Street Calls of the Week

- Cheniere LNG crisis cancels out misguided rally sparked by Freeport LNG

- Magnitude of plunge makes market technically oversold

- 54 billion cubic feet U.S. storage build forecast

It had to take one LNG producer’s misfortune to cancel out the misguided rally sparked by the crisis of another.

Even then, there was no certainty the deep-pocketed hedge funds that had been chasing natural gas futures higher for weeks in defiance of bearish fundamentals were ready to call it quits.

The decision by the Environmental Protection Agency (EPA) to deny Cheniere LNG’s export terminals an exemption from meeting rules on turbine mandates was the key driver of the week-to-date dive of 11% in gas futures on the New York Mercantile Exchange’s Henry Hub.

In the week prior, an extended delay in the operational return of Freeport LNG—a gas processing plant shut since June—caused the Henry Hub to experience its first double-digit pricing in 14 years, instead of a plunge expected by bears in the market. The front-month contract in U.S. gas futures had then crossed the key $10 per thermal unit mark.

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, noted that the trade kicked off the abbreviated week of trading with a barrage of selling that came right after Monday’s US Labor Day holiday.

High on the list of catalysts for the selling was the Cheniere debacle, which could push gas supply back into the market the same way as the Freeport crisis did. Texas-based Freeport was consuming about 2 billion cubic feet (bcf) per day of gas before it was shut on June 8 by an explosion.

In the three months that followed the explosion, the Henry Hub’s front-month plunged from a high of $9.66 to an initial low of $5.36 by the end of June, then surged to break $10 in a run higher that often defied logic, based on the bearish factors at play, including record production.

To break it down for those who hadn’t been following, the EPA denied Cheniere a bid for exemption from emissions mandates regarding several dozen poison-emitting turbines that were put in place in early March 2022 with a deadline for compliance by September 5.

Cheniere utilizes these turbines to cool natural gas into a liquid form that can then be transported via LNG cargos to destinations outside of the U.S. However, the turbines used in this process have been emitting poisonous, cancer-causing, formaldehyde emissions. The EPA has been attempting to stop the usage of these turbines until they have been brought into compliance with clean air standards.

Since Cheniere did not comply with the mandates over the last six months, the EPA has the option to stop the operation of these turbines until they have been made compliant.

The exact details of how the EPA will be enforcing this mandate have not yet been made clear, but they said that they would ‘work with’ companies that are not in compliance. The details of the plan will be forthcoming, but it is being speculated that the EPA will probably require production of LNG from the Sabine Pass LNG, Cameron LNG, and Corpus Christi LNG export facilities to be reduced in order to incrementally address the issue until they’re all brought into compliance.

The Cheniere news hit natural gas prices hard. At the end of trading on September 6, the Henry Hub’s front-month, October, tumbled 64.1 cents to settle at $8.145, marking the biggest single-session decline since June 30 and the lowest close since August 9. As of the time of writing, October gas was hovering at under $7.90.

The Henry Hub was also pulled lower by an increase in dry gas production, which advanced slightly above 99 bcf/d over the holiday weekend and remained underpinned around 98.5 bcf/d during Monday’s early-cycle flow data. Even in the midst of solid powerburn, gas market bears also garnered some strength from an increase in Canadian imports and a dip in LNG export demand.

Traders were also observing the near-term and longer-range temperature outlook, which are yet another price-weakening catalyst for the Henry Hub. Even though widespread late summer heat is overspreading large areas of the West and parts of the Rockies and Plains, the above-average temperatures are slated to pull back in coming days. The gas-weighted degree days for the period of September 7-20 are the third most for the period in the last five years but will quickly start to drop around the middle of the month.

As powerburn starts its seasonal decline in mid-September, it will result in a notable loosening of the supply/demand imbalance, particularly as the dry gas production is slated to climb toward 100 bcf/d potentially by mid-to-late October.

Another catalyst that could be adding to the price weakness in U.S. natural gas is the recent mass sell-off/liquidation of Dutch-based TTF prices, which serve as benchmark for European gas. The recent plunge of the TTF from record highs sparked a massive surge in margin calls. In the current rising interest rate environment where too many trading houses were leaning long in the U.S. and Europe energy markets, margin calls have been triggered to the tune of $1.5 trillion in recent days.

But will this liquidation in the Henry Hub last?

Gelber Associates’ Lammey has his doubts, explaining:

“Even though bearish price-setting mechanisms are now gaining traction over bullish market influencers, because of the magnitude of the sell-off in the last few days, prices have become near-term technically oversold, so it wouldn’t come as a shock to see a near-term rebound before prices plumb even lower lows.”

Sunil Kumar Dixit, chief technical strategist at SKCharting.com, concurred, adding:

“Prices continue to be nested within the previous month's bullish candle.”

“Henry Hub’s drop from the glory of $10 straight to $7.76 seems to have paused at the important confluence of the 100-Day Simple Moving Average and the weekly middle Bollinger Band of $7.88.”

Dixit said October gas’ oversold daily stochastics reading of 4.7/8.2 called for a short-term rebound towards the 50-Day Exponential Moving Average of $8.29 - $8.68 and $8.98.

