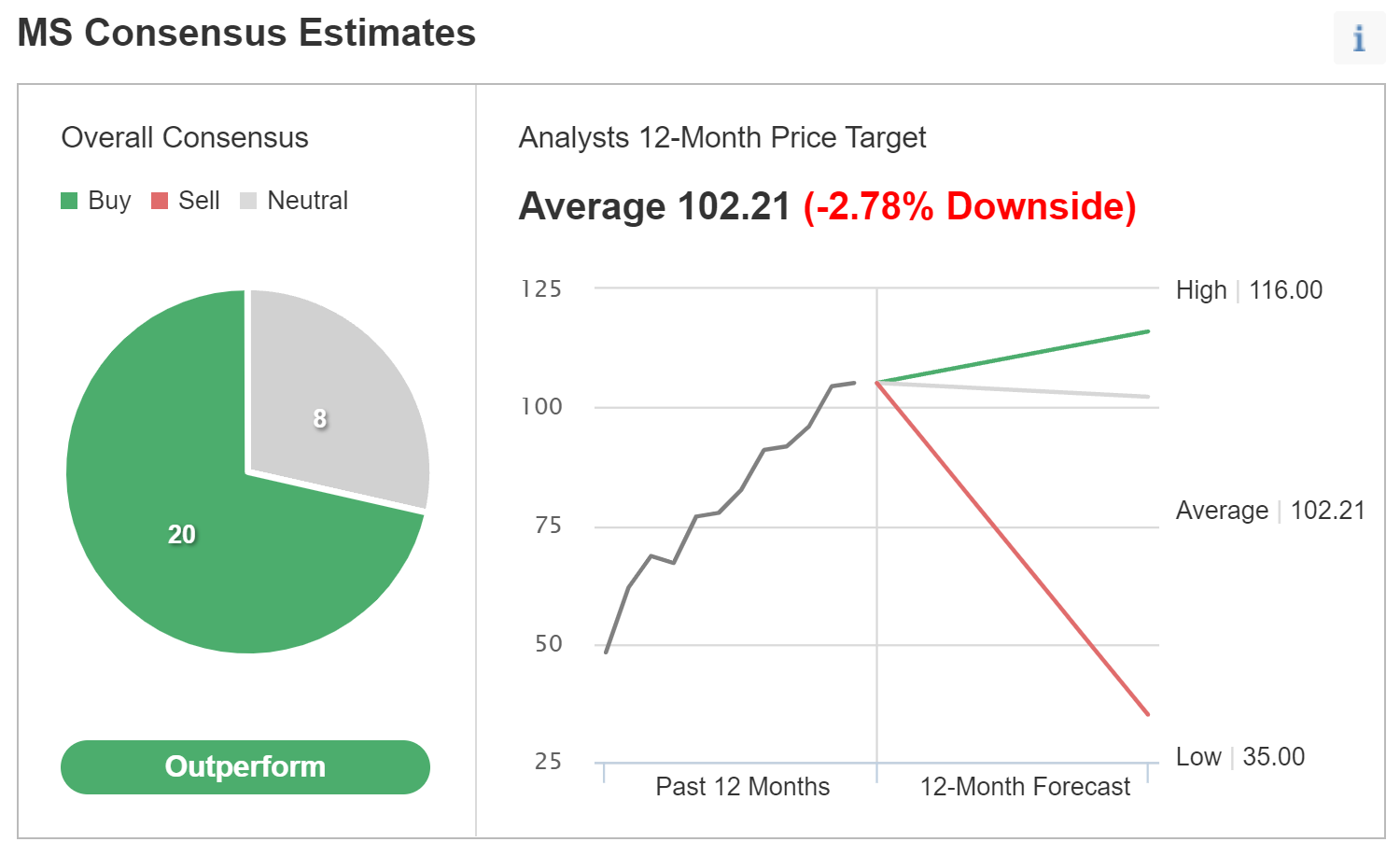

Ameritrade calculates the Wall Street consensus outlook from the views of 12 analysts who have issued ratings and price targets within the past 90 days. The consensus outlook is Moderate Buy, with 8 analysts rating the stock a buy and 4 assigning a neutral rating. The consensus 12-month price target of $103.55 is 1.5% below the current share price.

Source: Ameritrade

Investing.com calculates the Wall Street consensus using ratings and price targets from 28 analysts. The consensus rating is outperform, with 20 of the analysts giving MS a buy rating and 8 with a neutral rating. The consensus 12-month price target is 2.78% below the current share price.

Source: Investing.com

The Wall Street consensus rating is equivalent to a buy, but the share price currently exceeds the consensus 12-month price target. I interpret the situation as indicating that the price has risen faster than the analysts revisit their price targets. In addition, the ratings may represent a longer view of a company’s prospects (e.g. beyond 12 months). Having the analyst consensus price target indicate that the next 12 months of growth prospects are already priced into the stock is a note of caution.

