cathie wood’s ARK sells Tesla stock, buys Baidu and Trade Desk

The US dollar gained ground against the Japanese yen and Swiss franc as Fed rate cut bets were pared back. With bullish price patterns now forming, could the move stretch further into Friday’s close?

- U.S. yields jumped after strong data and fading 2025 rate cut bets

- USD/JPY and USD/CHF rebounded, forming bullish reversal patterns

- Correlation with U.S. 10-year yields has strengthened recently

- Tokyo CPI due shortly provides near-term event risk

USD/JPY, USD/CHF Outlook Summary

Bullish reversal patterns and higher U.S. interest rates should have USD/JPY and USD/CHF traders on alert for continued upside heading into the weekend. For those focused on the yen, the July Tokyo consumer price inflation report—released three weeks ahead of the nationwide figure—provides a near-term event risk that may determine whether the bullish bias sinks or swims.

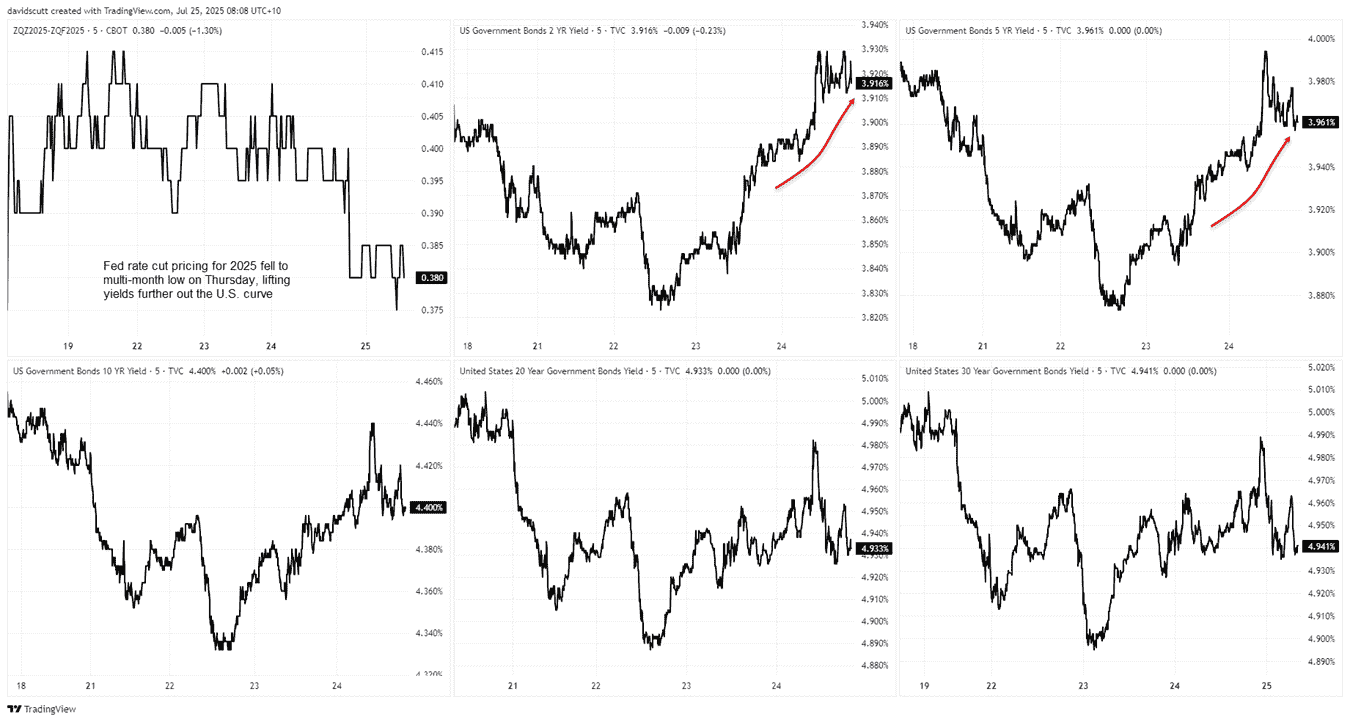

Data, Powell’s Survival, Boosts USD

Strong activity in the U.S. services sector and continued declines in initial jobless claims, combined with a neutral ECB bias, delivered a meaningful lift in U.S. short-dated interest rates on Thursday, as seen in the chart below tracking movements across the US curve.

