Berkshire Hathaway reveals $4.3 billion stake in Alphabet, cuts Apple

I did this research using AI when I asked the question:

Can natural gas producers afford to extract gas if the price is below 4?

Whether natural gas producers can afford to extract gas below $4/MMBtu depends on:

- Breakeven Price: Most dry gas wells need $2.70-$3.20/MMBtu to be profitable. Some areas, like parts of the Marcellus Shale, can be profitable below $2/MMBtu. NGLs (Natural Gas Liquids): Wells producing wet gas with NGLs have lower breakeven points because NGLs are valuable, like Marcellus wet at $1.77/MMBtu versus dry at $2.43/MMBtu. Associated Gas: In oil-rich regions like the Permian Basin, gas is a byproduct, and extraction is tied to profitable oil production, regardless of gas prices alone.

- Existing vs. New Wells: Existing wells have lower breakeven points as initial capital is spent.

- Technology: Advances reduce costs, improving profitability at lower prices.

In essence, some producers can afford it, especially in low-cost basins or when associated gas or NGLs contribute to profitability, while others, particularly those focused on dry gas wells or with higher costs, may struggle.

According to the chart of the August contract, as long as natural gas remains below $3.40, we do not really know where the low-ball threshold is.

In November 2024, the contract traded as low as $2.97 before buyers showed up.

That turned out to be a spectacular rally up to $5.26 this past March.

So, I believe we are close to the bottom, which is why I am writing this daily.

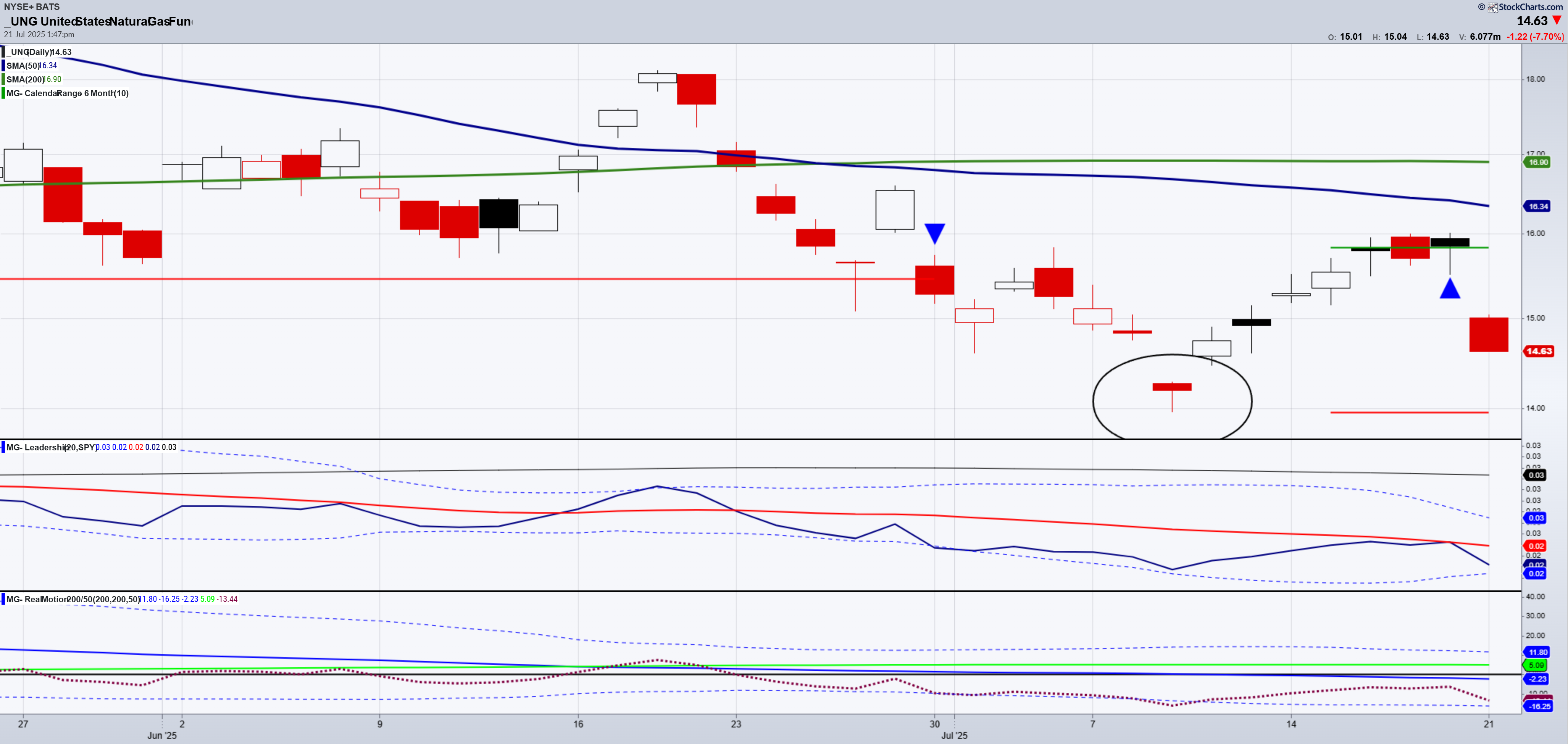

For more insight, let’s look at UNG, the ETF for Natural Gas.

Have you seen the chart of Utilities XLU?

It is trading at all-time highs.

There is a growing demand for electricity from data centers, EVs, and onshore manufacturing. YET

Energy prices are weak. Utility companies are often regulated, allowing them to pass on certain costs, including fuel costs, to consumers.

This pricing power can help them maintain profitability even when facing fluctuations in energy prices.

For a while.

The UNG chart shows an island bottom (circled). So while we look at the underlying futures price that does not have the same technical pattern, we pay attention.

Last Friday, the price cleared the July 6-month calendar range high (blue arrow).

Monday, the gap lowers, negating that strength.

However, until or unless UNG breaks below the island bottom low, dips do not scare me.

In fact, we will be watching for a move over Monday’s high as a reliable indication. Natural gas is overdone to the downside.

One last note from the weekend Daily and IWM.

“We now have a year of resistance at both calendar ranges.

The longer the resistance, the more powerful it is once it clears.”

It has yet to clear.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 628 calendar range high

Russell 2000 (IWM) 220 support and still stuck

Dow (DIA) 440 key support

Nasdaq (QQQ) 558 calendar range high to hold

Regional banks (KRE) 62 pivotal

Semiconductors (SMH) did not clear the calendar range high

Transportation (IYT) 70 pivotal

Biotechnology (IBB) Broke support at 130, now watching 127

Retail (XRT) 79-80 support and must clear 81.70

Bitcoin (BTCUSD) 116 support 125k next