Street Calls of the Week

This article was written exclusively for Investing.com.

- Energy in the crosshairs

- Coronavirus is the leading issue

- Ironic future impact of risk-off's return

- Scaled-down commodities plan for the long-term

On Nov. 3, American voters will go to the polls to choose who will be president of the United States for the next four years, as well as elect representatives in the House; some states will also be voting for members of the Senate. The outcome of the election will determine which party’s agenda will shape domestic and foreign policy initiatives in the coming years.

Markets reflect the economic and political landscape. Since the US is the world’s leading economy, the election has substantial ramifications for the global financial system.

Within that network, commodities tend to be the most volatile asset class. Raw material production is often a local affair.

On the other hand, minerals, metals, ores, and energy output come from parts of the world where the earth’s crust contains the commodities. Agricultural products come from countries where fertile soil and water is available to support crops.

Meanwhile, consumption is ubiquitous. Commodities support everyday life for all people on our planet. The upcoming election will influence commodity prices over the coming years.

As well, the odds of a secular bull market in raw material prices are rising. The tidal wave of central bank stimulus and unprecedented levels of government aid is increasing the supply of money. As fiat currencies lose value, inflationary pressures are likely to push commodity prices higher in the coming years.

Therefore, the results of the November US election will play an important role in the direction of the global financial system starting in early 2021.

Energy in the crosshairs

The United States is currently the world’s leading crude oil and natural gas producer. US crude oil production rose to a record 13.1 million barrels per day in March. As of Oct. 2, it was still at the 11 mbpd level. Massive discoveries of natural gas in the Marcellus and Utica shales increased US reserves of the energy commodity. At the same time, technological advances in fracking to extract oil and gas from the earth’s crust and an energy-friendly regulatory environment under the Trump administration supported the rise in the production of traditional fossil fuels.

The Democrats appear to be substantially ahead in the political polls with under one month to go before the election. The opposition party could capture not only the White House but a majority in the US Senate and retain control of the House of Representatives. A sweep of these branches of the US government by the Democrats will likely cause more regulations when it comes to energy production and a move towards alternative sources that leave less of a carbon footprint on the environment.

Meanwhile, a decline in US oil and gas production will not cause the short-term requirements for the energy commodities to decline dramatically. However, it could hand the power and influence in the markets back to the international oil cartel OPEC and Russia.

In the world of commodities, US energy policy and its impact on the rest of the world could experience a significant change, which would impact both the economic and political landscapes around the globe. The election is a referendum on the future of US energy output as the current administration remains an advocate for 'drill-baby-drill' and 'frack-baby-frack.'

Coronavirus is the leading issue

Nevertheless, the leading issue for many voters is the global COVID-19 pandemic and the Trump Administration’s response to the coronavirus. This issue has vaulted to the top of the list again as the second wave of cases begins to sweep across Europe and the US.

President Trump and many of those in his immediate circle, including the first lady, have caught the virus. If the President of the United States can catch the disease, then everyone is potentially at risk. With over 210,000 fatalities and more than 7.4 million cases in the US as of October 9, the pandemic is at the forefront of voters' concerns.

Recall, then, that coronavirus has caused more than a few dislocations in commodities markets. Shutdowns and slowdowns at production and processing facilities have resulted in low prices for producers and rising prices, along with shrinking availabilities of many goods for consumers.

The coronavirus has also wreaked havoc with US and global supply chains. Perhaps the starkest example was in the animal protein sector of the raw materials asset class. Ranchers and producers found themselves stuck with cattle, hogs, and other livestock as processing plants experienced slowdowns.

The situation weighed on futures prices earlier this year even as it created a glut of supplies. However, consumers did not benefit from the low prices since shortages developed. In fact, prices rose. Many markets and retailers limited purchases and increased prices.

Another example comes from the lumber market. The price of wood futures rose to a record of $1000 per 1,000 board feet in September.

Low interest rates and migration from urban centers increased the demand for new homes. At the same time, lockdowns and the rising number of people working from home and furloughed from jobs, caused an increase in the need for wood for home improvement projects. At the same time, mill closures or slowdowns caused supply shortages.

There are many other examples of how the pandemic causes significant problems in the supply chains of several commodity markets over the past months.

Ironic future impact of risk-off's return

The risk-off periods caused by the virus could, ironically, turn out to be the most bullish factor for commodity prices over the coming years. Risk-off causes all asset prices to decline, as we witnessed earlier this year when WTI crude oil futures fell into negative territory, copper fell to almost $2 per pound, silver dropped to its lowest level since 2009, lumber dropped to a low of $251.50 per 1,000 board feet, and many other commodities experienced significant declines and reached bottoms in March and April 2020.

Another risk-off period could have a similar impact on the raw materials asset class. However, economic therapy for risk-off is bullish fuel for commodity prices in the long run. A tidal wave of central bank liquidity, quantitative easing, and low interest rates across the yield curve, combined with government stimulus including bailouts, enhanced unemployment insurance, and helicopter payments to individuals all have one thing in common. They increase the supply of money.