Source: TradingView

Fed rate cut expectations for 2025 dwindled further, sliding to just 38 basis points according to futures, hitting levels not seen since February. 2-year and 5-year yields pushed higher in response, while the moves were more muted for maturities 10-years and longer.

Notably, longer-dated yields had been higher earlier in the session but pared gains as it became clear US President Donald Trump was not about to deliver an imminent termination notice to Federal Reserve Chair Jerome Powell during his visit to the Fed’s Washington, D.C. headquarters.

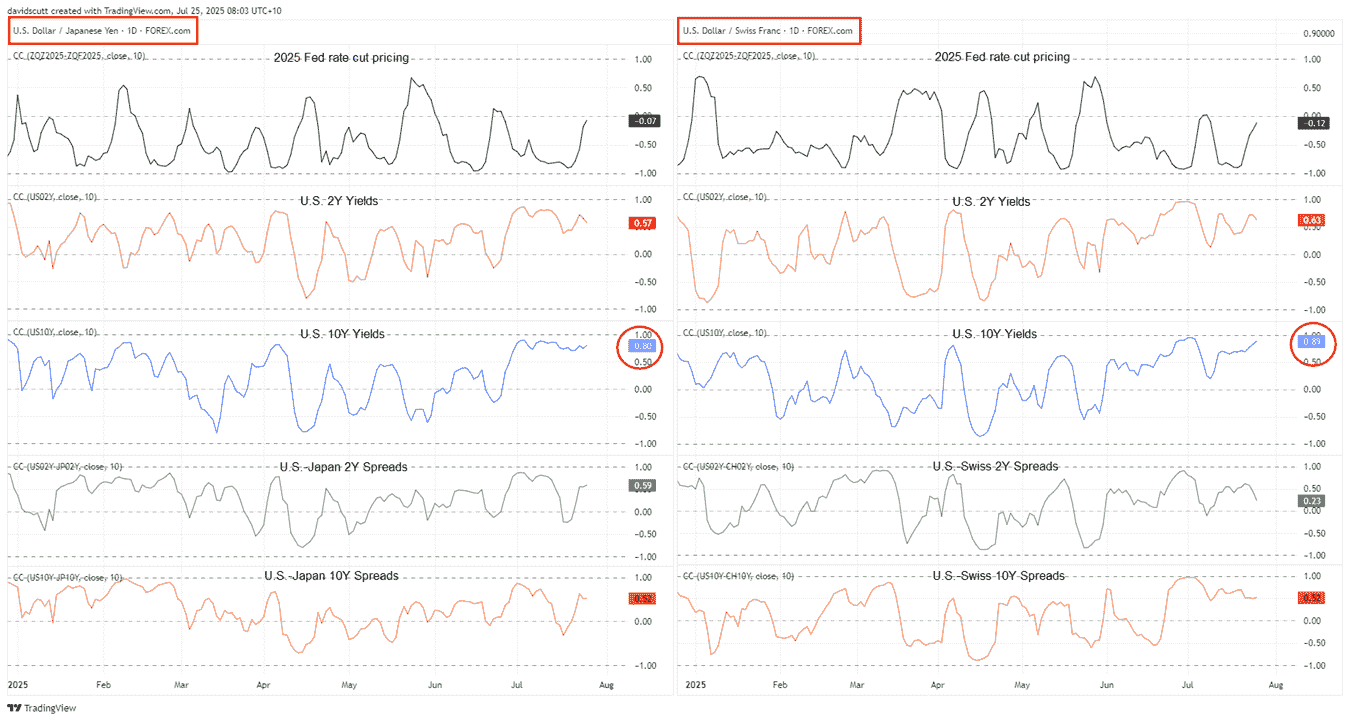

Combined, the two factors likely explain the bounce in USD/JPY and USD/CHF seen during the session, helping to underpin the dollar and extending the strengthening relationship both pairs have had with shifts in U.S. interest rates over the past fortnight.

Rate Relationship Resumes

Source: TradingView

As seen in the chart above, USD/JPY and USD/CHF have been particularly correlated with moves in U.S. 10-year yields over that period, sitting with correlation coefficients of 0.8 and 0.89, respectively. That’s far stronger than the relationship with short-dated U.S. rate moves, or short and longer-dated rate differentials between Japan and Switzerland with the United States, over the same period.

