United Homes Group stock plunges after Nikki Haley, directors resign

Happy New Year, everyone. The "Santa Rally" I mentioned in my last update on December 22, 2022 (see here) gave us an +0.80% return. When the index finishes the first five trading days of a year higher, it has been positive more than 80% of the time at year-end with an average gain of about 13%, according to Stock Trader's Almanac. It was up 1.3% on January 9. Thus, 2023 is off to a good start.

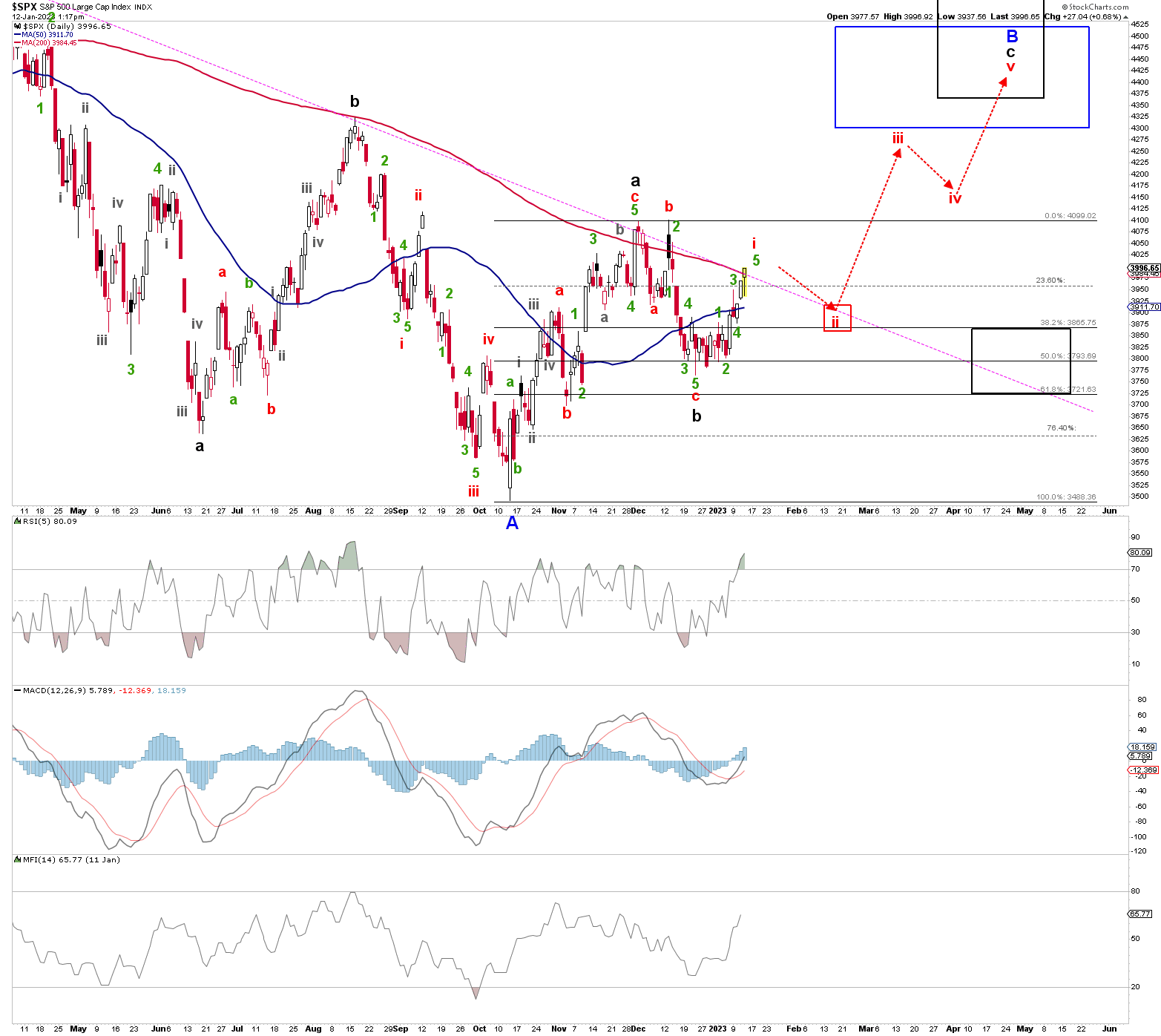

Besides, in our last update, we were looking for the S&P 500 (SPX) to bottom in the "green W-5 … ideal target zone of $3725-3755." As per the Elliott Wave Principle (EWP), our primary expectation has been for many weeks

"Once the $3800+/-70 zone is reached, …, we must entertain the notion all of black W-b has already bottomed out. The index will have to move below $3635 (the 76.40% retrace of the October 13 - December 1 rally), with the first warning below $3725, to start to suggest there will not be a more significant C-wave rally to $4300+."

The SPX bottomed at $3764 on the day of our update, only 0.2% (9p) from our ideal target zone. Currently, it trades at $3996. An over 220p, 5.8%, gain in three weeks.

Moreover, it has rallied in what counts best as five waves higher. See Figure 1 below. Alternatively, the current rally from the December 22 low is still only in green W-3.

Since C waves consist of five smaller waves, the current rally should only be red W-i of black W-c of blue W-B. As such, we anticipate a red W-ii soon, ideally down to $3875+/-25, before the red W-iii to ideally $4275+/-50 kicks in. See the red dotted arrows as our anticipated path in Figure 1.

Thus, our conclusion from before the Holidays, "When combining these facts [seasonality, Santa Rally] with the EWP count, we have been tracking over the last few weeks; it is prudent to conclude that a sustained bottom could be close." was correct. And unless the index breaks back below the December 22 low, with a first warning below $3850, there is no reason for this pattern not to unfold, and the following multi-day correction should be considered a low-risk buying opportunity.