With uncertainty rising, is gold’s bull run far from over?

After a year of remarkable gains, e-commerce giant, Amazon.com (NASDAQ:AMZN) is now finding itself in rough waters.

Shares of the company plunged almost 8% on Friday, the stock's biggest slump in more than a year, after the e-tail behemoth disappointed investors with its latest earnings report, released on Thursday, after the close.

On its face, Q2 earnings weren’t bad. The Seattle-based tech giant made $113.1 billion in sales, a jump of 27% in the period that ended on June 30, slightly missing analysts’ consensus estimate of $115 billion. Profit was $15.12 a share in the period, surpassing the average estimate of $12.28.

Investors also overlooked better-than-predicted profits and a strong performance from the company’s advertising business as well as from Amazon Web Services, the company's cloud unit. AWS revenue jumped 37% in the quarter to $14.8 billion—the biggest year-over-year sales jump in two years. The company’s “other” revenue category, primarily advertising sales, gained 87% to $7.92 billion. Both units topped analysts’ estimates.

But beyond these fantastic growth numbers, Amazon didn’t have much to satisfy growth-hungry investors, concerned that the remarkable run the online retailer had during the pandemic is perhaps already in the rearview mirror.

Shareholder focus is on the company's core e-commerce business which is, indeed, slowing, especially at the same time that founder Jeff Bezos has handed over the executive role to a long-time lieutenant, Brian Olsavsky. In a conference call, the new CEO didn’t mince words regarding the situation, telling analysts the slowdown in sales will continue through the remainder of the year.

“People are getting out more and doing things besides shopping,” Olsavsky said in a call with reporters, referring to the reopening of the economy after more than a year of restrictions which created a conducive environment for online shopping.

Analysts Remain Bullish On The Stock

Revenue will be $106 billion to $112 billion in the period ending in September, Amazon said. Operating profit will be $2.5 billion to $6 billion. Analysts, on average, projected $8.11 billion in profit on sales of $118.7 billion, according to data compiled by Bloomberg.

Despite the setback on the earnings front, the majority of Wall Street analysts remain bullish on the company’s long-term prospects and its leading position in e-commerce. Though some have adjusted their price targets on the stock as sales slow, many believe any lingering weakness offers a buying opportunity.

The Telsey Advisory Group has an outperform rating and $4,000 price target for Amazon. Analysts said in its note that the company is becoming more valuable in the post-pandemic environment:

“We understand Amazon shares are likely to trade down, given soft 2Q21 results and a lower 3Q21 outlook. That said, we believe Amazon is executing at a high level and should continue to gain market share by leveraging its sticky customer base, small business relationships, and retail consolidation. The focus on newer businesses and initiatives—grocery, pharmacy, fashion, home, private brands, third-party, same-day/one-day delivery, and Amazon Logistics—is making Amazon more valuable.”

Stifel Nicolaus, which also has a buy rating on the stock with a price target of $4,400, said:

“We now have better visibility into the 2H and estimates are adjusted better reflecting the new normal as we emerge from the pandemic. We believe the setup is attractive now that the shares are on the other side of the COVID comp reset. We would be buyers on the share decline stemming from tonight’s report.”

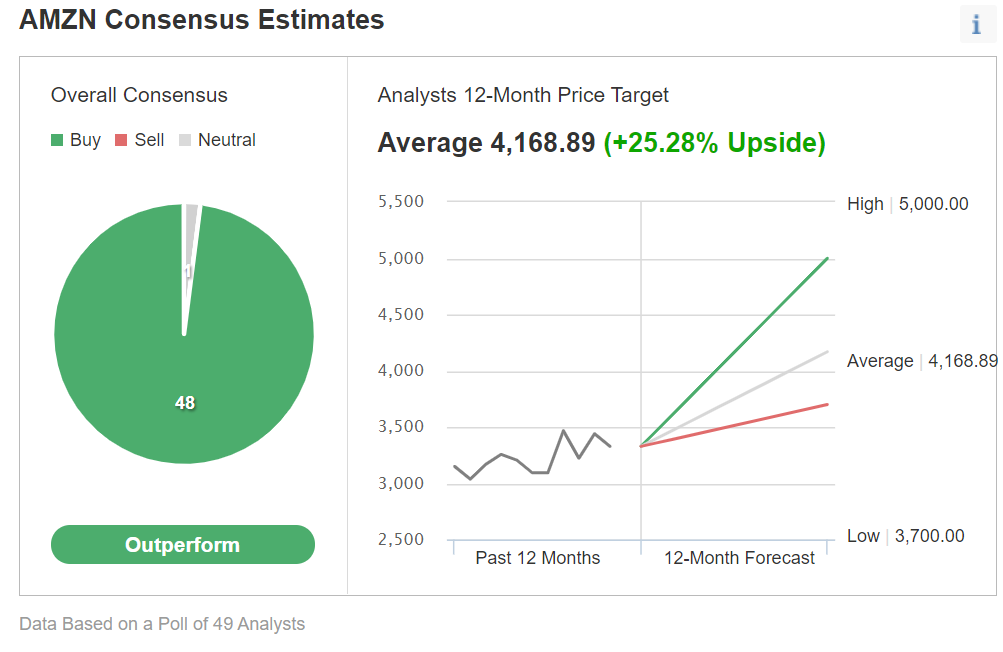

Of 49 analysts polled by Investing.com, 48 had a buy rating on AMZN, labeling it a stock that will 'outperform.'

Chart: Investing.com

The average, 12-month price target provided by respondents was $4,169, or a +25% upside.

Bottom Line

Shares of Amazon may experience more downside after the weak Q3 guidance for its core e-commerce sales, post the brisk buying activity seen during the pandemic.

But that weakness offers an entry point for investors sitting on the sidelines, given the company’s rapidly expanding revenues from its cloud and ad businesses, along with its still-dominant position in the e-commerce arena.