“Alternatively, a break below $7.55 will resume the drop to $7.38 -$7.10 and deepen the bearish streak to $6.88 - $6.58. The weekly stochastics reading of 54/70 is in favor of the bears and continues to suggest further downward momentum.”

Where gas prices go later in the week could depend much on the weekly US storage numbers to be reported by the Energy Information Administration (EIA) at 10:30 ET (14:30 GMT).

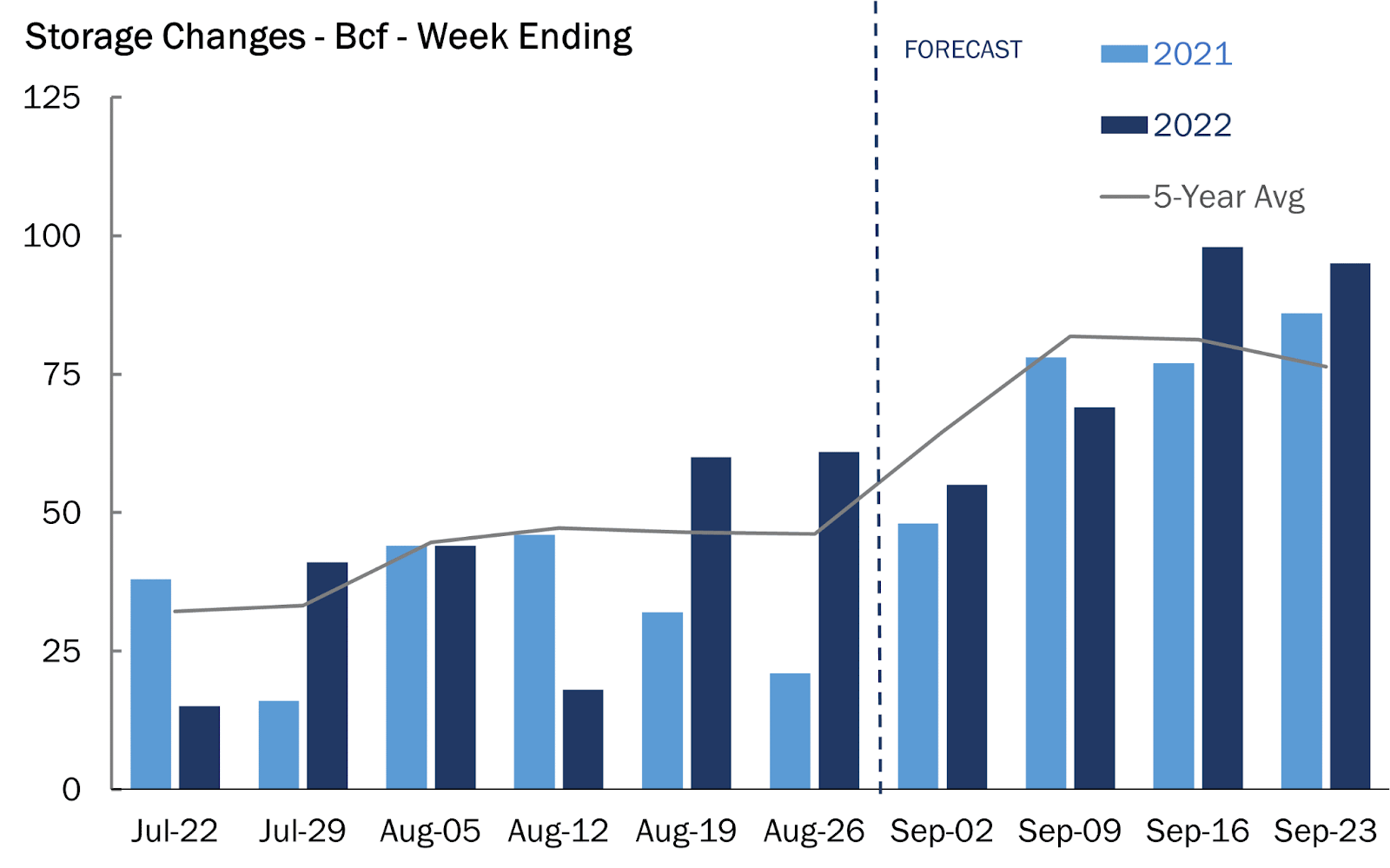

Source: Gelber & Associates

Ahead of the EIA report, a Reuters poll showed U.S. utilities likely added a smaller-than-usual 54 bcf of natural gas to storage last week as power generators burned lots of gas to keep air conditioners humming during a heat wave.

That injection for the week ending September 2 compares with a build of 48 bcf during the same week a year ago and a five-year (2017-2021) average increase of 65 bcf.

In the week ended August 26, utilities added 61 bcf of gas to storage.

The forecast for the week ended September 2 would lift stockpiles to 2.694 trillion cubic feet (tcf), about 11.5% below the five-year average and 7.6% below the same week a year ago.

There were around 90 cooling degree days (CDDs) last week, which was much more than the 30-year normal of 73 CDDs for the period, data from Reuters-associated data provider Refinitiv showed.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65° Fahrenheit (18° Celsius).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.