Moody’s downgrades Senegal to Caa1 amid rising debt concerns

Fed expectations have been driving USD/JPY, leaving the August jobs report as the market’s real litmus test this week.

- USD/JPY stuck in tight range since July jobs data

- Market focus locked on this Friday’s payrolls

- Other U.S. releases seen as secondary risks

- Japan data continues to have little impact

- Payrolls outcome may sway Fed rate cut bets

USD/JPY Outlook Summary

Shifts at the immediate front of the U.S. interest rate curve remain influential on USD/JPY movements, meaning anything that can change expectations regarding the outlook for monetary policy from the Federal Reserve carries the potential to spark volatility. On that front, Friday’s August nonfarm payrolls report looms large for traders, with a smattering of important labour market indicators released in between.

Rather than inflation prints, politics or any data from Japan, these reports screen as the most likely catalysts to wake USD/JPY from its northern hemisphere summer slumber.

Fed Pricing Remains Influential

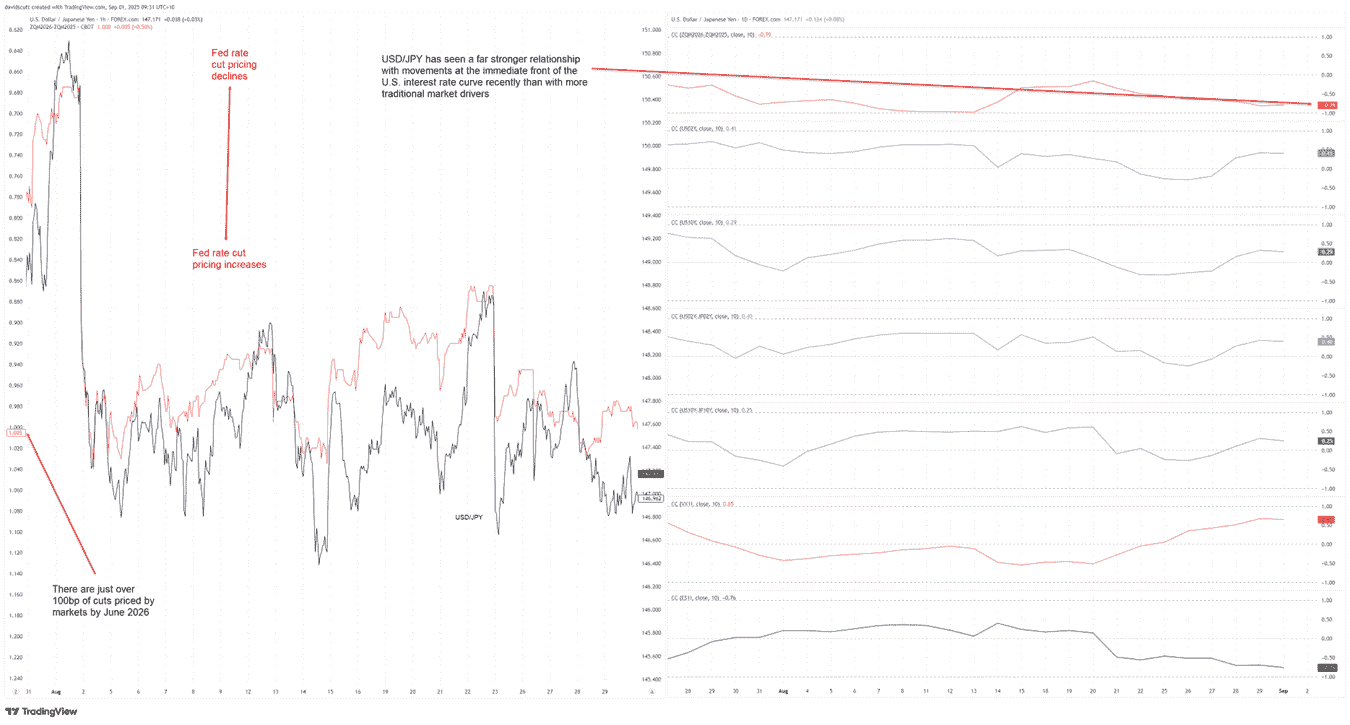

Market pricing for the Fed funds rate has remained highly influential on USD/JPY over the past fortnight, continuing the trend seen throughout August. You can see that visually in the left-hand pane below, which overlays USD/JPY against the shape of the Fed funds futures curve between June of this year and next.

That’s backed up by analysis in the right-hand pane, which shows a correlation coefficient between the two of 0.79, far stronger than more traditional drivers such as U.S. Treasury yields, yield spreads between the U.S. and Japan, or risk appetite in markets over the same period. It’s all happening in the front end of the U.S. interest rate curve when it comes to USD/JPY.

