Moody’s downgrades Senegal to Caa1 amid rising debt concerns

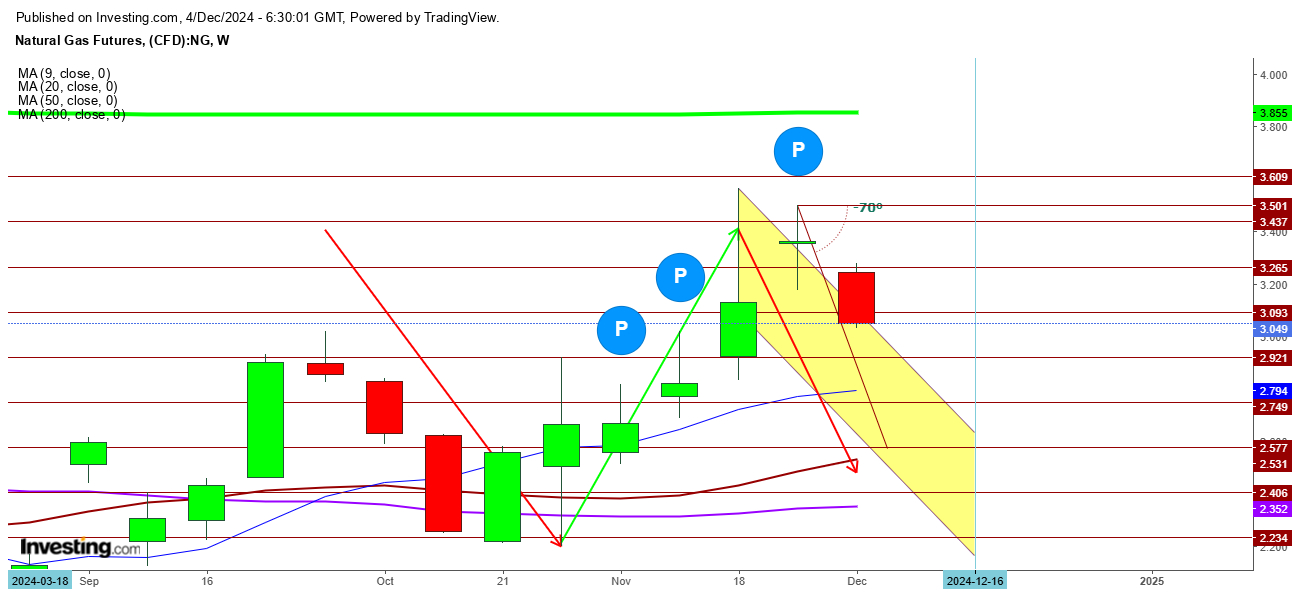

Natural Gas Futures are showing clear signs of extended bearishness, reinforcing the downtrend outlined in my last analysis. The completion of a double-top formation has positioned prices for further declines, with technical signals aligning to suggest lower levels ahead.

Building on the fundamentals and technical insights I shared in November, today’s analysis will focus on recent movements across multiple timeframes, mapping out critical support and resistance levels and shedding light on what traders should watch for next.

Weekly Chart: Gap-Down Signals Persistent Selling Pressure

In the weekly timeframe, natural gas futures opened with a gap down this week, continuing last week’s indecisive candlestick pattern. The selling momentum appears intact, with immediate resistance at $3.093, followed by a more significant hurdle at $3.265.

On the downside, support is seen at the 9-day moving average (DMA) near $2.793, and a breach below this level could lead prices to test the next support at $2.692.

Daily Chart: Below Key Moving Averages Post Double-Top

Zooming in to the daily chart, natural gas futures remain under the 50 DMA after confirming the double-top pattern. Immediate support lies at $2.9, and failure to hold this level could accelerate bearish momentum toward Dec. 20.

Resistance levels to watch include the 50 DMA at $3.082 and the 20 DMA at $3.161, which serve as critical barriers for any upward retracement attempts.

4-Hour Chart: Bearish Crossovers Hint at New Lows

The 4-hour chart paints an equally bearish picture. Despite an effort to stabilize following this week’s gap-down opening, the formation of double bearish crossovers—where the 9 DMA and 20 DMA have moved below the 50 DMA—signals mounting downward pressure.

The 200 DMA at $2.873 emerges as a key support level. A decisive breakdown here could pave the way for natural gas futures to explore fresh lows in the short term.

Conclusion: Bearish Range May Tighten

For now, natural gas futures seem trapped within a bearish range between $3.093 and $2.841. A breakout beyond this zone could provide traders with clearer directional cues. Until then, caution is warranted as the technical outlook favors further downside.

Disclaimer: This analysis is for informational purposes only. Readers are advised to exercise their judgment and trade at their own risk. The author holds no position in natural gas futures.