With little on the U.S. economic calendar likely to alter the rates outlook meaningfully on Friday, it suggests the move in USD/JPY on Thursday may extend into the weekend. Price signals also favour continued upside.

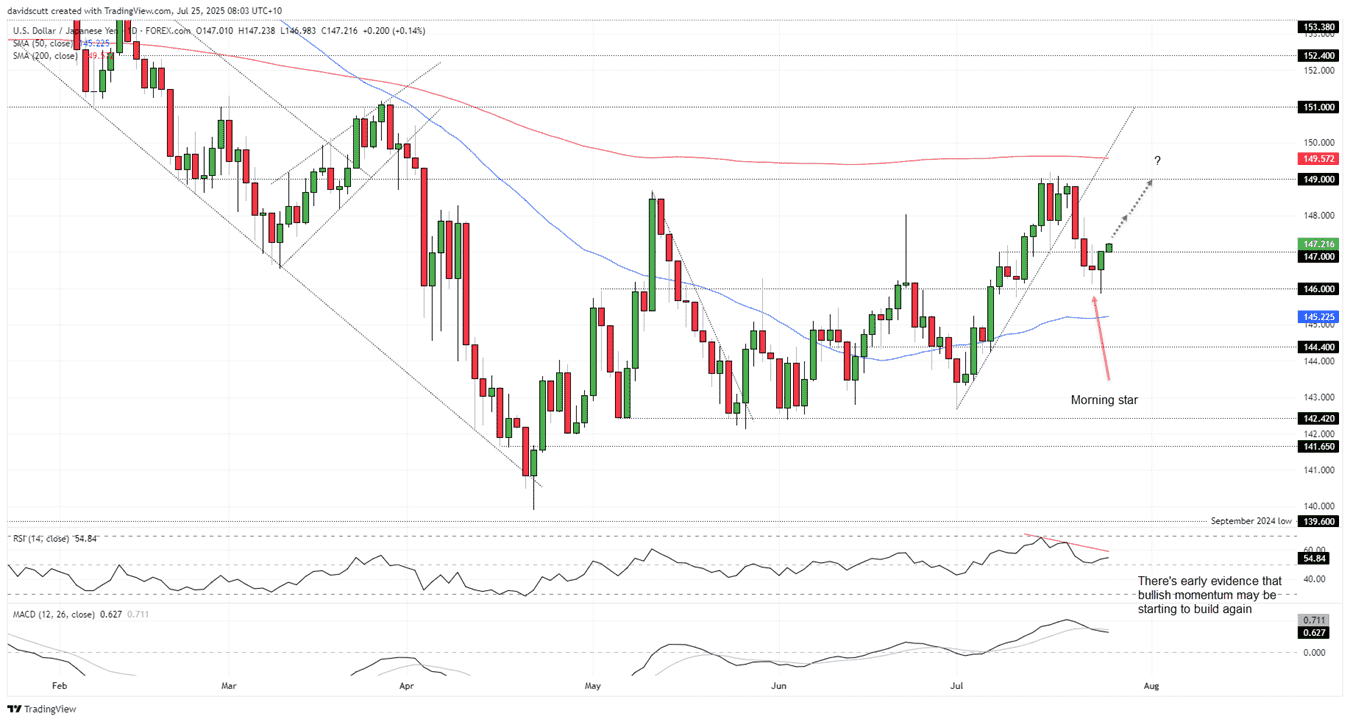

USD/JPY Delivers Bullish Price Signal

Source: TradingView

Looking at USD/JPY first, the pair completed a three-candle morning star pattern on Thursday, bouncing strongly from beneath 146.00 to above 147.00. Coming after a near three big figure decline from levels seen last week, the bullish reversal signal is strengthened.

If USD/JPY can hold above 147.00, it provides a base to build bullish setups around, allowing for longs to be established above the figure with a stop beneath for protection. As for potential near-term targets, it’s obvious USD/JPY has been gravitating towards big figures in recent months, putting 148.00 and 149.00 on the radar for bulls.

While RSI (14) and MACD continue to point to waning upside momentum, both remain in bullish territory, providing a cautious signal rather than something outright bearish.

Despite fundamentals and technicals signalling near-term upside risks, the release of Tokyo CPI data for July at 8.30 am in Japan provides a near-term event risk. The key figures to watch will be the underlying measures. Ex-fresh food is seen decelerating a tenth of a percent to an annual rate of 3%.