Source: TradingView

Which Puts Emphasis on Payrolls

Now, I don’t want to come across as flippant when it comes to what else traders should be focused on. Just because there has been a relatively tight correlation recently doesn’t mean it will remain that way forever—it won’t. Nor does it mean that other factors can’t influence USD/JPY over the course of this week.

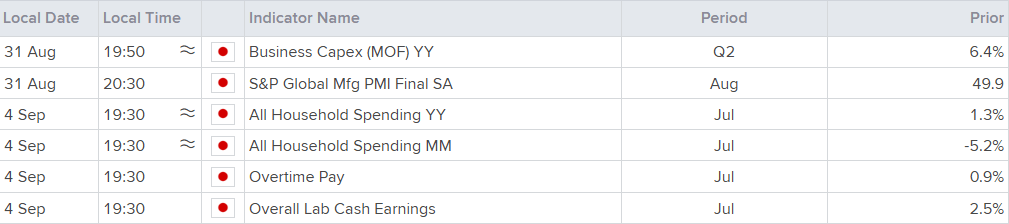

But it’s been obvious for a while now that USD/JPY has not reacted meaningfully to any Japanese economic data, including last Friday’s Tokyo inflation report. While there is more top-tier data released in Japan this week, including bond auctions of 10-year and 30-year debt not shown below, unless that trend changes, better trading opportunities may be found around the release of U.S. economic data.

I’m not in the business of trying to hype events up which are likely to end in a fizzle.

Source: LSEG (U.S. ET used for calendars)

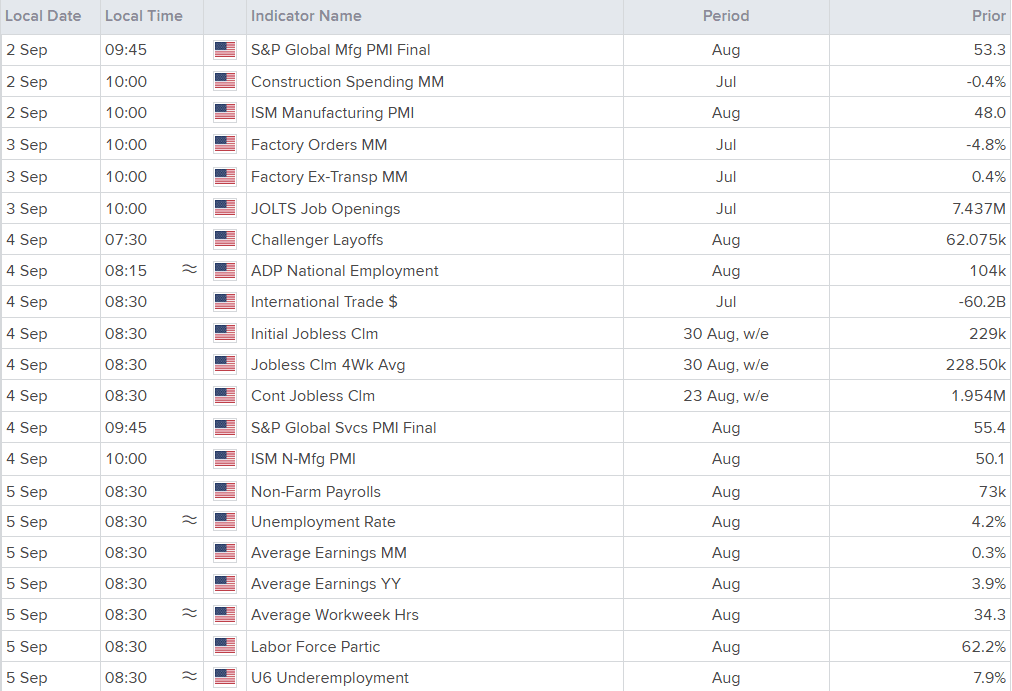

Looking at the U.S. calendar, we have PMIs and factory orders among other releases, but when it comes to true potential volatility generators that could see USD/JPY break out of the narrow range it’s been sitting in over the past month, there is really only one this week: the August nonfarm payrolls report released Friday. While frequent readers of my research would know the emphasis I place on the unemployment rate when it comes to the key piece of information to focus on, in this instance it’s hard to suggest it won’t be the payrolls figure given how much attention the big undershoot and massive downward revision to the prior two months’ data received when the July payrolls was released.

