United Homes Group stock plunges after Nikki Haley, directors resign

- SBUX is facing many uncertainties, including a management change and labor unrest

- Starbucks sales in China plunged 44% in Q2 amid the country’s renewed COVID-related shutdowns

- Chief Executive Officer Howard Schultz is charting a new course that will affect every aspect of the business

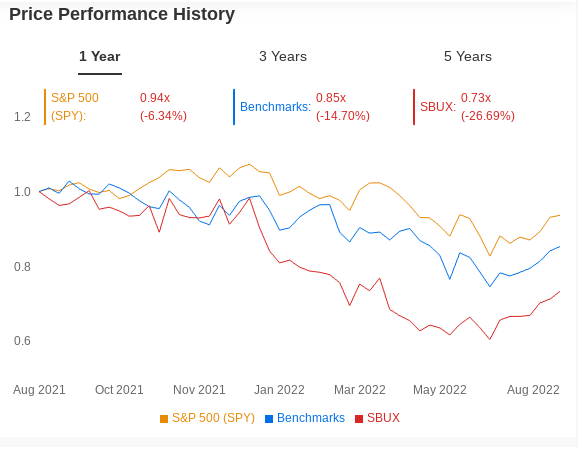

Shares of Starbucks Corporation (NASDAQ:SBUX) have staged an impressive rebound after this year’s dip. They are up about 25% since the middle of June amid a slow and steady climb.

Despite the recent upward move, the global coffee chain remains one of the worst-performing multinational restaurant operators on Wall Street this year, underscoring its many short- and long-term challenges.

The Seattle-based giant’s latest earnings report should provide tailwinds for the company’s rebound by signaling that the worst could be behind.

Source: InvestingPro

The coffee chain reported on Tuesday that its sales in North America remain strong even though it implemented many price increases to counter the escalating costs. Starbucks’s global same-store sales for the three months ended July 3 were up 3% from the same period last year, helped by a 9% jump in U.S. same-store sales.

The average ticket—or cost per order—rose 6%, but comparable transactions fell 3%, showing that higher prices make up for a lower sales volume.

While consumer demand in North America shows a strong trend, Starbucks sales in China—its second-largest market—remained depressed. Sales plunged 44% in the world’s second-largest economy amid the country’s renewed COVID-related shutdowns and other restrictions. The decline was deeper than the 39% drop expected by analysts.

Despite the recent rebound, SBUX’s upside potential remains limited, given the coffee chain’s many uncertainties. The biggest ones are the management uncertainty, the labor unrest, and the path the pandemic takes in China going forward.

Reinvention Plan

The company’s founder Howard Schultz, who returned as CEO in April as a stopgap arrangement to fix the company’s ongoing issues, suspended a share-buyback plan, arguing that he needed the cash to spend on stores and employees.

Since taking over, Schultz has shaken up management and attempted to blunt a growing union drive in the U.S., where 184 of Starbucks’s 9,000 stores are already unionized. Additional union elections are pending at 54 stores.

On a call with analysts, Schultz said Starbucks has a “reinvention plan” that will affect “every aspect” of the business. Details are expected during the company’s investor day on Sept. 13.

These uncertainties add to the already-hostile macro environment. With the highest inflation rate in four decades at home and the war in Ukraine, food and coffee prices are escalating, cutting back Starbucks’ profit margins.

The management change, inflationary pressures, and uncertainties about the company’s new direction are some factors that make SBUX stock less desirable to own despite the company’s strong brand and wide economic moat.

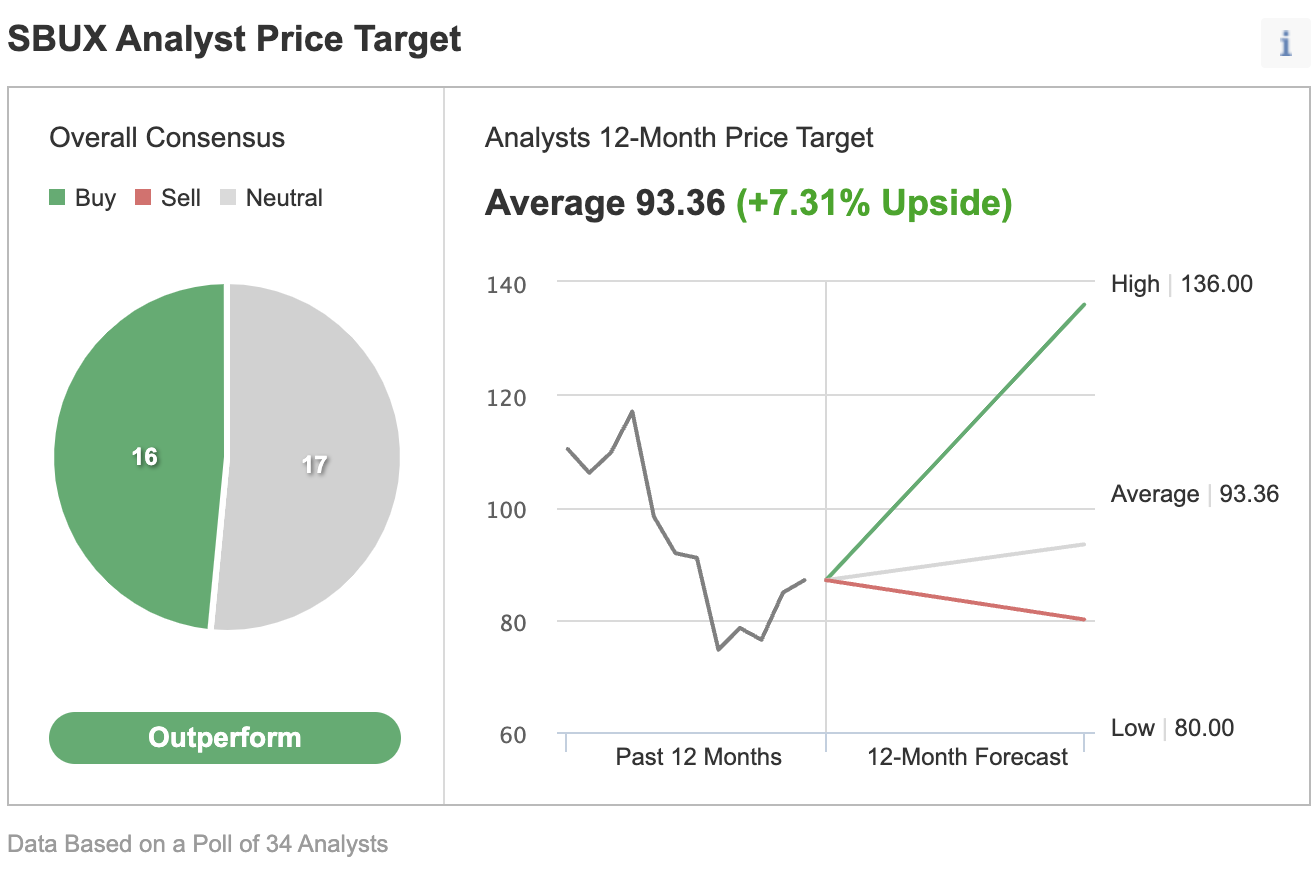

In an Investing.com poll of 34 analysts, half don’t recommend buying the stock, with a consensus price target that implies a little upside from the current levels.

Source: Investing.com

Bottom Line

SBUX stock continues to face a challenging operating environment where further upside potential is limited. Investors are better off staying on the sidelines until Schultz finishes charting a new direction for the company and the China market opens up.

Disclosure: The writer doesn’t own any of the securities mentioned in this article

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »