ReElement Technologies stock soars after securing $1.4B government deal

Wall Street was pleased with Alphabet's (NASDAQ:GOOGL) Q4 and FY 2021 results released on Feb. 1. Before the release GOOGL stock was around $2,700. The next day, it surged to $3,030.93.

The tech giant also announced a 20-for-1 stock split that will take place in July—a move that investors typically like.

This is not the first time the Parkway, Mountain View, California-based company has divided its shares. We previously explained how the company split shares into two classes in April 2014, resulting in Class A (ticker GOOGL), which has voting rights, and Alphabet Class C (NASDAQ:GOOG), which doesn’t.

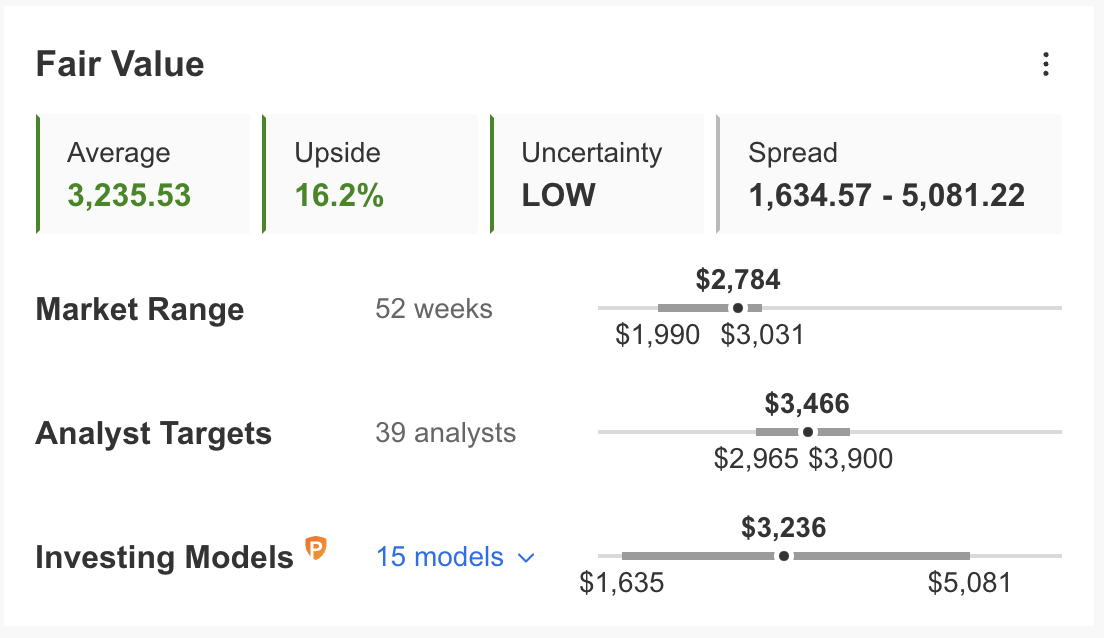

As we write, GOOGL shares are around $2,784. Yet, the average fair value for GOOGL stock via InvestingPro stands at $3,235.53, implying an increase of around 16.2% from current levels.

Source: InvestingPro

If GOOGL shares were to trade at $3,000 at the time of the upcoming split in July, the new price would stand around $150 per share. Therefore, Wall Street now regards Alphabet as a candidate for inclusion in the Dow Jones, a price-weighted index.

Alphabet’s strong results have also focused on the communications services sector. Therefore, today we introduce two exchange-traded funds (ETFs) that could appeal to readers who want to participate in the potential growth in this segment and Alphabet shares.

1. Fidelity MSCI Telecommunication Services Index ETF

- Current price: $46.18

- 52-week range: $45.10 - $57.33

- Dividend yield: 0.76%

- Expense ratio: 0.08% per year

The Fidelity MSCI Communication Services Index ETF (NYSE:FCOM) invests in the communications services sectors. The fund started trading in October 2013.

FCOM, which has 114 holdings, tracks the MSCI US IMI Communication Services 25/50 USD Index. The top 10 holdings account for close to 67% of net assets of $788.8 million.

Among the leading companies on the roster, Alphabet has the largest slice, as the fund holds both GOOGL shares (11.60%) and GOOG shares (10.85%). Then comes Meta Platforms (NASDAQ:FB) with 17.33%. Following its disappointing Q4 earnings released on Feb. 2, FB stock has come under significant pressure.

Other names we see in FCOM include Walt Disney (NYSE:DIS), Verizon Communications (NYSE:VZ), AT&T (NYSE:T), Comcast (NASDAQ:CMCSA), and Netflix (NASDAQ:NFLX). In terms of sub-sectors, close to half of the portfolio comes from Interactive Media & Services. Next are Media stocks (20.57%), followed by Entertainment names (18.29%).

Since the start of the year, FCOM is down 9.6%. Trailing P/E and P/B ratios are 7.39x and 3.13x.

As a result of the recent sell-off in tech names, many stocks in the portfolio trade at lower valuations compared to 2021. Therefore, interested readers, especially those who want significant exposure to shares of Alphabet and Meta Platforms, could consider investing in FCOM in February.

2. iShares Global Comm Services ETF

- Current price: $76.14

- 52-week range: $74.72 - $91.21

- Dividend yield: 1.92%

- Expense ratio:0.43% per year

Our next fund, the iShares Global Comm Services ETF (NYSE:IXP), gives access to global firms in media and social media, entertainment, video, gaming, and telecommunication services. The fund was first listed in November 2001.

IXP currently has 74 holdings, where the leading 10 names comprise about two-thirds of net assets of $247.7 million. Like the FCOM ETF, close to half of the portfolio is in Interactive Media & Services. Then, we see Integrated Telecommunication Services (19.46%) and Movies & Entertainment (8.70%).

Over 70% of the stocks in the fund come from the US. Next are companies from China (7.13%), Japan (6.6%), the UK (2.76%), and Canada (2.49%), among others.

Alphabet stock’s total weighting is over 23%. Meta Platforms follows with over 12%. Other leading names in the portfolio are China's Tencent Holdings (HK:0700) (OTC:TCEHY), Verizon, Comcast, Disney, and AT&T, among others.

Over the past 12 months, IXP lost 3.8%. P/E and P/B ratios stand at 17.93x and 3.11x.

Despite the recent price declines in many holdings, these companies are among the most important names in their segments. They have wide moats and generate consistent cash flows. Therefore, potential buy-and-hold investors could consider adding IXP shares to their portfolios around current levels.