Rising money supply weighs on the value of all fiat currencies. The inflationary impact of liquidity, stimulus, and increasing debt levels erodes the value of money. Inflation tends to boost commodity prices. Therefore, risk-off periods that cause declines in commodity prices create a rising potential for higher future prices.

The liquidity and stimulus that followed the 2008 global financial crisis caused a substantial rally in the commodities asset class that took prices to multi-year or all-time highs by 2012. While the cause for central bank and government action a dozen years ago was different, the side effects of increasing the money supply are likely to be the same.

Scaled-down commodities plan plan for the long-term

Risk-off periods over the coming weeks and months could push commodity prices lower. However, the state of the global financial landscape supports far higher commodity prices over the coming years. The US Federal Reserve has told markets to expect short-term interest rates to remain at zero percent into 2023.

The central bank will tolerate a rising rate of inflation above its 2% target rate. The US deficit is above $27 trillion, and is rising. Another round of stimulus will push it over the $30 trillion level. The value of money is declining.

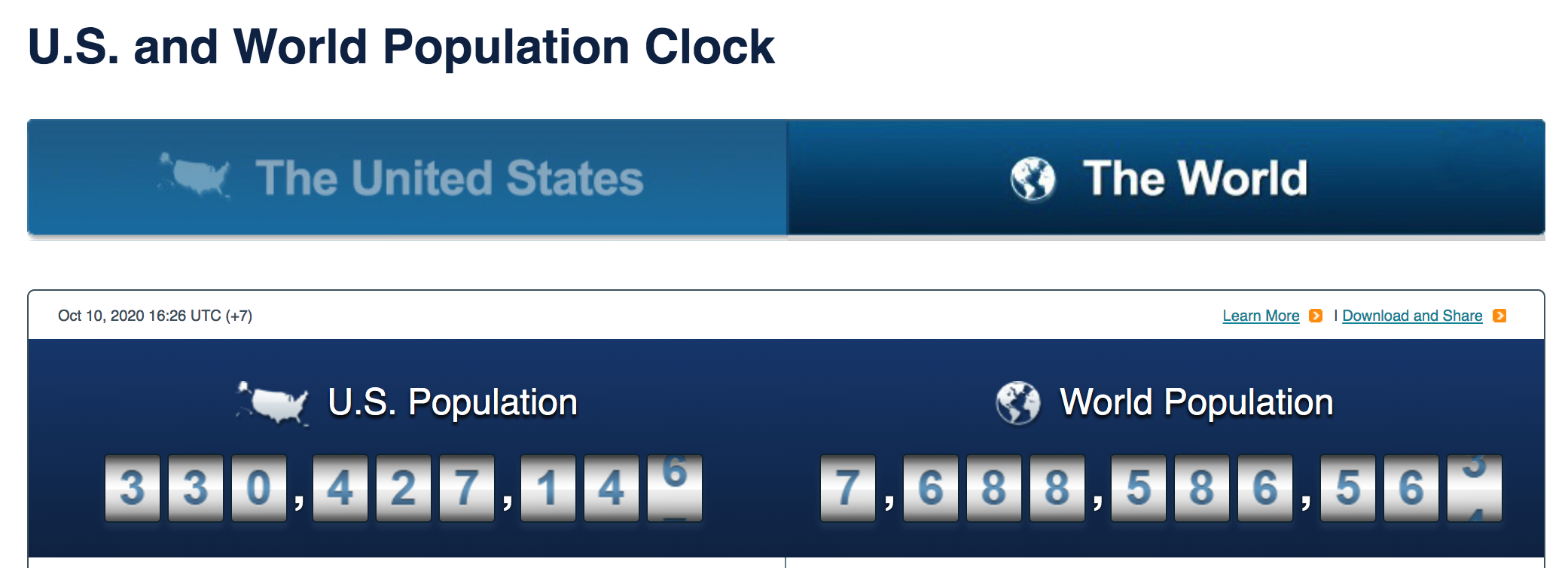

Simultaneously, the global population continues to grow by approximately twenty million each quarter. At the turn of this century, six billion people inhabited our planet.

Source: US Census Bureau

At the end of last week, the population was over 28% higher over the past two decades as it stood at above 7.688 billion. More people require more nutrition, energy, housing, and clothing in 2020 than in 2000. The demand will be greater in 2021 than in 2020, as population growth is a powerful force for the demand side of the fundamental equation for raw materials. And, as we've already stated above, commodities are essential elements that fulfill people’s basic requirements all over the world each day.

Risk-off in the commodities asset class could present a golden opportunity for investors over the coming weeks and months. Stimulus and liquidity are bullish fuel for commodities, and they are likely to continue and even increase over the coming years. The rise of the supply of money and a decline in purchasing power is another bullish factor for the raw materials that feed, power, shelter, and clothe the world.

The US election could cause lots of volatility in markets across all asset classes. Any outcome is likely to lead to higher commodity prices over the coming years.