Adaptimmune stock plunges after announcing Nasdaq delisting plans

Well, it did not get to $2,000 as I argued in my last post.

But gold will still likely get a second chance at mid-$1,800s, which is quite comical from the perspective of longs who have spent half a year chasing the yellow metal as it went from $1,900s highs to mid-$1,800s and even sub-$1,700s at one point, before bouncing back to $1,900s and collapsing again this week to $1,700s.

Technical charts now indicate a return to mid-$1,800s. You know the drill: Rinse, repeat.

What’s amusing though is the inanity of gold bears and Wall Street analysts (read: airheads) who find one ridiculous narrative after another each day to justify the continued selling and cheapening of a commodity that’s supposed to be the world’s number one hedge against inflation—in what is interestingly described now as one of history’s most most supercharged moments for inflation.

In the latest act of this circus, markets had apparently lost confidence in gold altogether on Wednesday after the Federal Reserve laid out what the media managed to sensationalize as an overly hawkish rate and tapering regime coming soon after a year of super-easy monetary policy to accommodate the pandemic.

All charts courtesy of S.K. Dixit Charting

Let’s be clear about two things.

One: The Fed is NOT raising rates tomorrow. Its so-called dot-plot plan suggests the earliest increase—albeit, two hikes—will come before the end of 2023, which if my maths is correct, tells it as 2-½ years or 30 months away.

Two: The central bank is still seeking data that will point to the appropriate time for it to start scaling back the $120 billion in asset purchases it has been carrying out for the past year to shield the credit markets and the economy from the worst impact of COVID-19. In fact, Fed Chair Jerome Powell went to great pains during his news conference to emphasize that asset tapering—a term so overused in headlines now that its mere print or mention is enough to send shivers down people's spines—will NOT occur until the Fed sees adequate signals to justify such action. Powell also assured that the Fed will telegraph well in advance to investors and traders its taper intentions to avoid inordinate market response.

“Our intention for this process is that it will be orderly, methodical and transparent,” the Fed chief said at his news conference.

“We will do what we can to avoid a market reaction but ultimately when we achieve our macroeconomic goal, we will taper as appropriate. We will taper when we feel that the economy has achieved substantial further progress.”

Listening to the talking heads of CNBC and other financial show hosts and their guests, one might have gone away with a different idea as both the rate hike and taper were made to appear imminent, as though they were just a quarter away from happening. Ostensibly, almost every guest on these shows has a position in the markets and they are there to talk their book; unlike analysts like me who do not trade for the sole reason of staying objective and unbiased with my market views. To be sure, I’m not a fan of gold, but a fan of reason and objectivity.

To me, Powell’s words were clear, and to deliberately act against the message of the Fed can be deemed as irresponsible and even stupid; if not for the fact that shorting gold itself in an environment of manufactured hype and fear can be very profitable for the bears and their clients. And so, the gold-bashing charade continues.

What makes this week’s plunge in gold even more absurd is that it came on the back of the first hike in US unemployment claims after seven straight weeks of declines that once again raised questions about the consistency of the labor market recovery from the pandemic. If gold is indeed a protection against financial and political troubles, then an inconsistent job market certainly ticks one of the boxes for investors to get into the yellow metal. Instead, what we witnessed was a near $87, or 5%, plunge on the day that brought gold's losses for the week to more than $120.

Enough of Fed talk and the silly season of hypes and fears over gold. Let’s take a look now at where prices will likely go in the coming days and weeks.

With some sanity returning to the precious metal on the upside, Investing.com’s outlook suggests near term highs in the mid-$1,800 range for gold.

