Street Calls of the Week

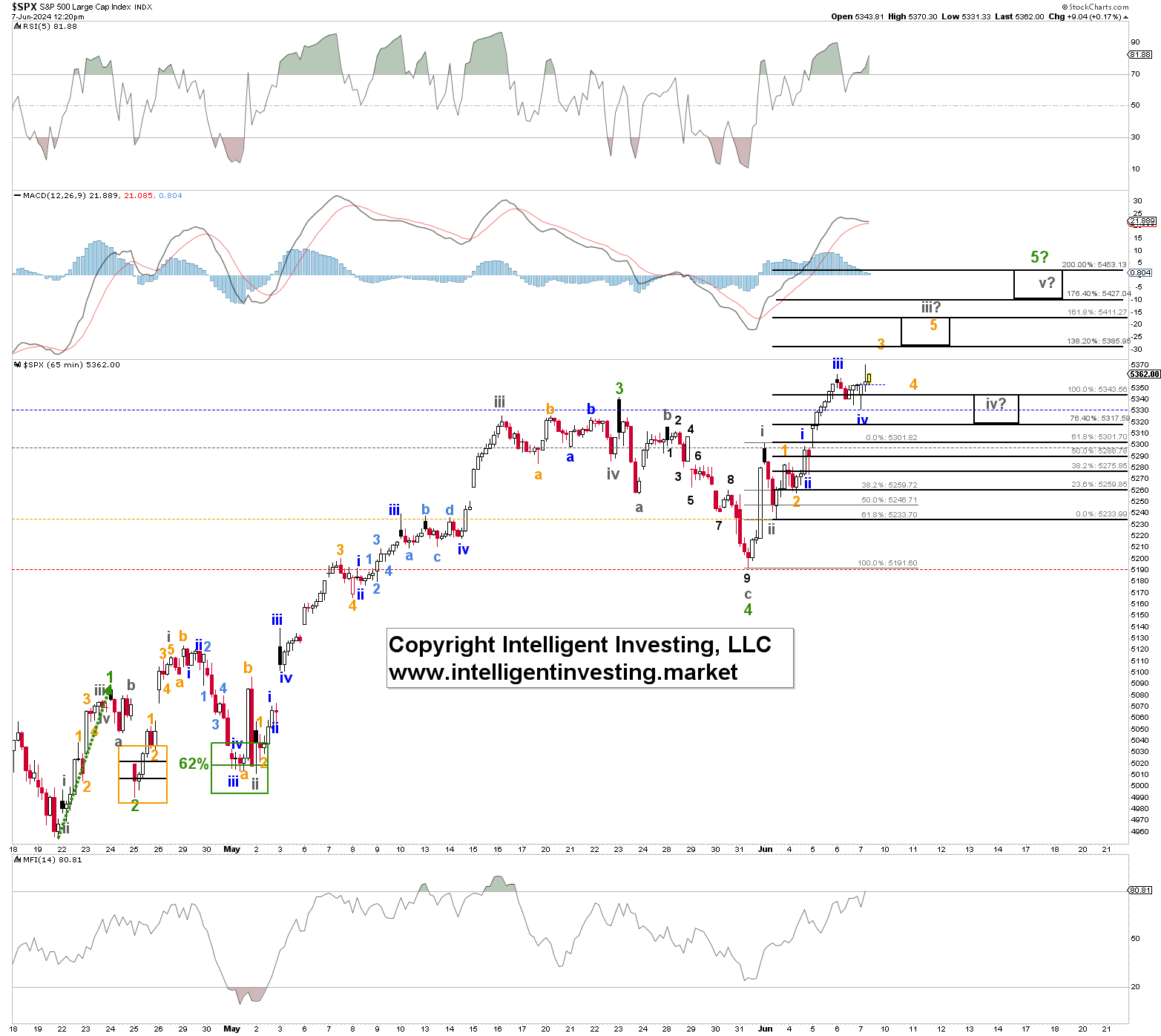

We track the S&P 500 (SPX) using the Elliott Wave Principle (EWP) primarily and view the current rally from the May 31 $5191 low as an impulse 5th wave targeting ideally $5427-53 contingent on holding above the colored dotted horizontal lines.

See Figure 1 below. These levels are warning levels for the Bulls. Blue is the Bulls’ 1st warning, grey the 2nd, etc., and if the index drops below them, it increases the odds that the upside target will not be reached. Hence, they can be used as stop (loss) levels.

Figure 1. Hourly SPX Chart with Detailed EWP Count and Technical Indicators

The current rally first saw an initiation move, grey W-I to $5301, a classic 61.80% retrace of that rally to $5233 for the grey W-ii. The pattern should now be in the grey W-iii to ideally $5385-5411. Moreover, the grey W-iii is subdividing into smaller waves (the orange and blue waves).