Market-Implied Outlook for MS

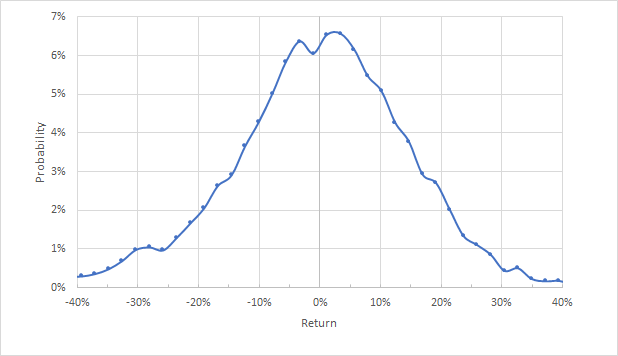

I have analyzed call and put options at a range of strike prices, all expiring on Jan. 21, 2022, to generate the market-implied outlook for MS for the next 3.8 months (from now until that expiration date). I have also calculated the 8.6-month market-implied outlook using options that expire on June 17, 2022.

Source: Author’s calculations using options quotes from ETrade

The market-implied outlook to Jan. 21, 2022 is generally symmetric. The peak probability corresponds to a price return of +3% for the 3.8-month period. The annualized volatility derived from this distribution is 31%. This level of volatility is very close to what I calculated for JPM last week (29%).

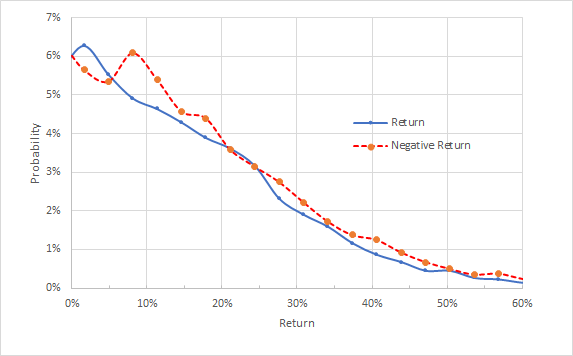

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the market-implied outlook about the vertical axis (see chart below).

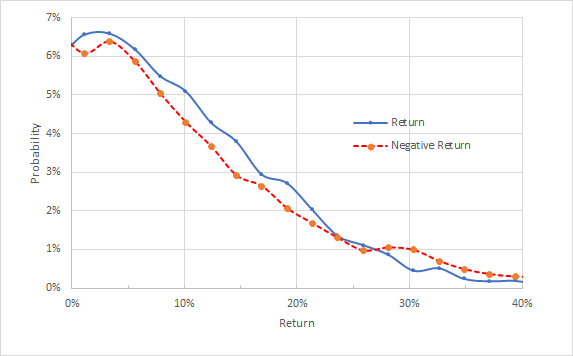

Source: Author’s calculations using options quotes from ETrade. The negative return side of the distribution has been rotated about the vertical axis.

This view shows that there are consistently elevated probabilities of positive returns relative to those for negative returns (the solid blue curve is above the dashed red curve for a wide range of the most-probable outcomes). This is a bullish outlook.

In theory, we expect the market-implied outlook to exhibit slightly higher probabilities of negative returns due to risk-averse investors over-paying for put options to protect against losses in long positions. In addition, the probabilities of negative returns tend to be higher than for positive returns for dividend-paying stocks because the dividend payments reduce the upside potential of a stock. Considering both of these factors makes the outlook for MS for the next 3.8 months look even more bullish.

The 8.6-month market-implied outlook for MS, calculated using prices of options that expire on June 17, 2022, has slightly elevated probabilities of negative returns (the dashed red line is above the solid blue line for most outcomes). In light of the factors that tend to create an overall negative tilt in the market-implied outlook (as described in the previous paragraph), I interpret this 8.6-month outlook to be neutral. The annualized volatility derived from this distribution is 32%.

Source: Author’s calculations using options quotes from ETrade. The negative return side of the distribution has been rotated about the vertical axis.

From now until early 2022, the market-implied outlook is bullish, with moderate volatility for an individual stock. Looking out to the middle of 2022, the outlook shifts to neutral and the volatility is consistent with the nearer-term outlook.

Summary

Morgan Stanley management describes the firm as being at an inflection point, as the company solidifies its position as a fully-integrated financial services juggernaut, offering investment banking, retail banking services, wealth management, and investment management.

The rapid ascent of the share price reflects Morgan Stanley’s rapid progress. The Wall Street analyst consensus is bullish, but the current share price is slightly above the consensus 12-month price target.

The market-implied outlook to early 2022 is bullish, becoming neutral as we look out to mid year. The projected volatility is moderate. Given the modest share valuation, the impressive outperformance on earnings over the past year, and the bullish Wall Street consensus and market-implied outlook, I am assigning a bullish rating on MS despite the lack of upside potential implied by the consensus price target