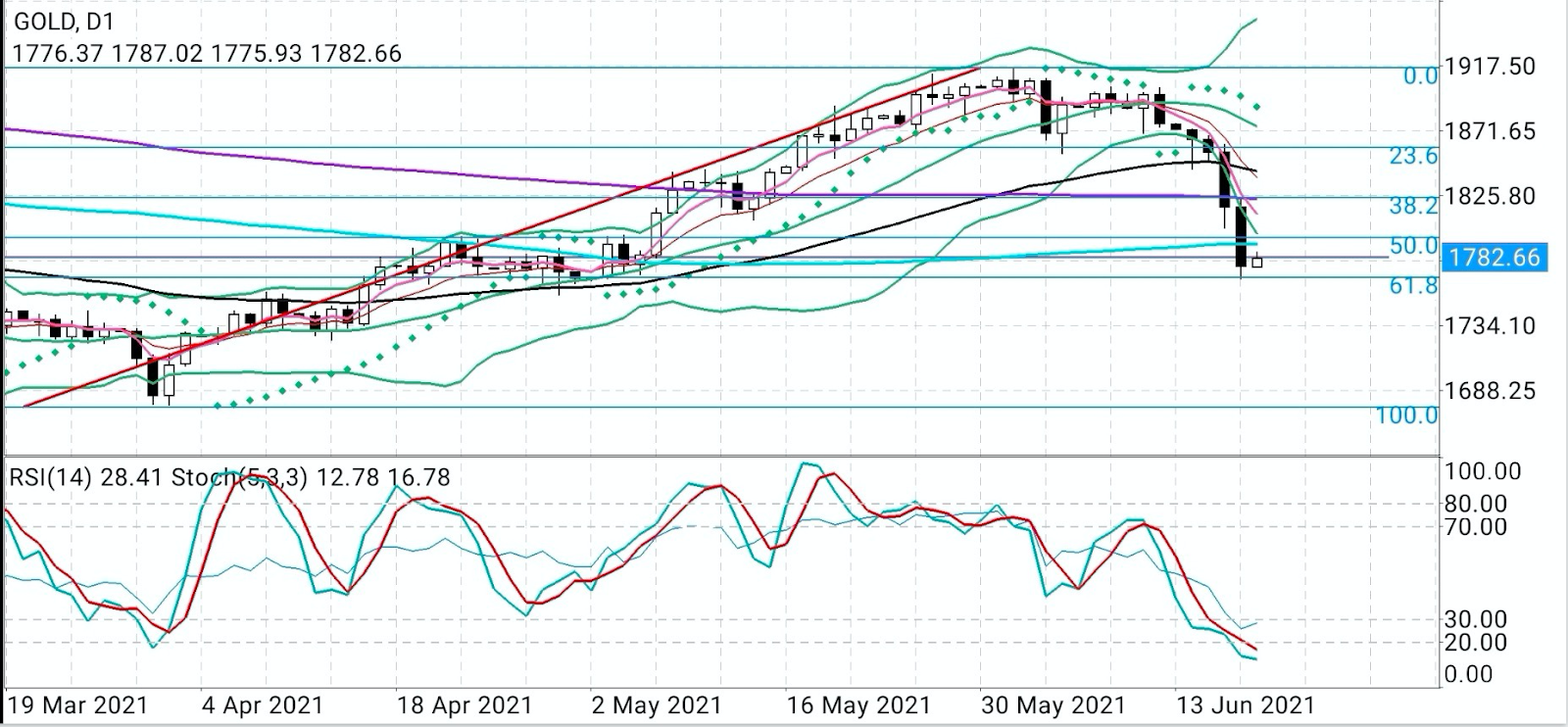

Our Daily Technical Outlook still maintains a “Strong Sell” recommendation for spot gold—we use the spot price because traders and fund managers sometimes decide on the direction for gold by looking at this, instead of gold futures—but a rebound certainly seems on the cards.

Under our combined ‘Fibonacci’ and ‘Classic’ forecasting models, gold could be trading between $1,847 and $1,869 in the near term—between $64 and $86 from where spot gold was trading at the time of trading.

Under the Fibonacci model, spot gold could first attempt a return to $1811, then $1,825 and later $1,847.

In the Classic model, the positive pricing for spot gold could first reach $1,810, then $1,847 and later $1,869.

Sunil Kumar Dixit, chief chartist of S.K. Dixit Charting in Koltata, India, concurs with Investing.com’s targets.

In a technical outlook on spot gold exclusively plotted for us, Dixit said:

“The daily chart stochastic reading at 13/16 indicates the metal has reached oversold territory and a bounce back from the lows is very likely, conditioned by prices holding above $1,770.”