Excluding fresh food and fuel, the rate is tipped to remain unchanged at 3.1%. Hotter-than-expected figures may scupper the bullish bias, while softer reads should help promote further USD/JPY upside, taking pressure off the BOJ to lift interest rates again before the end of the year.

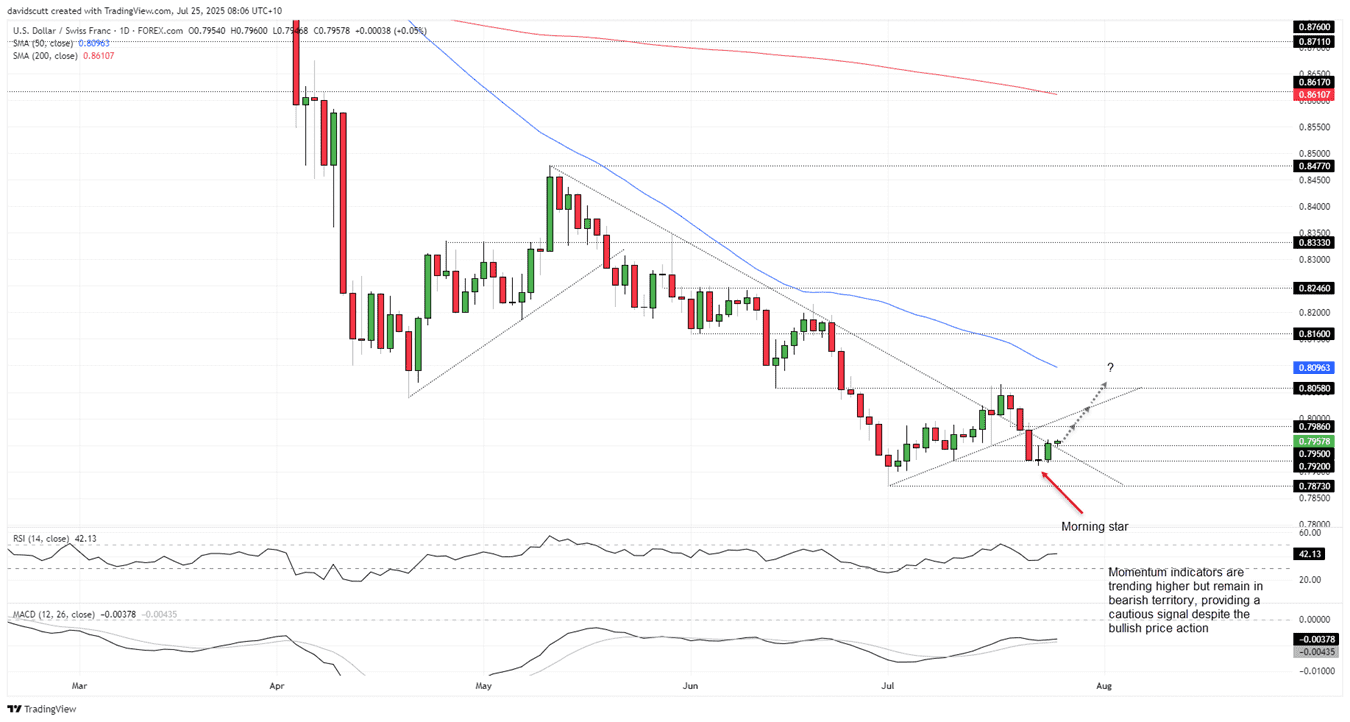

USD/CHF Bid as Risks Recede

Source: TradingView

The technical setup for USD/CHF is unsurprisingly similar to USD/JPY, with the pair completing a three-candle morning star after bouncing from support at .7920 earlier in the session.

Having climbed above .7950—a minor level that acted as support and resistance earlier this month—it has generated a decent setup for longs should the price hold there, allowing for positions to be established above with a stop beneath for protection.

.7986 is another minor level located above, making it screen as an initial target for longs. If it were to be broken, former uptrend support from the July 1 lows is located at .8000, providing another option. If that’s cleared, it should improve the probability of a retest of .8058.

Unlike USD/JPY, momentum signals remain bearish despite the bullish price action, although neither RSI (14) nor MACD sit at levels that make a compelling case to retain a bearish-at-all-costs mindset.