Source: LSEG

Unpacking Payrolls for Trading Signal

An increase in payrolls of 78,000 is expected, up marginally from 73,000 in July. Watch for revisions to prior data, especially if downward which would increase the risk of the July figure turning negative. While the unemployment rate is derived from a separate survey, it came within a whisker of rounding up to 4.3% in July despite another decline in labour force participation. Therefore, the 4.3% forecast for August doesn’t screen as an overly high hurdle.

If the unemployment rate were to print at 4.4% or higher, especially if accompanied by a similar upside shift in the broader underemployment rate, which would have negative connotations for wages growth, it could easily see markets start to price in a meaningful risk of the Fed delivering a 50 basis point cut later this month. Alternatively, if we were to see the unemployment rate hold at 4.2% or even tick lower, it would surely raise questions about whether there’s a need for the Fed to cut at all given accelerating inflationary pressures.

Everyone knows the monthly payrolls report is an important piece of economic data, but this one comes across as particularly important for interest-rate-sensitive markets such as USD/JPY.

Given the focus on labour market conditions, I suspect the ADP and JOLTs reports may have an outsized impact on markets this week relative to historic norms. For a long time, ADP in particular has been regarded as a flaky economic release, known for providing false signals to markets. But given how wild recent payrolls revisions have been, ADP now looks far more complementary to the signal coming from the official jobs report.

FOMC Composition in Focus

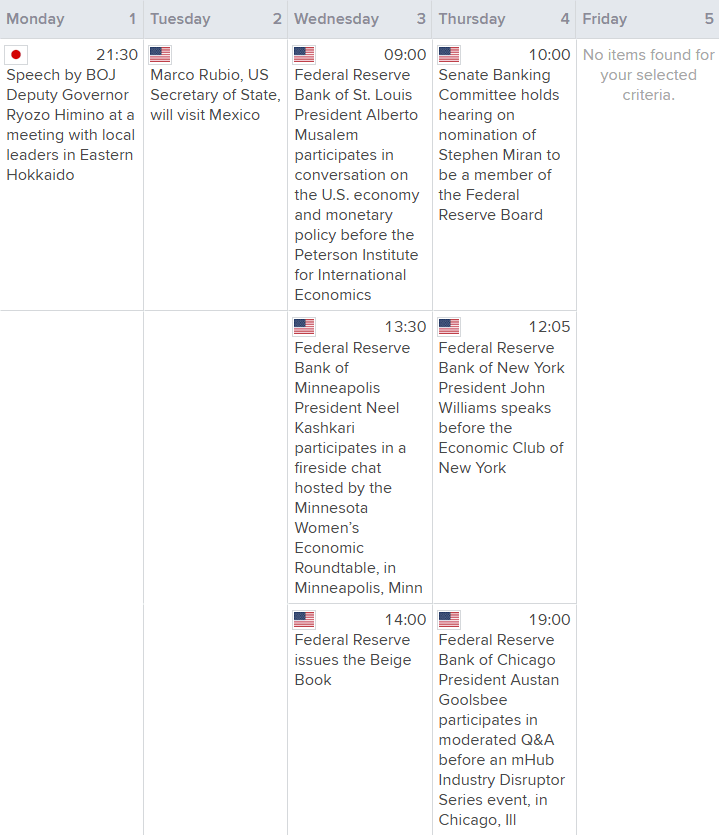

Source: LSEG

Outside of labour market data, Trump’s pick for the vacant Fed governor position, Stephen Miran, will have his confirmation hearing before the Senate Banking Committee on Thursday morning U.S. ET. Along with any information about whether current Fed governor Lisa Cook will be allowed to vote at the September FOMC meeting, it has the potential to spark knee-jerk market reactions in USD/JPY.

USD/JPY Range May Come Under Threat

Source: TradingView

USD/JPY has been rangebound since the July nonfarm payrolls report was released on August 1, attracting bids beneath 147.00 with offers emerging on probes above 148.00. Every time we’ve seen a close above or below those levels in the period since, it has been reversed, reinforcing the choppy, directionless trend.

Unsurprisingly, the message from momentum indicators is entirely neutral, with RSI (14) just below 50 after breaking the downtrend it was trading in. MACD is also sitting just in negative territory, having trended lower ever since the July payrolls report was released. Price signals are therefore far more relevant for traders over the coming week.

If the 146.25 low of the August range were to be breached this week, 146.00 support, the April 22 uptrend (145.20) and 144.44 support are the levels to watch. Alternatively, if the August range high of 148.75 were to be taken out, the 200-day moving average, 149.00 resistance and 151.00 resistance should be on the radar. If any of these levels are to be tested, I suspect it will be on Friday following the payrolls report, in the absence of any unexpected black/grey swan-type event.