On the flip side, he said weakness in gold could continue if the spot price breaks below the $1770 level, opening up to bearish targets at $1,753 - $1,735.

Adds Dixit:

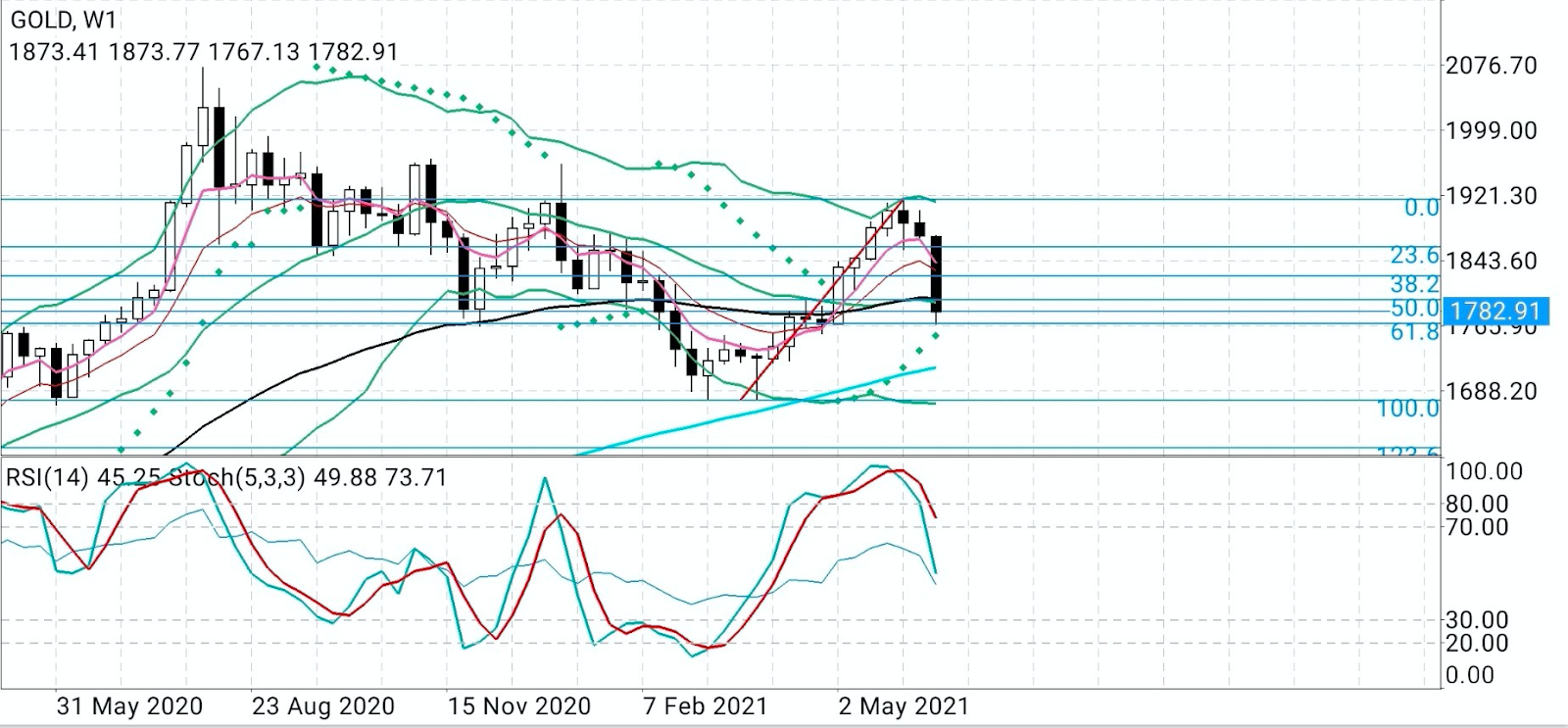

“The weekly chart stochastic reading at 49/73 indicates that the bounce back may be limited and another bearish wave can trigger if bears challenge the $1,868 zone. Thanks to the damage done to gold in the past 24 hours, it’s very important to see price action behaviour once reaching the tactical resistance zone of $1,868.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.