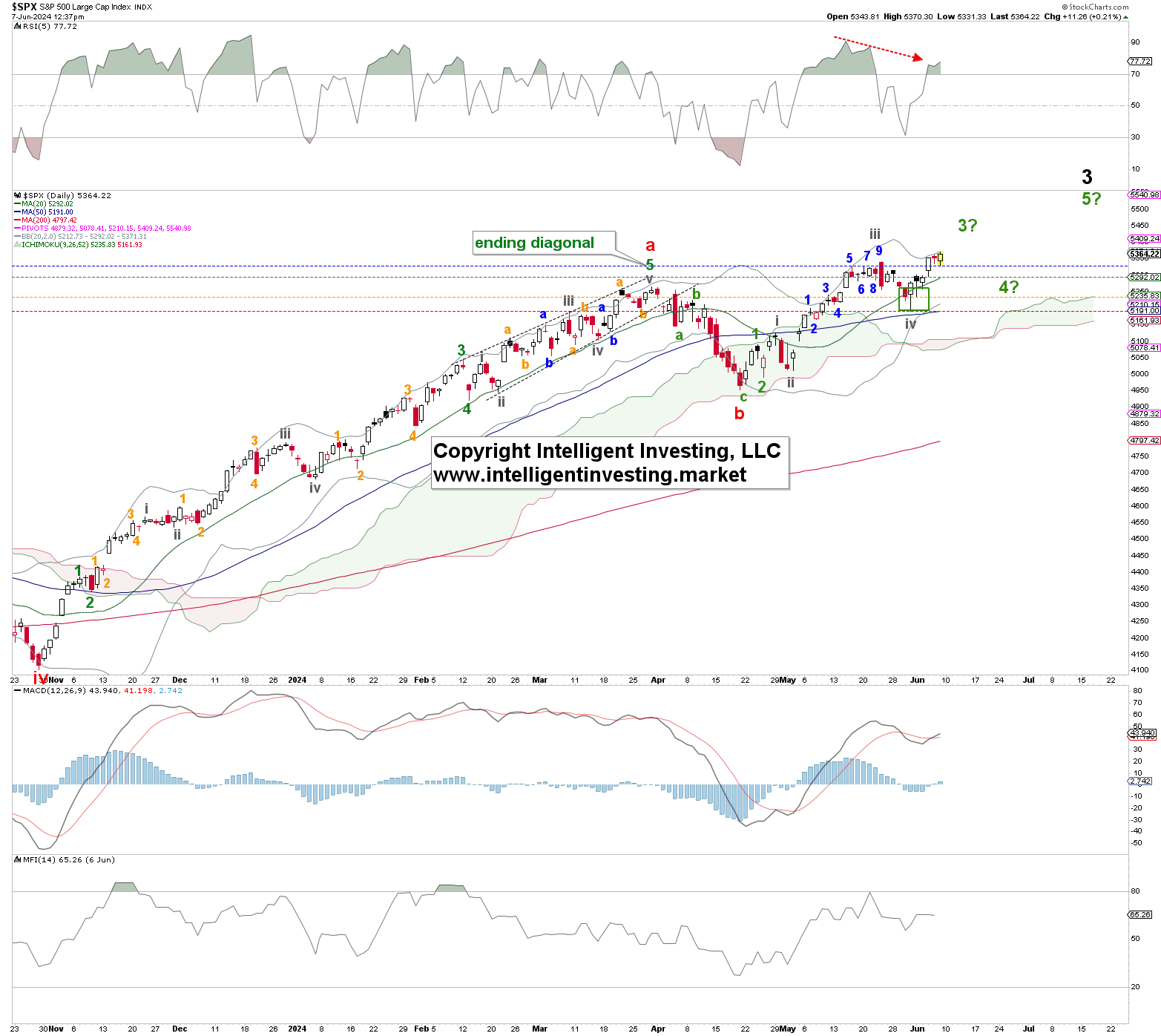

We expect the low to hold, and therefore, we can allow for the orange W-3, 4 to fill in over the next few days. Assuming we are correct, then we expect the index to enter a larger correction (~10%) once the green W-5 completes. However, we are cognizant of the possibility that the Bulls may have one more trick up their sleeves. See Figure 2 below.

Figure 2. Daily SPX Chart with Detailed EWP Count and Technical Indicators

Namely, the rally from the April 19 $4953 low, could see one more W-4, 5 sequence. Instead of a ~10% correction from the ideal $5427-53 target zone, we could only be treated with a single-digit pullback to around $5260+/-15 for the potential green W-4, followed by a last green W-5 to ~$5550+/-25. It will require a drop below last week’s low from the ideal $5427-53 target zone to strongly suggest a deeper correction is underway.

Thus, at this stage, we prefer to look higher, ideally to $5400+, from where a potentially larger correction can occur. However, it will require at least a drop below last week’s low to tell us that will be the case. Hence, there’s no need to front-run anything until that thesis is confirmed.